Bank bonds: Outdated reaction to market stress creates opportunities

Following the global financial crisis, markets appear to react to any macro wobble with a “shoot first, ask questions later” attitude when it came to both banks’ credit and equity prices. From many perspectives, whether it be earnings volatility, balance sheet dynamics, or the quantum and quality of capital, banks have undergone significant transformation and are no longer characterised by the vulnerabilities of the past. Nonetheless, a persistent investment behaviour can predispose investors to revert to outdated reactions to market stress. This behavioural inertia presents a potential opportunity to capture value in banks’ credit instruments that are indiscriminately discounted during episodes of market panic.

A recent case in point is the market reaction in banks’ market prices across equity and credit in the month post the US “Liberation Day” (April 2nd, 2025). We chose the one month period as we believe this captures both the sharp initial market reaction to uncertainty and provides a substantial timeframe to allow for meaningful adjustments to changes in forecasts for key fundamental metrics (we focus on consensus earnings expectations).

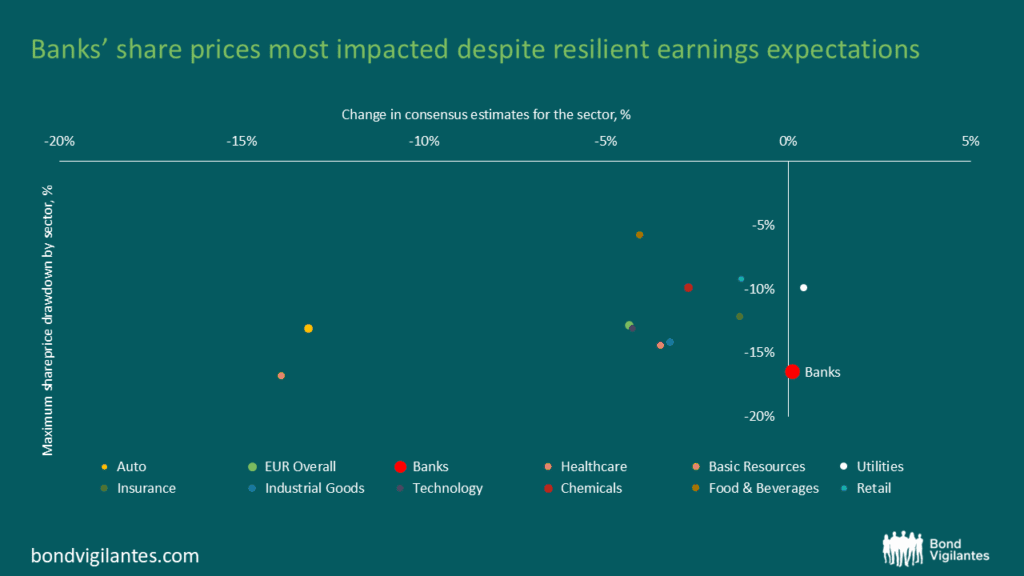

In the exhibit below, we look at maximum drawdown in equity prices across various sectors over this period, compared to the change in consensus expectations for these sectors. While most sectors follow a normal positive relationship, with changes in share price reactions broadly matching changes in FY25 consensus earnings, one sector – banks – stands out, with share price reaction matching the worst impacted sectors (such as autos and basic resources) while seeing positive consensus revisions over the period. In effect, banks have proven themselves not just as one of the highest beta sectors (again) but one that has not been matched by a fundamental deterioration. We note that this pattern – i.e. positive consensus revisions – holds for longer periods beyond the one month cut-off, with the banks sector seeing the highest consensus earnings revision between April 1 and July 1.

Source: Bloomberg, M&G analysis; Data covers period between April 1st and May 1st

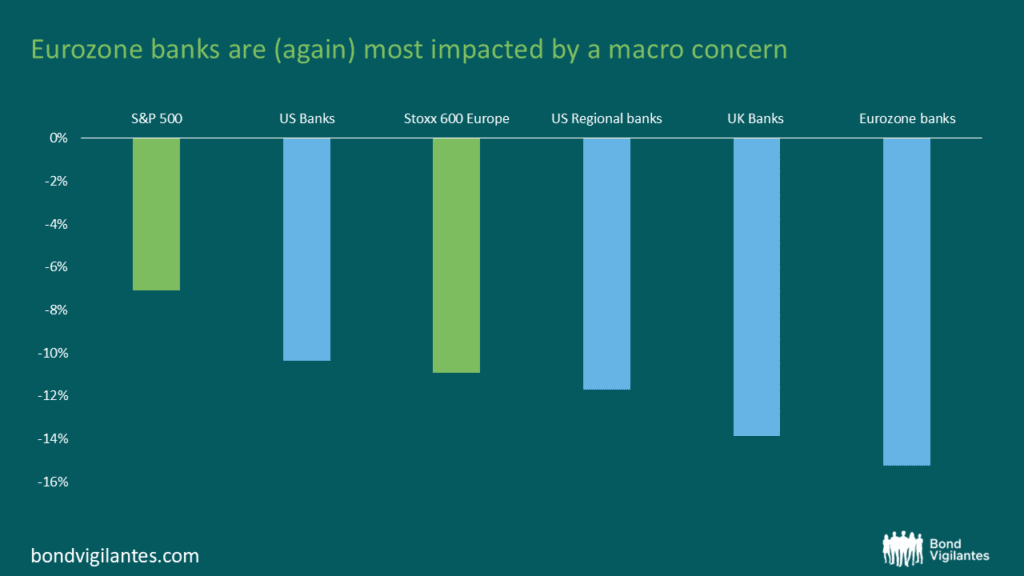

Geographically, Eurozone banks were disproportionately impacted, underperforming U.S. (both Global Systemically Important Banks and regional banks), as well as U.K. peers. This pattern is consistent with historical ‘high beta’ responses, particularly in the context of European sovereign risk. However, the magnitude of the reaction appears increasingly disconnected from current fundamentals.

