Unlocking value in aligning capital with Sustainable Development Goals

Many have written in recent weeks about outflows from ESG funds and a retreat from ESG investing. From my experience, speaking with a large number of institutional investors, I would not describe it as a retreat but rather a reset. Today, investors are shifting their focus away from fund exclusions and moving capital to where it genuinely matters: into targeted, outcome-driven areas like clean energy and improved health. This shift is not simply for appearance; it makes economic sense, especially considering the adverse impact of neglecting climate risk or health solutions.

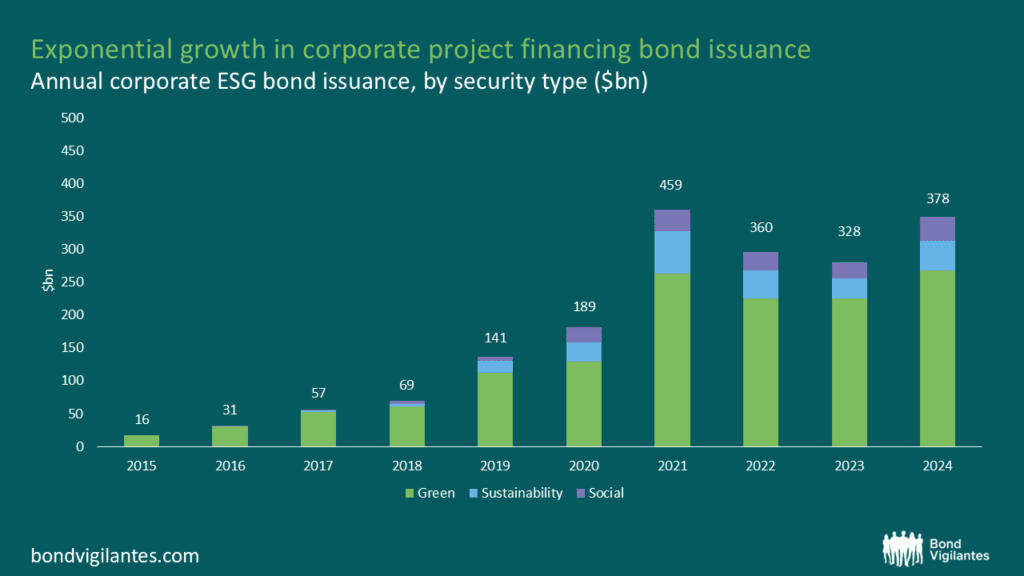

According to one key roadmap for a better future – the United Nations’ (UN) 17 Sustainable Development Goals (SDGs) – urgent action is needed to accelerate progress, with currently only 17% of targets on track according to the latest UN SDG progress report. One of the most effective ways for bond investors to help advance the UN Sustainable Development Goals is by directing funding to environmental and social projects. The good news is that we have observed rapid growth in project financing bonds over the past ten years, with annual issuance in the corporate bond space exceeding $300 billion in each of the last four years.

Source: Dealogic, Bloomberg, Barclays Research. Left chart: Corporate issuers only. DM hard currency bonds only. Excludes covered bonds.

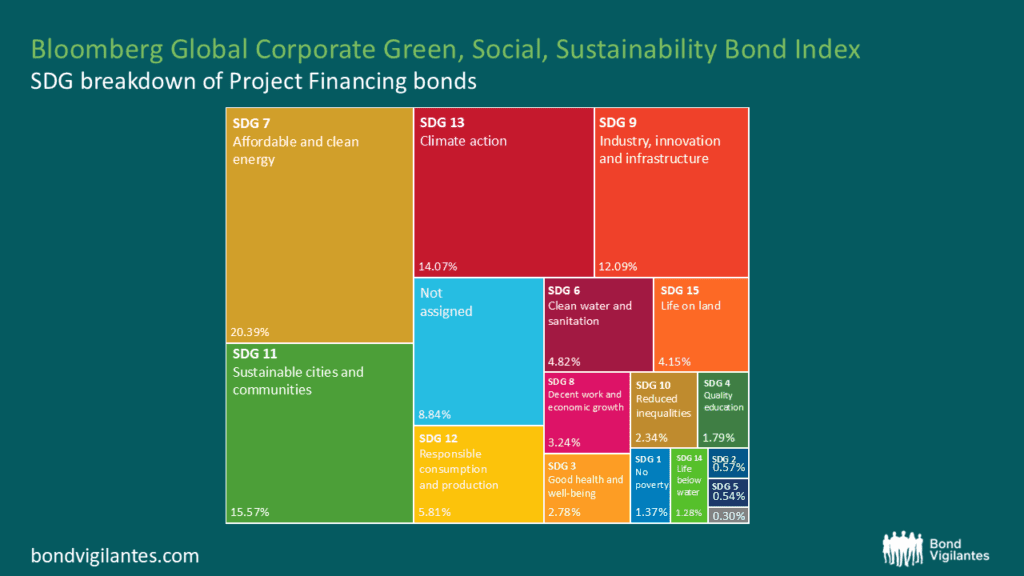

Most project financing bond frameworks indicate the targeted contribution of eligible projects to the Sustainable Development Goals. This provides an opportunity to map project financing bonds according to their SDG targets. To achieve this, I use the Bloomberg Global Corporate Green Social Sustainability (GSS) Index. Most project financing frameworks aim to target multiple SDGs; hence, I have allocated the index weight of a bond pro-rata, assuming an equal allocation to the targeted SDGs. This is a simplification, as the effective allocation of proceeds can, and likely will, differ from a proportionate distribution.

