The Parable of Goldfinger

Is there a relationship between the price of gold and bonds? Most vigilantes would agree that there is some correlation based on inflation, with bond yields and the price of gold rising when inflation is on the way up, and vice versa. Most “goldbugs” would probably agree with this assessment. They would say that the metal was a repository of long-term value and was an effective medium for protecting purchasing power. The late Julian Baring was the man with the golden fund1. He presented the relative purchasing power of gold in terms of fixed-price menus at the Savoy, an exercise he frequently undertook with M&G’s former CEO Paddy Lineker2. Baring’s results were somewhat mixed, but there can be no doubt of his conclusion that, over time, the gold price not only equalled but outpaced the rate of inflation. It would be easy to conclude, in today’s world of rising bond yields and a historically high gold price, that there is a correlation, and that it is still valid.

But is it? An answer to this can be found in Ian Fleming’s novel, Goldfinger.

Before we turn our attention to Bond, Treasury Bonds… Let me enlighten you on the secret life of Ian Fleming. He worked at (but not for) the Bank of England3, and in both the film and the novel, he stages a well-crafted scene in one of its palatial offices. He introduces us to a fictional Colonel Smithers, whose job it was to monitor the quantity of gold in the vaults and to stem any bullion ‘leakage’ (smuggling to you and me). Enter the evil Auric Goldfinger, who leads Bond on a merry chase across Europe and the US.

Part of that chase takes Bond to Geneva, where Fleming attended university. Here’s where things get interesting. Goldfinger’s lair where he melts down his gold Rolls-Royce, is on the outskirts of a small village called Coppet4. Fleming gives a detailed description of the village’s ancient chateau, the small forest behind it and the position of a building which houses his foundry. This all exists in real life, except that the foundry is actually the tomb of one of the earliest Bond Vigilantes: the banker Jacques Necker, who was a finance minister under Louis XVI. Necker was popular because he thought debt finance was preferable to placing a heavier tax burden on the public.

Central to Necker’s concept of debt finance was the establishment of a central bank along British principles and a beneficial partnership between sovereign and private investors. System and laws were all-important. He succeeded in raising substantial loans for the beleaguered King as the nation’s political scene deteriorated. His scheme worked for a while, but the debt he created expired worthless. Necker got the sack, the King met the guillotine and a popular government was installed. In its place came the revolutionary interest-free fiat currency called the Assignat. These bills came with a dark warning on their borders5: “Death to counterfeiters, and rewards to denouncers”.

I’ve decided that none of this is a coincidence (or I wouldn’t have an article). What is Fleming actually trying to tell us? The message is clear that there is a link between debt and the value of gold. But does it hold true for inflation?