Source: Bloomberg, M&G analysis. Data covers period between April 1st and May 1st

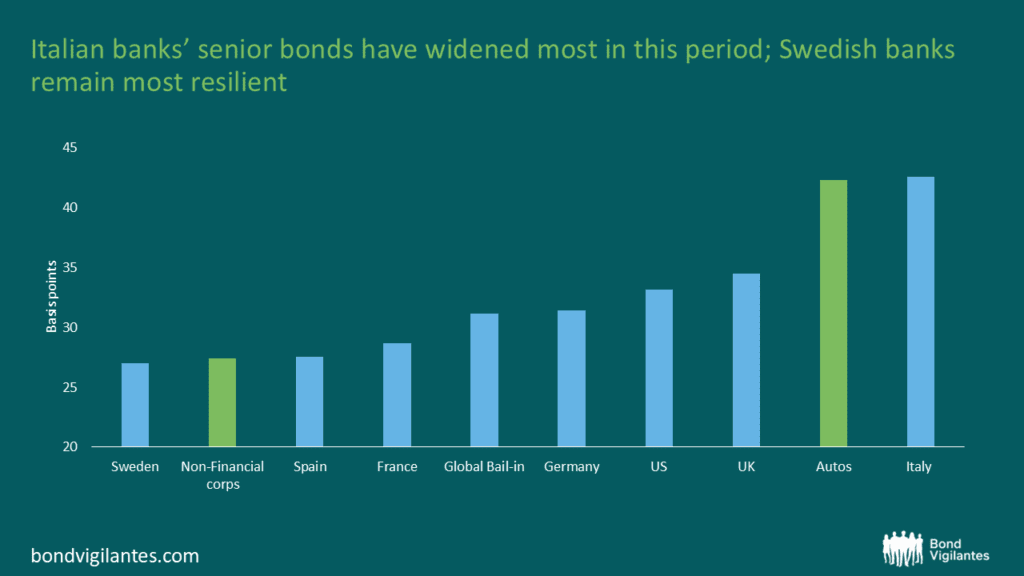

In credit markets, senior bail-in bank bonds followed a similar pattern, especially when looking at national indices. In the exhibit below, we look at maximum spread widening in the iboxx € Senior Bail-in indices over this period. A few observations stand out. Italian banks’ senior bonds have widened the most amongst their peers, while Swedish banks’ spreads proved most resilient. This follows the historical beta patterns developed in the aftermath of the European sovereign crisis. Perhaps most surprising in our dataset was that Spanish banks appear to have broken the historical relationship, perhaps driven by both industry consolidation, significant credit deleveraging in the economy, and overall Spanish economic resilience.

Source: Iboxx, M&G analysis

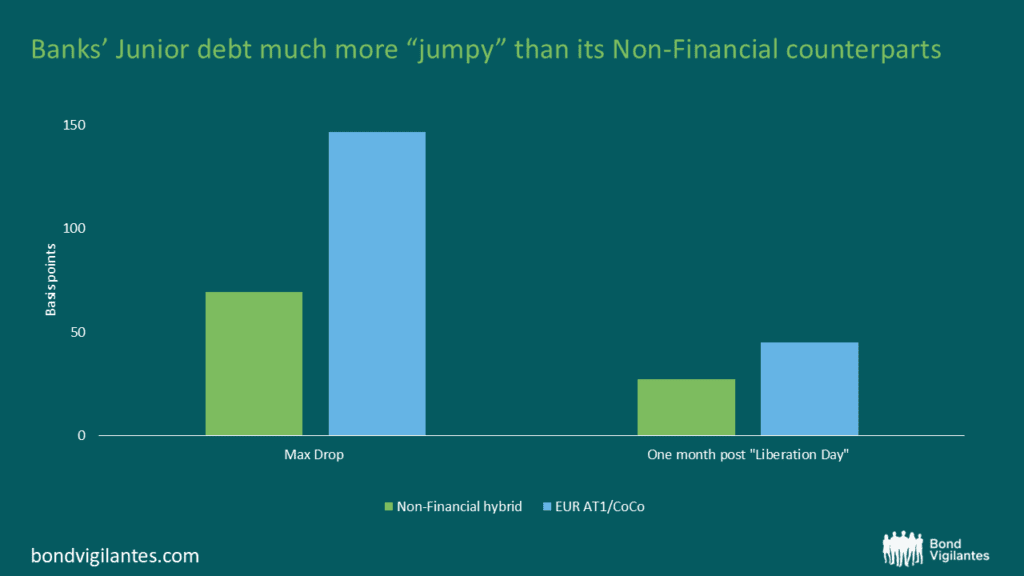

While we do not have granular data at the national level for the more junior parts of the capital structure, we can see that junior bank debt (AT1/CoCos) exhibited heightened volatility relative to their non-financial hybrid peers and have remained wider than their non-financial counterparts even a month post liberation day.

Source: Iboxx, M&G analysis. Data covers period between April 1st and May 1st

The market’s tendency to revert to crisis-era heuristics overlooks the substantial regulatory and structural enhancements supported by both macro and micro-prudential policies that have bolstered bank resilience. For long-term, fundamental-driven investors, this behavioural lag presents a compelling opportunity to capitalise on mispricings across the bank capital spectrum—particularly in credit instruments unjustly penalised during episodes of market stress.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.