Is there still value in EM Local markets after the 2025 rally?

Is there still value in EM Local markets after the 2025 rally?

Investors’ appetite for local markets remains solid. In our view, this is supported by two main factors. The first one being that emerging markets continue to offer compelling macroeconomic fundamentals, and the second one being a rising interest in diversification from structurally long USD exposures. Below, we outline four key reasons why our Emerging Market Debt (EMD) team believes EM local debt should continue to offer value in the quarters ahead:

First: strong monetary policy discipline and good management of inflation:

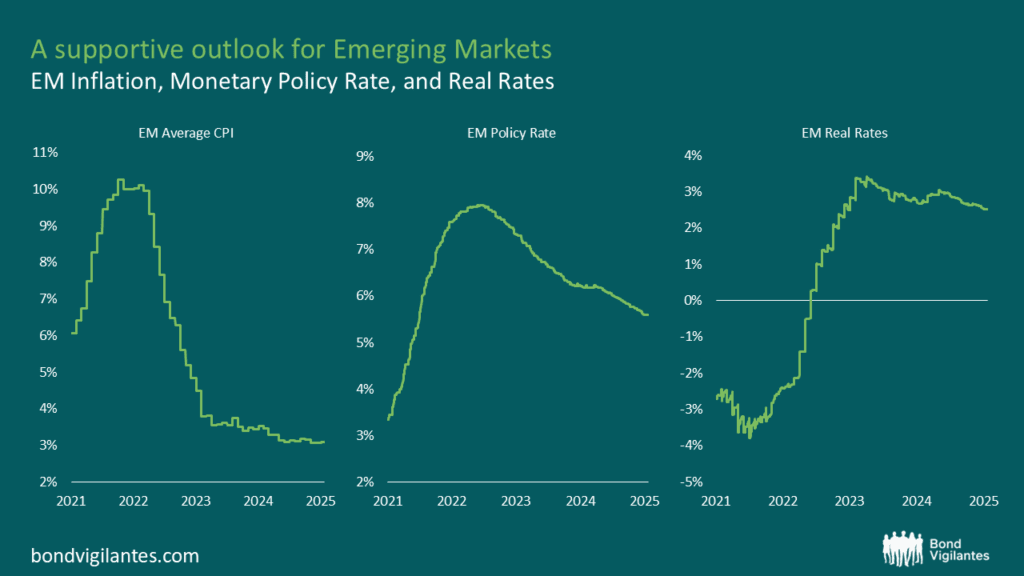

Emerging Market (EM) central banks have done an exceptional job in managing monetary policy over the last year, as despite widespread easing during 2025, EM real rates have remained broadly stable and at attractive levels. This means they avoided the common policy mistake of excessive easing. The three charts below illustrate this dynamic, showing the simple averages of EM policy rates, EM CPI, and EM real rates (policy rate deflated by 12-month CPI) for 18 EM countries. As the charts below show, real rates currently stand at approximately 2.5%, and have not moved much. Looking ahead, we would expect inflation to remain well contained through 2026, supported by stronger EM FX, subdued oil prices, and moderate GDP deceleration, all of which favour a supportive outlook for EM local bonds.

Source: M&G, Bloomberg

Second: EM offers a tight fiscal anchor, with a steady improvement relative to DM:

Fiscal dynamics have been a strong driver of price action. For example: Argentina’s sovereign bonds roughly tripled in price since Milei took office on Dec-23 and narrowed the fiscal deficit from 4% to 0%. Similarly, Ecuador bond prices doubled since Noboa won in April of last year with the most important point of the agenda being cutting fiscal spending. Meanwhile, Senegal saw a collapse in bond prices after it became public that there had been a misreporting of public deficits. Developed markets are facing similar scrutiny, with the U.S. seeing its longest government shutdown in history as lawmakers struggled to agree on funding.

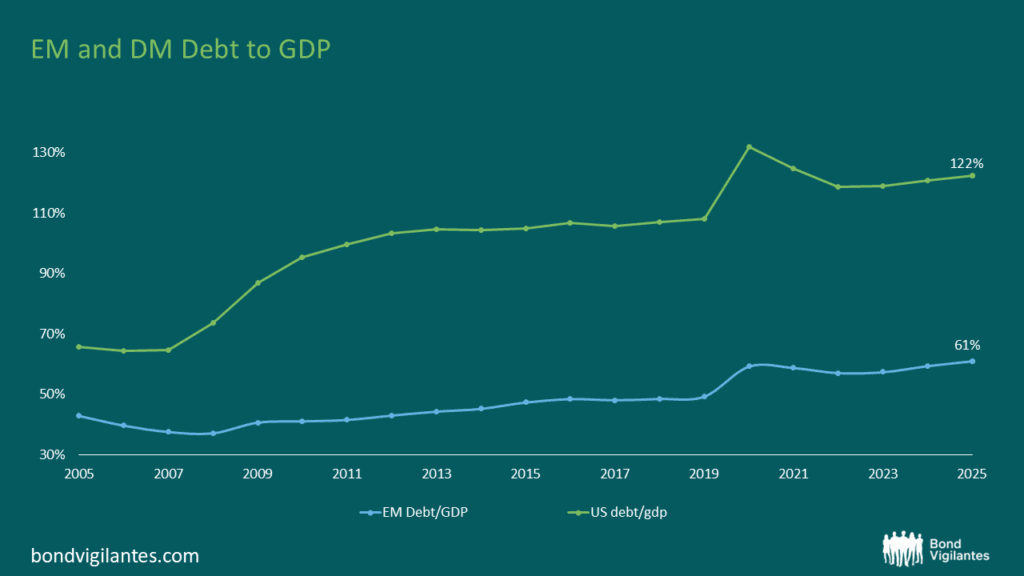

Against this backdrop, EM stands out: The chart below, compares EM and US fiscal dynamics. A simple average debt-to-GDP ratio for 19 countries in the J.P. Morgan’s GBI-EM index is roughly half that of the U.S., and over the past 20 years, EM debt has risen by 18 percentage points compared to a 57-point increase in U.S. debt (US debt nearly doubled over the same period).

Simple average of 19 EM countries. Source: M&G, IMF. Countries included in the chart are : Local, Brazil, Chile, Colombia, Dominican Republic, Mexico, Peru, Uruguay, South Africa, Czech Republic, Hungary, Poland, Romania, Serbia, China, Indonesia, India, Malaysia, Thailand, Türkiye.

Third: 19% returns in 2025 are causing “ownership FOMO”, and positions are still light despite last year’s rally:

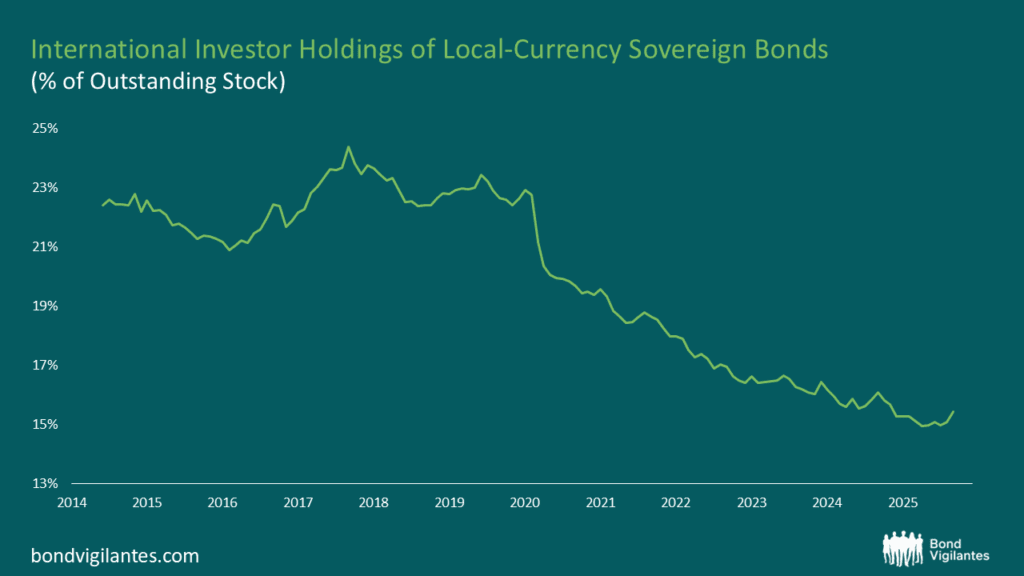

Positions are still light despite the rally: International investor ownership of local-currency sovereign bonds remains low by historical standards. Across 19 key EM countries, foreign participation averaged 15.4% of outstanding stock as of September 2025. Well below pre-COVID levels, when foreign holdings exceeded 20%. While part of this decline reflects supply dilution rather than outright selling, it suggests that much of the 2025 rally occurred with limited foreign involvement.

Source: M&G, Bloomberg. Simple average for: Brazil, Chile, Colombia, Mexico, Peru, Czech Republic, Hungary, Israel, Poland, Romania, South Africa, Turkey, Indonesia, Korea, Malaysia, Thailand, India, China. Source: M&G calculations based on J.P. Morgan data which comes from Finance Ministries or Central Banks.

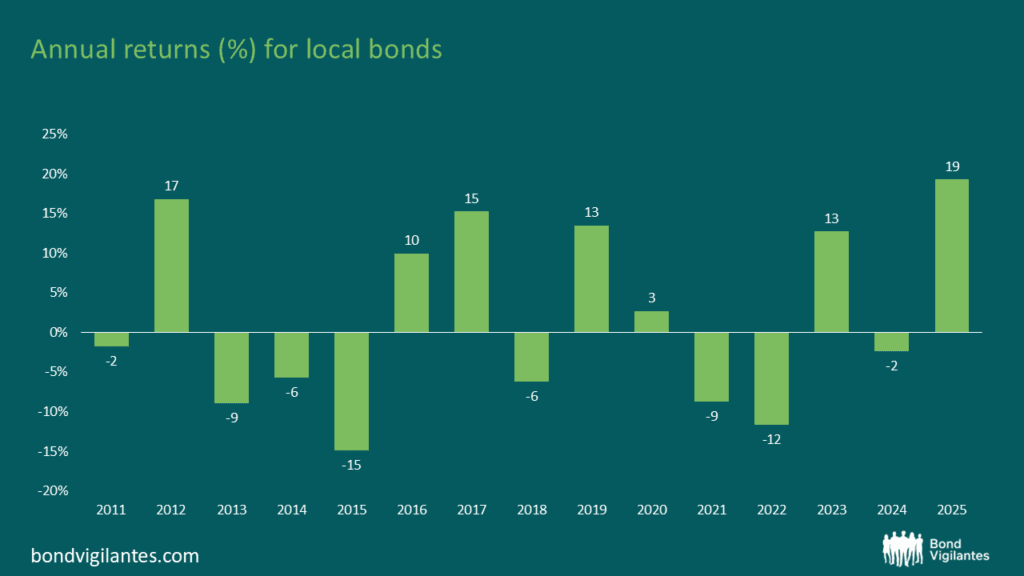

Meanwhile, 19% returns in 2025 are certainly raising eyebrows: Local bonds delivered an exceptional 19% return last year (combined FX and rates performance, per J.P. Morgan’s GBI-EM GD index). Such outsized gains for a sovereign fixed-income asset class naturally attract attention from non-EM investors, increasing the likelihood of inflows as global investors seek to capture momentum and avoid missing the trend.

Source: Yearly return for local bonds, as proxied by J.P. Morgan GBI-EM Global Diversified index. Source: M&G based on J.P. Morgan calculations

Fourth: the ongoing narrative of USD weakness should favor EM Local Markets:

In our view, US fiscal imbalances, widening deficits, rising public debt, and heavy US Treasury issuance, are factors pushing heavily towards diversification from USD assets. This combined with the Fed easing rates (which deteriorates interest rate differentials) and risks around the Fed succession plan, should favour EMFX. Additionally, it’s worth keeping in mind that the U.S. will have midterms in November, and historically, midterms have shifted congressional control, which suggests that the US political landscape may see some volatility in the second half of the Trump administration.

With all that said…what are some key risks to the bullish view?

The first key risk is U.S. policies towards EM: US policies have a large impact on EM. For instance, Venezuela’s U.S. intervention triggered a sharp rally in sovereign bonds, uncertainty regarding the Panama Canal caused volatility in early 2025, and Colombia’s tensions between Petro and the U.S. government have added uncertainty to bilateral trade. These are just a few examples of how U.S. decisions can contribute to the rapid alteration of EM asset pricing, and investors should not rule out further actions in 2026.

Separately, we note that some countries in the region will have presidential or parliamentary elections, such as Brazil, Costa Rica, Colombia, Peru, Thailand and Hungary, and this can add volatility, as investors navigate the rising political uncertainty.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.