What Oasis taught me about market signals and credit markets

On the news of the Oasis reunion almost a year ago, my colleague Joe Sullivan-Bissett previewed the tour with some interesting historical analysis around Oasis and periods of volatility. Roughly 12 months on, I can confirm that Wednesday 30th July 2025 was the best night of my life, being one of the lucky thousands to see Oasis perform at Wembley Stadium. As I reflect on the two hours of back-to-back bangers, I realise the subtle references to credit markets that lie within the songs.

Some Might Say it is difficult to find a clear picture of the market at the moment, with diverging signals coming from different asset classes. Credit spreads paint a buoyant picture, with both investment grade (IG) and high yield (HY) spreads near their historic tights. Government bond yields, on the other hand, are indicating uncertainty, reflecting fears around debt levels and their sustainability, but also impending central bank cuts. Gold has been the best performing asset class of the 21st century so far, and is continuing to march higher, reflecting a bearish signal. Equity markets, although choppy, are also optimistic. In a Wonderwall of valuations and economic data, what to make of all this? The Gallagher brothers said it best…

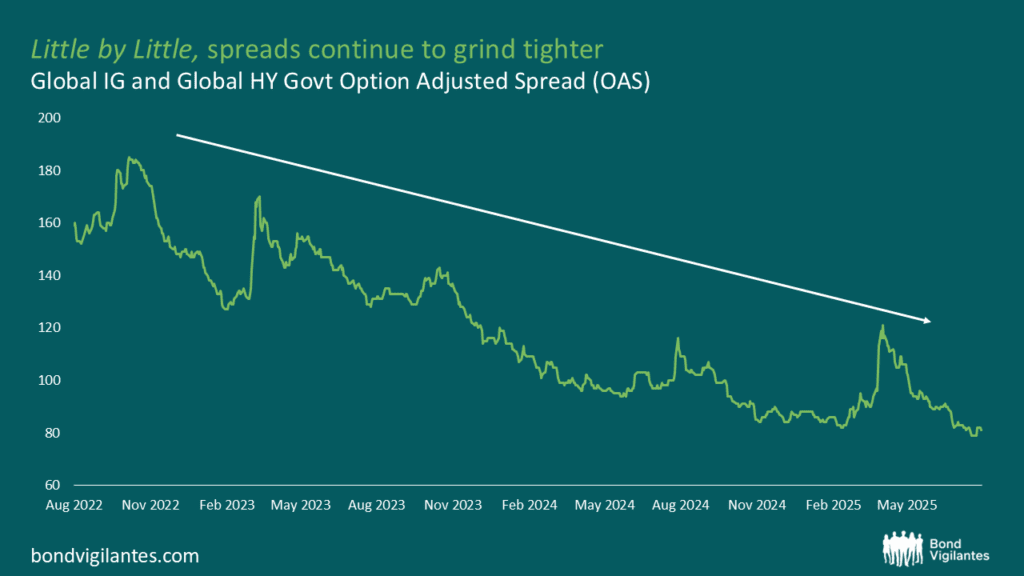

Little by Little credit spreads are grinding tighter across IG and HY, tightening in from +185bp in global IG in 2022, to +79bp at the end of July 2025. Tight credit spreads are typically a reflection of positive sentiment in the market, yet the economic data is deteriorating. Job Openings and Labor Turnover Survey (JOLTS) data from the US is showing a decline in job openings, new hires and the quits rate, reflecting the softening conditions in the jobs market.

Meanwhile in the UK, the struggle for real growth is a story we know all too well. So with this backdrop, what is the driver of these tight spreads? There has been a swathe of investors into corporate credit who are feeling Supersonic, seeking to take advantage of elevated, attractive all-in yields. The wave of passive buying, which is unconcerned with valuations and spreads, has been a catalyst for the receding level of premium on offer in investment grade corporate bonds. Whilst company balance sheets generally remain in good health and default levels are low, spreads are tighter than over 95% of historical observations.

With an excess of $7 trillion still on the sidelines in money market funds, could these tight spreads Live Forever? There are possibly further inflows coming into the investment grade market, a natural home for this money sitting in cash, meaning that we have perhaps not yet reached cycle tights. Although reaching for yield may seem appealing in an environment of seemingly ever-tightening spreads, Don’t Look Back in Anger if the broader signals start to be reflected in valuations over time and the bulls get hurt.