As one might expect, given the dominance of green bonds in the GSS market, the vast majority of project financing bonds aim to advance environmental goals such as Affordable and Clean Energy (SDG 7), Climate Action (SDG 13), and Sustainable Cities and Communities (SDG 11).

Source: Bloomberg, M&G, June 2025. For illustrative purposes only. The diagram above references the UN SDGs – “Sustainable Development Goals”. Index weights of bonds pro-rated, assuming equal allocation to targeted SDGs.

Bonds that earmark proceeds for social projects are comparatively rare, with only 2.78% of the index supporting projects that contribute to Good Health and Wellbeing (SDG 3) and 2.34% supporting Reduced Inequalities (SDG 10). As a value investor, this piqued my curiosity to explore whether the market prices in any scarcity premium for bonds supporting social Sustainable Development Goals that are less prevalent in the public debt market.

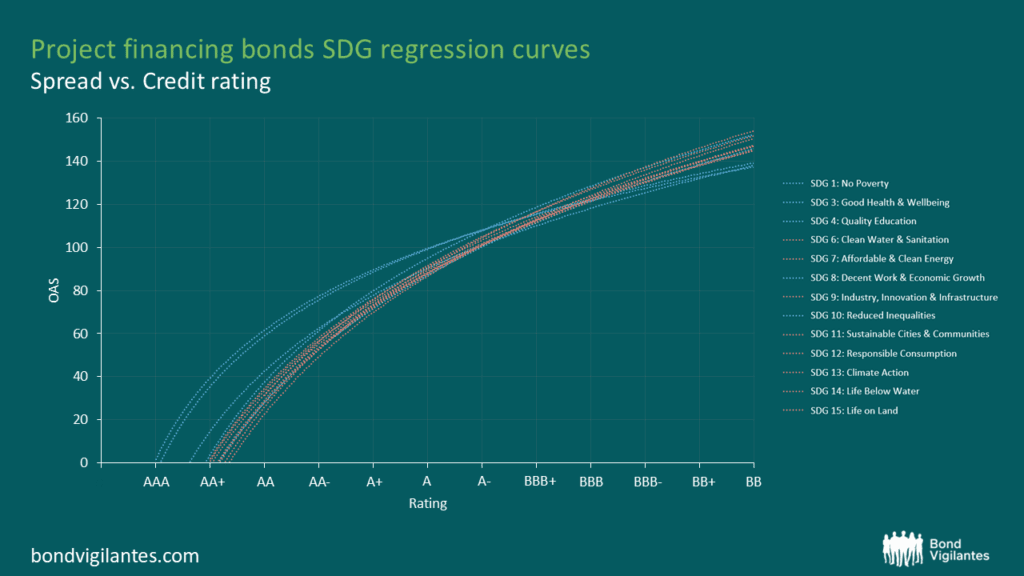

One way to approach this is to plot regression curves of index-eligible GSS bonds according to their targeted SDGs. It is not uncommon for sustainable financing frameworks to target multiple SDGs. Hence, as part of our analysis, the same bond can serve as input to multiple regression curves, should more than one SDG be targeted. The graph below plots the SDG regression curves in relation to the risk-reward measured by option-adjusted spread and credit rating. Out of the 17 SDGs, I compare regression curves of eight environmental SDGs, highlighted in red, and five social SDGs, highlighted in blue, for which we have a sample size of at least 100 bonds. The majority of project-financing bonds are being issued as intermediate paper. As a result, the spread duration of the sample size, while not identical, is broadly similar and regarded as comparable.

So, what findings can we draw from our analysis? Contrary to my hypothesis, bonds that provide solutions for social challenges do not seem to trade at a premium despite the relative scarcity of such project financing bonds. As the chart shows, regression curves of social and environmental SDGs tend to be fairly aligned. If anything, project financing bonds of higher credit quality that aim to target social SDGs trade cheaply compared to bonds that target environmental SDGs.

Source: Bloomberg

My reading of this is that while there is less supply of securities targeting social SDGs, there is also less specific demand for them. The majority of fixed income bond buyers do not manage strategies with formal objectives toward positive social outcomes. Why is that, you might ask? Bond investors face an asymmetrical risk-reward (limited upside with potentially unlimited downside). As a result, diversification and position scaling are key in fixed income portfolio management, which in turn requires a broad enough investment universe.

The rapid growth of the green bond market allows fixed income managers to run funds that exclusively fund green activities. Unsurprisingly, we have seen the launch of green bond strategies over the last few years. In comparison, there are only a few bond strategies in public markets that aim to exclusively deliver positive social outcomes, due to the fact that the investment universe still needs to expand and mature. The lack of dedicated mandates that target social SDGs might explain why project-financing bonds with social SDG contributions do not trade at a premium compared to more abundant environmental project-financing bonds.

This, in turn, provides an opportunity for active fund managers to take advantage of market dislocations or a lack of an SDG-focused investor base to build outcome-driven strategies that help progress social Sustainable Development Goals without necessarily having to pay a premium for owning securities that are less frequently issued.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.