‘But really, why would I invest in investment grade now?’

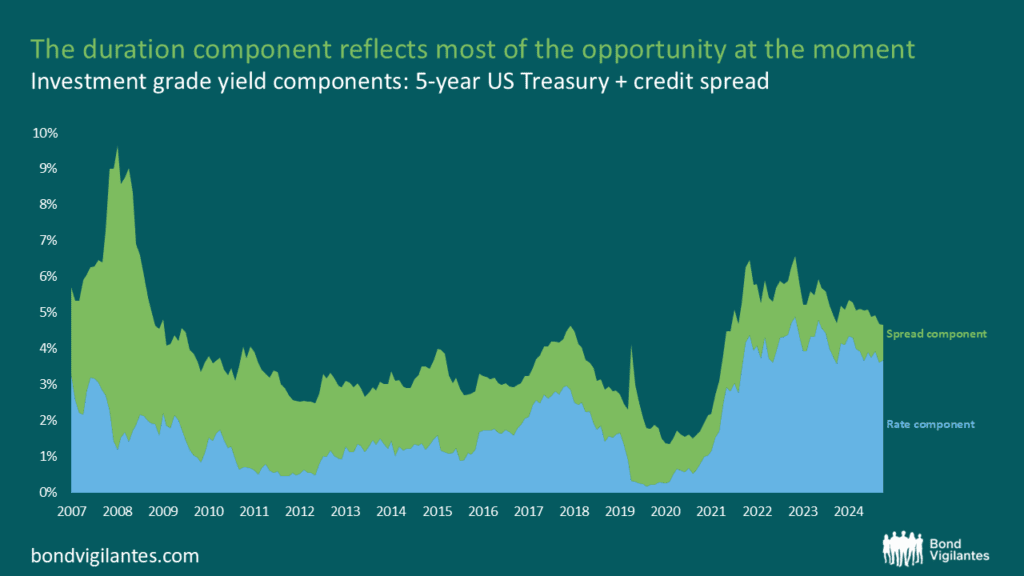

‘Why would I buy investment grade credit now, spreads are so tight’ is the cry that I hear. It’s true, IG spreads have been tight for some time now, but with all in yields looking attractive fixed income shouldn’t be overlooked. I make the case that now is the time to be looking at investment grade credit in spite of tight spreads…

The Case for IG: Alpha and Total Return

There’s a common belief that you should wait to buy investment grade (IG) credit until spreads widen. Fair enough, the core logic makes sense, but this misses two critical nuances:

- Alpha Opportunity: For those prioritising alpha generation, current market conditions may present opportunities. Some active managers are reducing risk in response to tight spreads. These funds will be positioned to buy aggressively when spreads widen, capturing alpha both on the way out and back in. The upside? Potentially hundreds of basis points versus benchmarks.

- Total Return Risk: If your objective is total return, consider this: when spreads widen, risk-free rates may be much lower as central banks cut rates to support a slowing economy — which is our base case. Waiting could mean missing out on a significant portion of the total return available today. That’s a real risk.

Timing Is Everything — And It’s Hard

It’s incredibly difficult to invest decisively when spreads are widening. Markets move fast, and hesitation can mean missing the window. That’s why it pays to be invested in credit markets before spread widening to capture alpha and give you the best opportunity to maximise total return.

Diversification and the Government Bond Paradox

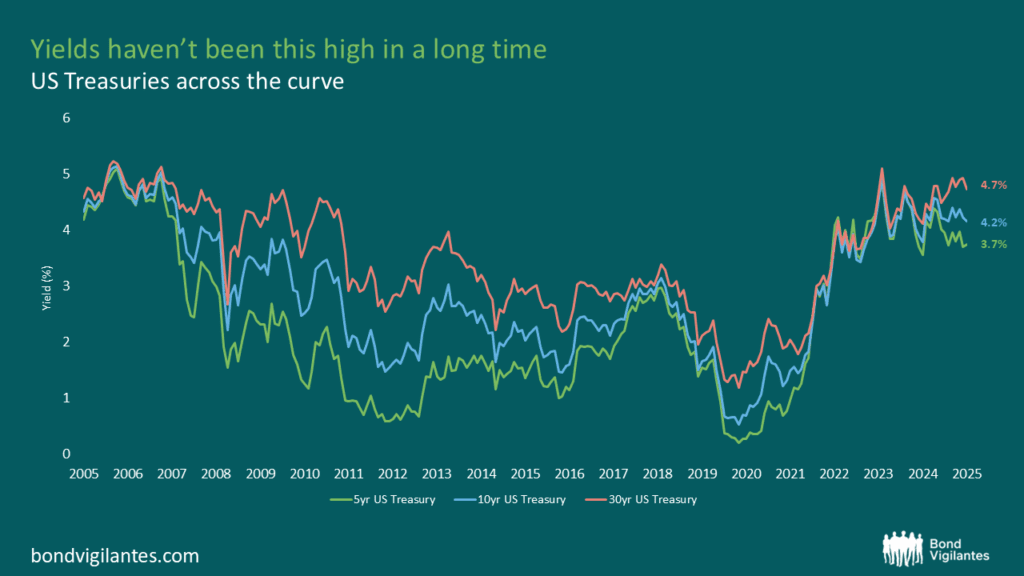

There’s a lot of yield buying happening in the market at the moment — passives, fixed maturity products, you name it. Yet, there’s simultaneous anxiety about government bonds. If you’re not yield buying now, with equities at expensive valuations and bonds looking cheap, then you might be nervous about government bonds.

But here’s the twist: if you’re buying yields now, whether you realise it or not, you’re expressing a preference for government bond yields. That’s where the opportunity lies — not just in fixed income, but potentially across asset classes.

Source: M&G, Bloomberg (30 September 2025)

Source: M&G, Bloomberg (30 September 2025)

Conclusion

Whether your goal is alpha, total return, or diversification – IG credit is an area of opportunity at the moment, not a time to be underweight. Let’s not miss the moment.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.