Source: Bloomberg (06 August 2025)

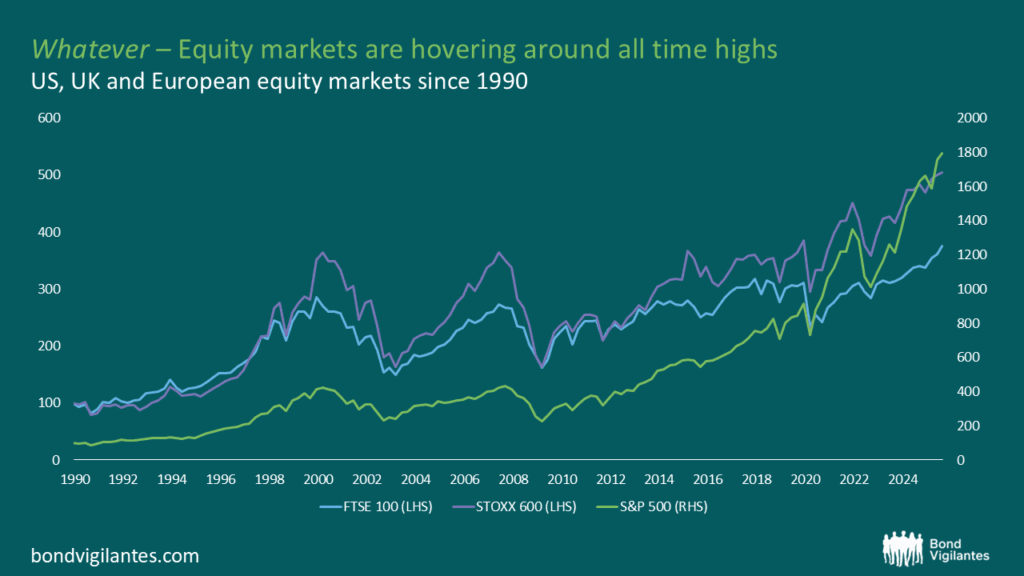

All Around the World, despite slowing momentum in the macro picture – weak growth, low consumer confidence, falling new manufacturing orders to name a few – the response from the equity market seems to be Whatever. The S&P 500, STOXX 600 and FTSE 100 all find themselves around their all-time highs. There is clear appetite for further risk amongst many investors, perhaps flying in the face of the expected pattern of behaviour as macro signals deteriorate and as tariffs are implemented by the world’s largest economy. Equities appear to be telling the bears, Stop Crying Your Heart Out.

Source: Bloomberg (07 August 2025)