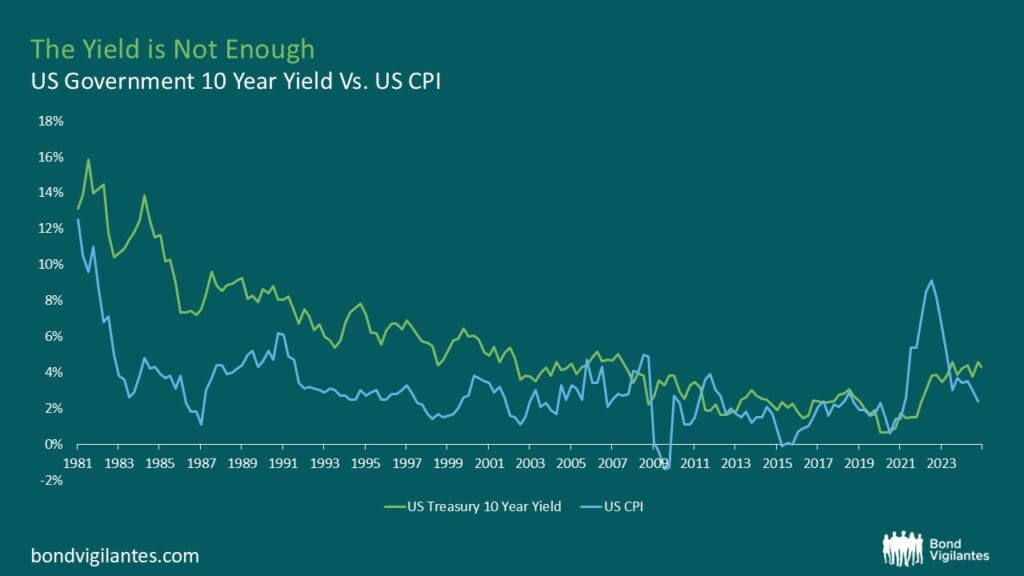

Below is a graph that is going to come as no surprise to the contemporary Bond Vigilante. It shows an observable correlation between bond yields and CPI. When inflation goes up, bond yields go up. When it comes down, bond yields come down. Nothing exciting.

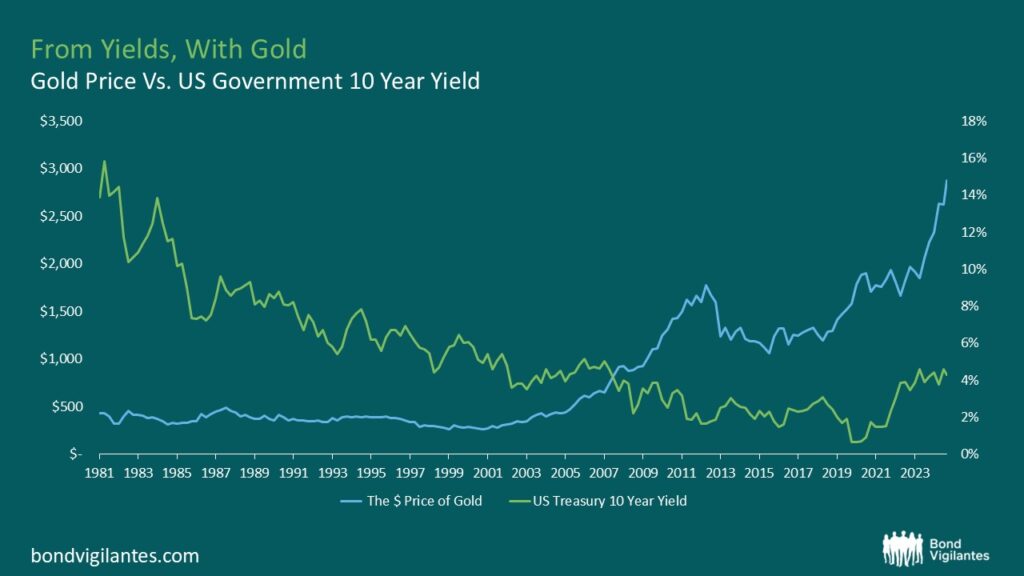

Now, let’s look at that again with the same bonds but set against the price of gold instead. We are looking for moments where the yield on the bonds fall and the gold price goes up to seek out some form of correlation between the two asset classes that we are told by textbooks exists.

Admittedly, a tricky graph there but there are a couple of times where we can see this in action. We see in ’82, ’87 and ’07 clear points where the yields fell and the gold price went up reflecting the ‘flight to safety’ that these trades tend to represent. So we are seeing a negative correlation in action. This sort of thing happens at times of market distress and when things in global markets look dicey.

