A memo to Howard Marks

In writing these blogs one hopes to be insightful, consistent, and timely, ie to try to emulate the output of Howard Marks at Oaktree.

His memo of January this year on equities inspired us to look further into the relative attractiveness of bonds vs equities (here).

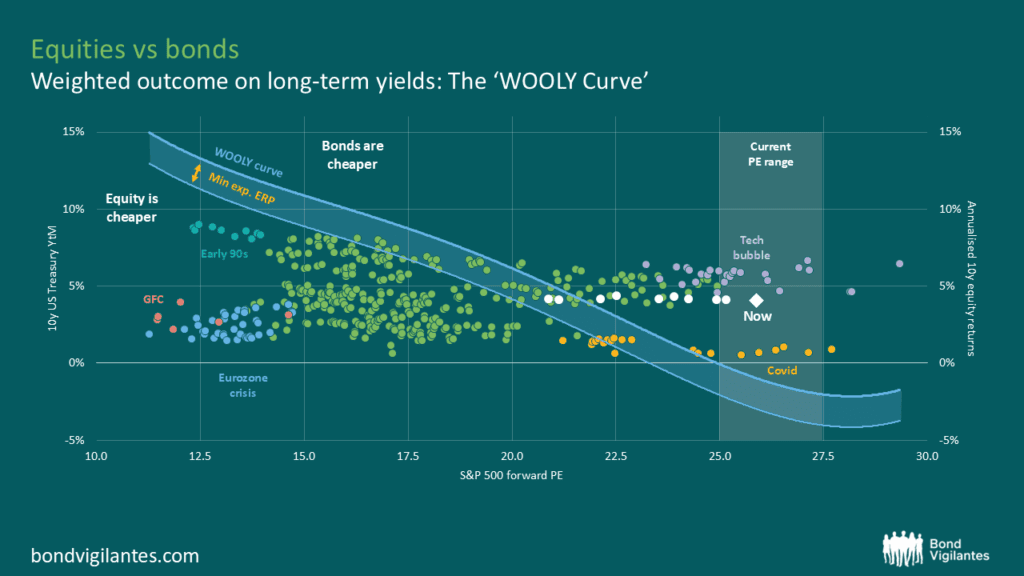

Howard has updated his thoughts in August (link) – this looks like something that is seriously on his mind. It is on ours as well, so we thought we would update our thinking on our Weighted Outlook On Long-term Yields.

A quick recap

The principle of investing is a function of choosing a good investment at the right price. When looking at the S&P 500, there are many great companies, but is the price cheap, fair, or expensive?

When we look at prospective returns based on current price to earnings (PE) ratios, we get a gauge of that price. In Oaktree’s January blog, the salient point was that purchasing this index at historically high PE levels generated unexceptional returns in the subsequent 10 years.

Where we added to this thinking was to simply compare these prospective returns with the yield if one simply bought and held a 10 year treasury. The risk free alternate.

Source: M&G, Bloomberg, October 2025.

When the 10-year bond yield is higher than a modelled prospective 10-year historical equity return, per annum, then in this simple model bonds are cheap versus equities. We are essentially comparing the Weighted Outlook Of Long-term Yields on the graph. Or, the ‘WOOLY’ curve.

In the update below we add some simple granular data so one can see the different regimes we have been in, and plot where we potentially are now.

Source: M&G, Bloomberg, October 2025.

On a relative long term earnings yield vs bond yield it is clear which regimes mark an attractive starting point of equities versus bonds, the Global Financial Crisis, and the Eurozone crisis. It can also be seen that the tech bubble was a time to prefer bonds to equities.

The white markers for 2025 echo that the starting point for US bond yields is attractive versus the S&P 500 index. Things are always different, but the fundamental analytical starting point remains the same.

As Howard Marks regularly says: “Investment success doesn’t come from ‘buying good things’, but rather from ‘buying things well’.”

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.