Getting caught in the middle – ASEAN economic implications and challenges

By the time this article is published, there could be significant changes to Donald Trump’s tariff policies in ways the market is unable to forecast. However, it remains worthwhile to explore how Trump’s trade wars have impacted Southeast Asian economies and could continue to do so.

Southeast Asian economies are strategically important to both China and the United States (US) due to their roles as trading partners, their geographical interests, and particularly, as military bases for the US. Yet, for the past decade, the region has repeatedly found itself caught in the middle as these two global powers compete for economic supremacy.

ASEAN consists of 10 countries: Brunei Darussalam, Cambodia, Indonesia, Lao PDR, Malaysia, Myanmar, Philippines, Singapore, Thailand, and Vietnam. With some 690 million people, or around 8% of world’s population1, the region accounts for over 3.5% of global GDP and 7.4% of global exports, demonstrating the bloc’s increasing importance to global economic activity2. ASEAN is China’s largest trading partner, while ranking as the US’ fourth-largest trading partner, after Mexico, Canada, and China.

The first Trump presidency: Unintended beneficiaries

During Trump’s first presidency, tariffs of 10-50% were imposed on various categories of Chinese products, primarily aimed at addressing concerns over intellectual property theft, forced technology transfers, and the substantial trade deficit with China. While tariffs were subsequently halved on the premise that China would import an additional US $200 billion from the US, only around US $30 billion in additional US goods were actually imported to China between 2020-2024.

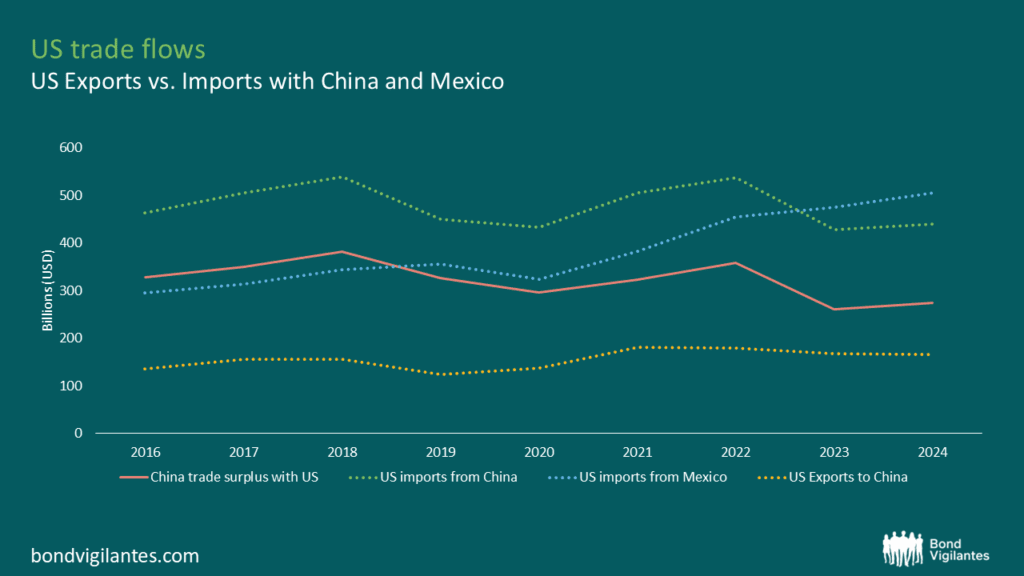

The tariff on Chinese imports created an unexpected opportunity for ASEAN and Mexico through supply chain realignment. Vietnam and Mexico emerged as particular beneficiaries. Vietnam’s exports to the US surged from just US $49 billion in 2018 to US $137 billion in 2024, while Mexico’s exports rose from US $344 billion to US $506 billion over the same period. The rapid increase can be attributed to the relocation of Chinese manufacturing facilities and the rerouting of goods, evidenced by the parallel rise in goods imports from China to both ASEAN countries and Mexico, predominantly in partially finished or finished goods.

China’s supply chain realignment strategy proved remarkably successful. Mexico is now the largest exporter to the US, replacing China in 2023.

Source: Bloomberg

Strategic positioning and political complexity

This shift was hardly surprising, as ASEAN has long been strategically important to China from multiple angles: as manufacturing bases, investment destinations, and for political influence. The region’s significant overseas Chinese population and close proximity to China have helped ASEAN countries grow closer to China over the years. Since 2018, ASEAN has become a critical hub for Chinese companies seeking to mitigate tariff exposure from the US-China trade war. Chinese firms have rerouted exports through ASEAN or established factories in countries like Vietnam, Cambodia, Thailand and Malaysia to bypass tariffs, making the definition of ‘origin of goods’ and ‘value-adding’ increasingly opaque.

Déjà Vu: The second Trump term

Fast forward to 2025, and investors face a déjà vu moment as Trump’s second presidential term has commenced with the strongest push yet for broad-based tariffs, maintaining significant focus on China. This reflects growing concerns about America’s enormous total trade deficits with the world, which have grown to just shy of US $1 trillion3. The US now understands the implications of imposing tariffs on China alone – the supply chain realignment has rendered previous tariffs ineffective in reducing the trade deficit.

ASEAN economies once again find themselves caught in the crossfire between the world’s two largest powers. This time, however, the implications are far more significant. The realignment of China’s manufacturing supply chains has created jobs and entire industries over the past five years. Another shift could unwind parts of this manufacturing ecosystem and threaten people’s livelihoods.

The geopolitical balancing act

There is also a broader geopolitical challenge. With escalating US-China tensions, ASEAN faces increasing pressure to align with one side. Thailand and the Philippines, as examples, are notably taking a more muted stance towards geopolitical alignments. This balancing act is particularly delicate – both countries host existing US airbases while also relying heavily on China for investments, tourism, and manufacturing. Given China’s strong dominance as a trade partner and investor in the region, combined with the US serving as both a major export destination and source of political influence for many ASEAN economies, this equilibrium requires careful navigation.

The path forward

ASEAN must continue to strengthen intra-regional ties and leverage trade deals such as the Regional Comprehensive Economic Partnership and the Comprehensive and Progressive Agreement for Trans-Pacific Partnership to insulate itself from global volatility. The path forward for ASEAN economies must be both strategic and deliberate to safeguard the region’s long-term interests.

ASEAN should focus on maintaining a delicate balance between the two global superpowers by adopting a neutral stance, while simultaneously strengthening internal resilience through enhanced intra-regional trade and improved competitiveness in manufacturing, trade, and foreign direct investments. To prepare for potential geopolitical decoupling, ASEAN should diversify its network of economic partners and deepen institutional integration, drawing lessons from the European Union to strengthen its collective influence on the global stage.

For businesses and investors, this evolving landscape presents dual-edged prospects: risks of supply chain disruptions, but also significant opportunities to position ASEAN as a key hub in future global trade and supply chains.

Implications for bond investors

While the temporary pause in new trade tariffs has brought some relief to bond investors, we view Trump 2.0 as bringing unprecedented growth risks for ASEAN. We expect a further economic decoupling between China and the US which will negatively impact global growth as trade declines. In the near term, this uncertainty warrants further rate cuts from ASEAN central banks as inflation stabilises, growth slows, and unemployment inches higher. Local currency bonds should therefore remain well supported.

We also expect to see some Net International Investment Position (NIIP) flows from US assets returning to Asia, lending further support to local currency asset prices and Asian currencies. However, we remain mindful of the longer-term effects on potential economic growth from supply chain realignment and global slowdown, which can have lasting impacts on ASEAN economies.

1 IMF World Economic Outlook

2 HSBC Global Research

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.