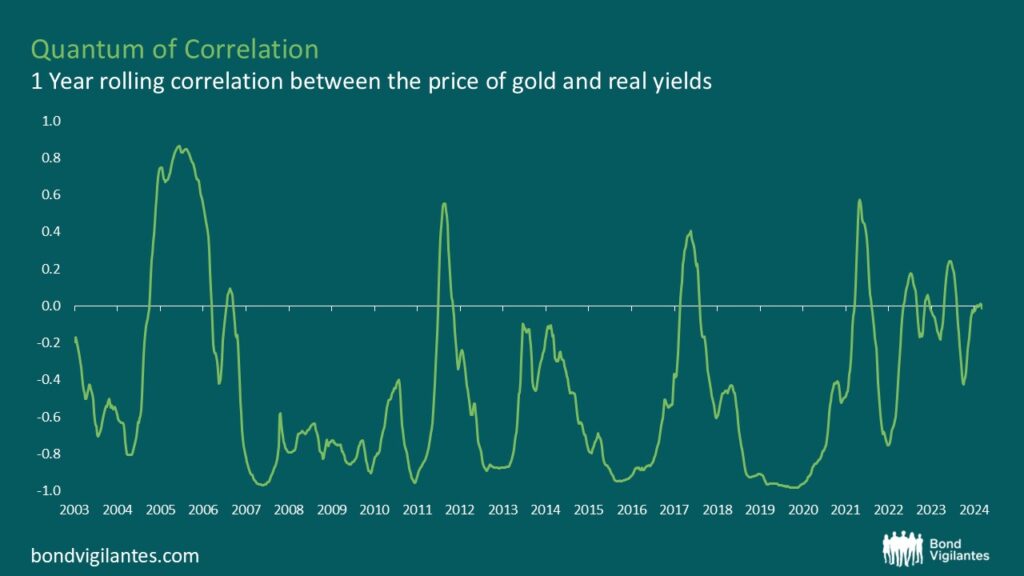

Of late though, once you dial in on the rolling correlation between the price of gold and the real yield of US Treasuries over the last 20 years, that relationship has begun to break down. In the last 5 years, the correlation has hovered around zero thanks to the recent rise in the gold price. So quite literally there is no correlation6 between the two assets (and we know there has certainly been market distress recently).

So what then should we make of gold recently breaking the $3,000 mark7? Is this significant for bond markets? Yes.

Things become clearer when we start considering broader macroeconomic movements over the last 50 years. From the 1980s onward, global market dynamics started to change with the introduction of Reaganomics, the Cold War summit and the widespread acceptance of globalisation. The world got smaller and the peace dividend grew, and with it came the development of broad mechanisms for an international system of freer trade. To the astonishment of Julian Baring, bond prices flew as global inflation fell and international cooperation improved. Bond risk premia dwindled.

Then, with the credit crisis of 2007 and the sovereign debt crisis of 2009, gold got moving again and made up for lost time. Why? Fear and uncertainty needled their way back into the bond markets and to gold’s residual value. In both government and commercial bond markets, investors began to demand higher yields8 because the benefits of globalisation seemed to be fast-disappearing9. We now appear to face a more uncertain macroeconomic environment, and quantitative easing, which eventually supported bond prices at artificially high levels, has gone into reverse. Just as the peace dividend now seems to be on the wane, the risk vectors have begun to rise.

Fleming, at the time of Goldfinger, was facing another series of global transformations: the wane of the Bretton Woods system, the possible change of the pound to a fiat currency and their effect upon the fabric of British social and political constructs10.

Gold has begun to behave like wampum, tulip bulbs and beanie babies11, bubble assets whose unexplained residual value eclipsed their intrinsic value and whose price reflects something other than the commodity it represents. To return to Mr. Baring, the Savoy index would now tell us that a single gold sovereign could buy you roughly 15 meals (a historic high). But where exactly is gold’s additional residual value coming from? I’d return to our friend Colonel Smithers, who supplied the moral to this, our Goldfinger parable.

Whilst bonds are the barometer of trust and faith in a system, Smithers maintains that…

“Gold is the talisman of fear”. Cue the Bond theme tune.

1 Gold & General Fund, which exists to this day

2 Written about at great length in “Turning Rocks into Profits”, also the coolest looking book I own. It’s gold!

3 The Ministry of Ungentlemanly Warfare

5 Zemeks take interior decoration seriously, this particular Assignat lives out its days above the dog beds

6 Gold vs. Real Yields – Updated Chart | Longtermtrends

7 FT – Gold hits $3000 for the first time on global growth fears

8 FT – US junk bonds slide as Donald Trump’s tariffs spark economic worries

9 wsj.com

10 For a greater exposition on this, see ‘Money: The Unauthorised Biography’ by Felix Martin

11 https://www.history.com/news/how-the-beanie-baby-craze-came-to-a-crashing-end

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox