What does Dr. Copper say?

We’ve spent nearly two decades on this blog exploring the economic outlook, and history shows that this is especially relevant for active bond managers.

Currently, risk markets are priced for a benign economic scenario. Credit spreads are historically tight, equity valuations are elevated, and interest rates are on a downward path as central banks unwind tight monetary policies to keep growth on track.

The global economy appears healthy, and markets seem to have rediscovered their appetite for risk.

But as always, we believe it’s worthwhile to explore alternative diagnoses.

Just as one might consult a doctor for a second opinion in life, we can do the same in economics: by turning to Doctor Copper.

Doctor Copper is simply the ratio of the price of copper divided by the price of gold. Copper, an industrial metal, reflects economic activity, while gold is traditionally viewed as a store of wealth. The theory goes: when the economy is strong, the ratio is high; when it’s weak, the ratio is low.

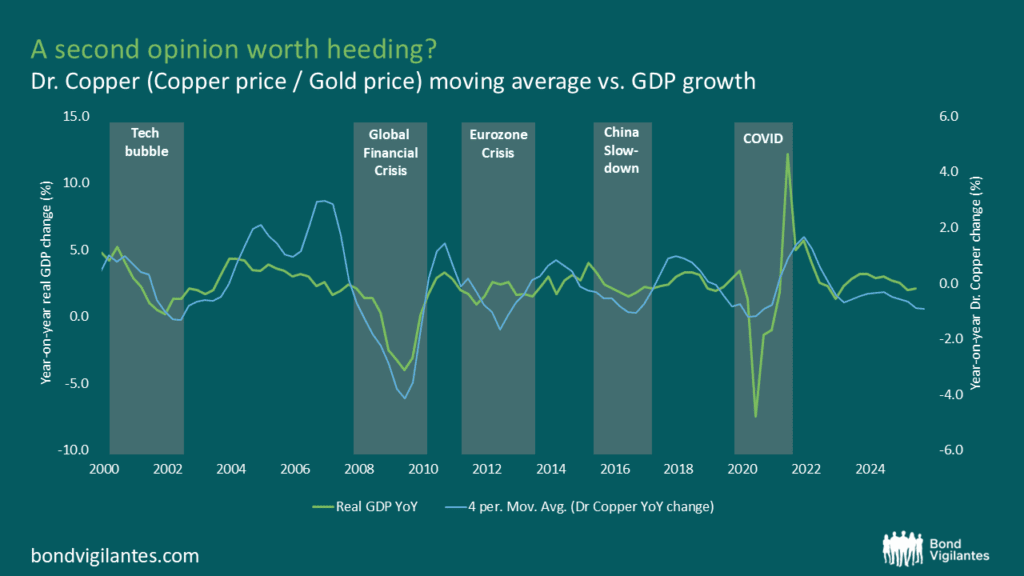

When we chart the effectiveness of this diagnostic tool over time, we find that it has merit.

Source: M&G, Bloomberg

The chart suggests that previous declines in the Doctor Copper ratio have often aligned with periods of economic slowdown or recession. While investors remain optimistic, the copper-to-gold ratio is signalling a more cautious view. Whenever the ratio has reached levels this low, it was consistent with a slowdown or even a recession. With the ratio trending lower again, it’s worth considering whether this indicator is once more highlighting risks that broader markets may be overlooking.

Could this decline be a sign of the Markets’ Risky New Appetite (MRNA)? Or is it a reminder to trust the traditional economic wisdom of Doctor Copper? Either way, something is different this time, and it might be worth paying attention.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.