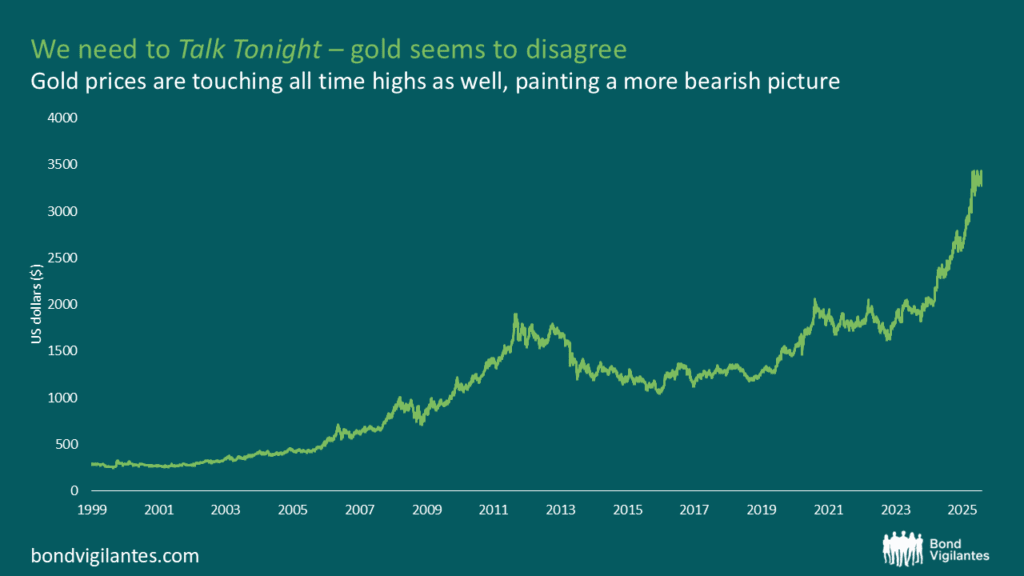

Turning to commodities, if you were to ask gold, it would probably say that we need to Talk Tonight. Amidst the heightened geopolitical risk, there has been a flight to safety in some parts of the market. In a century so far with seemingly regular crises – the Global Financial Crisis, Eurozone Crisis, trade wars and recent geopolitical tension – gold has been attractive.

Its annualised return of +7.8% (1999-2024) has outperformed the S&P – perhaps the perfect asset class for times when you just need to Roll With It. People far more qualified than me have talked about gold on this blog here and here, so I will not pretend to be an expert, but the +34% annualised return from the beginning of 2024 to the end of July 2025 is a textbook bearish indicator, and an interesting contrary signal to what we have seen in credit and equity.

Source: Bloomberg (31 July 2025)

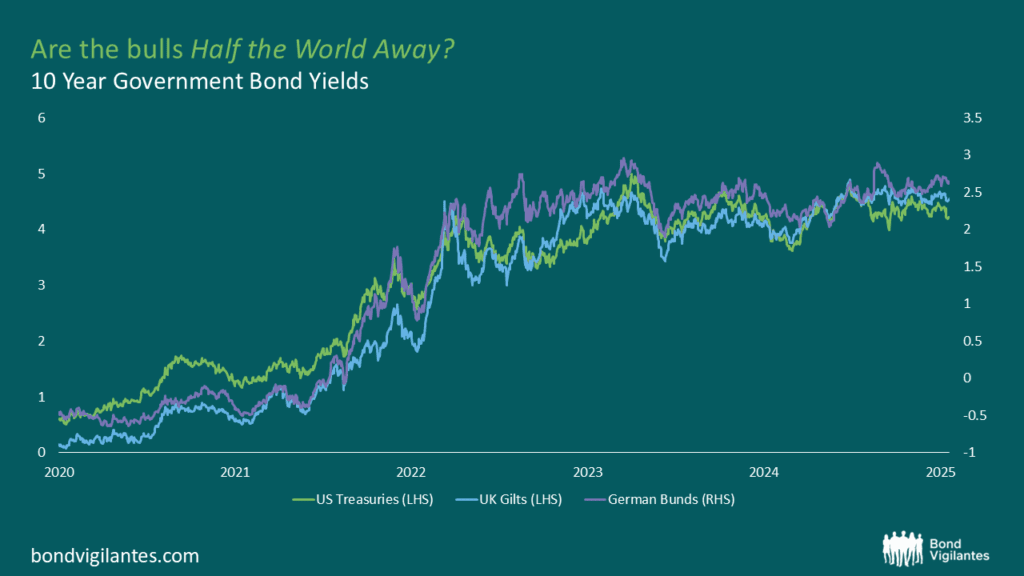

Similarly, developed market government bond yields appear to think the bulls in equity and credit are Half the World Away. In a world of ever-increasing government debt levels – expertly discussed by Rob Burrows on many an occasion – where the bond vigilantes have not been afraid to intervene when they think governments are stepping out of line, we appear to be in a limbo period.

10-year yields (a common barometer) remain elevated, despite the central bank cutting cycle beginning in earnest about 12 months ago. We have seen a significant steepening in the curve, as the front end gets excited about the need to cut to stimulate spluttering economies where the fiscal lever appears exhausted, while at the longer end, fears of debt sustainability and fiscal uncertainty remain. With 30-year yields hovering close to 5.5% in the UK and 5% in the US, it is a case of Stand by Me for those in Washington and Whitehall. I think the bond market will want to see a little bit more substance before we see much-needed flattening in long-end rates. So not the same risk-on tone here.

Source: Bloomberg (07 August 2025)

So, what is The Masterplan? Definitely Maybe equities and credit spreads have it right, and all our problems will just Fade Away… For active credit investors, perhaps a closer look at the broader environment and detachment from the risk-on frenzy is warranted at these valuations. D’You Know What I Mean?

Source: AI-generated image

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.