Demographics and bond yields: Is the relationship broken forever?

Demographic trends – once a guiding light for bond investors

There’s a great attraction in using demographics – i.e. trends in population growth, and changes to the composition of populations between the young and old – as an economic forecasting tool. This is because future demographic trends are largely baked in the cake, allowing us to make solid predictions. Like the famous basketball making its way through a snake, we can see where it’s been, make an informed judgement about where it’s likely to go, and at what speed. Traumatic events like wars, famines and plagues can occasionally change demographic trends (for example Russia after World War II), and there can be societal changes in birth rates (historically, tending to fall as economies get richer). That said, the composition of your population today generally tells you what it will look like in decades to come.

In addition, for much of the 20th century, understanding the demographic changes in the Western world would have allowed you to predict government bond yields pretty accurately. In the past few years, however, those old models have completely stopped working. So what is the relationship between demographics and bond yields, and why did it break down?

The traditional models worked like this. Knowing what population growth is likely to be allowed you to estimate an important input to an economy’s trend gross domestic product (GDP) growth. Trend GDP growth is often calculated as the change in working-age population plus any change in productivity growth. This estimate of trend growth is itself an important input to making a judgement about the long-term real interest rate (r*) appropriate for an economy. The changing mix between old and young in an economy is also, therefore, critically important for understanding where interest rates might go.

When the ratio of people of working age to those of non-working age (kids, retirees) is high, inflation is low and bond yields fall. The reverse also holds. Why? The first reason is driven by the supply of labour. When a society has a high proportion of workers relative to the population, workers are less able to demand high wages than at times when there is a ‘shortage’ of labour. Wage growth has historically been a driver of inflationary pressure, so weak wage growth is correlated with low consumer price inflation, and hence low bond yields.

A structural force driving inflation

Secondly, we can also think about the ratio of workers to non-workers as similar to the ratio of ‘producers’ to ‘consumers’. Children and the retired don’t make anything, they only consume goods and services (and are high consumers of state-provided services such as schools, universities, doctors, hospitals and carers). So within society, there is relatively more demand for goods and services compared to those involved in their production and provision. This itself is inflationary (bad for bonds), and demand for state-provided services causes higher levels of government borrowing (bad for bonds).

Finally, you can think of the working-age population being in an asset-accumulation phase of their lives – earning money and investing that cash into pensions and other assets to fund their retirement lifestyles. The retired are in an asset de-accumulation phase, selling their savings to fund consumption. It follows that when you have a large percentage of elderly people in the population there will be selling pressure on those assets (often fixed income) they had previously accumulated.

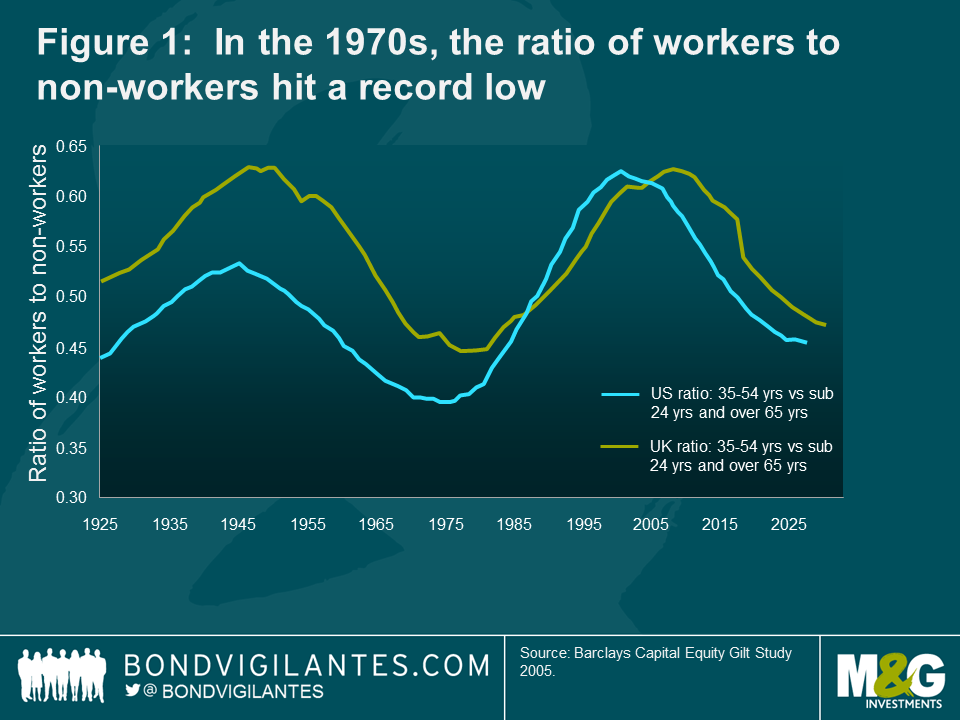

All three of these dynamics can be seen at work in Western economies over the past century. For modern investors, the biggest influence on demographics has come from the biggest basketball passing through the snake – the baby-boomers. The return of stability to much of the world after the end of World War II, together with the returning home of tens of millions of men to their homes after years away fighting, led to a huge number of babies being born in the following years (the term ‘baby boom’ was first coined in 1951). In 1938, for example, the US experienced 19 births per 1,000 population. In 1947 this was 26 births, and the birth rate remained above the 1938 level until the mid-1960s. The initial impact on economies may well have been negative, with strains put on public services and public debt rising after the initial sharp post-war deleveraging. By the time we got to the 1970s, we saw the ratio of working-age population to the young/old cohort hit a record low, falling from 53% in 1945 to below 40% in 1975 (see Figure 1). The baby-boomers had yet to fully enter the workforce and become ‘productive’.

It was a similar story in the UK. I’m currently reading Labour Member of Parliament Alan Johnson’s book Please, Mister Postman[1] about his time working in the Royal Mail in the 1970s, and he recalls the permanent struggle they had to fill vacancies.

The relatively low supply of labour in the 1970s gave power to those of working age. Trade union membership peaked in the late 1970s (when 12 million people in the UK were members) and wage growth outstripped productivity growth and inflation. Government debt burdens grew, and interest rates and bond yields hit double digits. There were talks of ‘buyers’ strikes’ by institutional gilt investors in the UK.

Thank the baby-boomer generation for the fall in interest rates, not central banks

But as the baby-boomers entered the workforce after school or college, there was a significant improvement in the demographic trends. From that low of 40% in 1975, by the end of the 1980s the ratio of workers to non-workers was back above 50%, peaking at over 60% by the end of the 20th century. The developed world had become a world with lots of workers, keeping inflation low (trade union membership shrank), producing tax revenue to reduce government borrowing (at times in the US there was even discussion about retiring the national debt), and investing in paper assets like government bonds to provide future incomes in retirement. Inflation collapsed (you could argue that central banks, despite becoming fierce inflation fighters over this period, starting with Paul Volker taking over at the US Federal Reserve in late 1979, should take little credit here; the demographics did the heavy lifting) and 10-year US Treasury bond yields halved from nearly 13% at the start of the 1980s to 6.5% by the end of the 1990s.

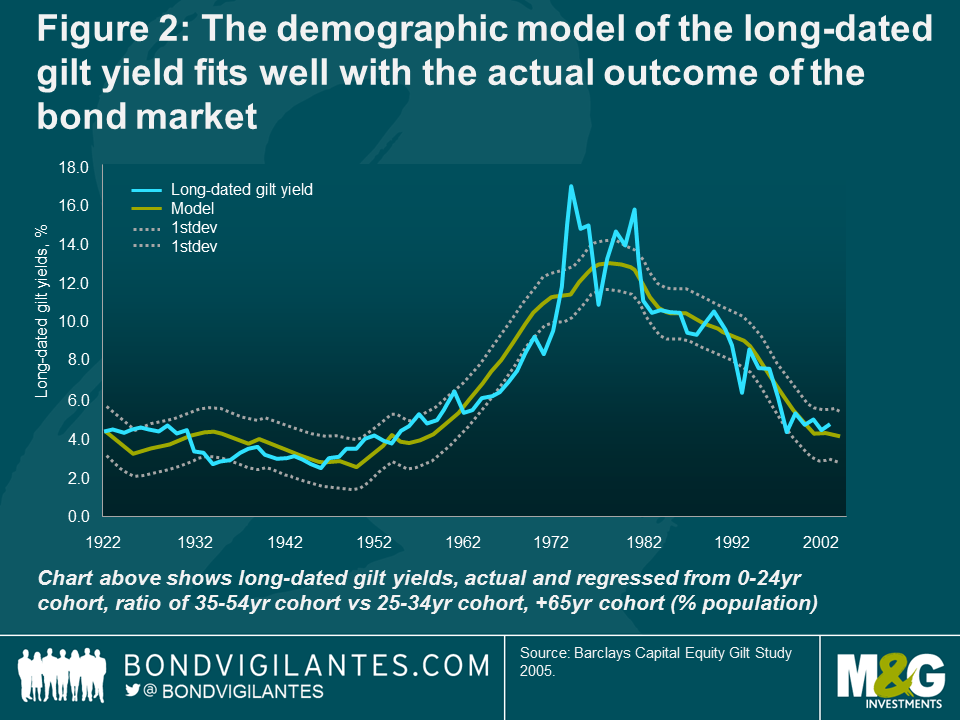

You can see that the demographic model of the long-dated gilt yield regressed against the ratios of demographically ‘productive’ cohorts to ‘unproductive’ cohorts fits very well with the actual outcome for the bond market (see Figure 2).

I remember being very keen on these models at the time, but I could never get a good answer to why one particular bond market had stopped behaving. Japan had already hit its peak benign demography in 1990 (about 15 years ahead of the West), and was well on the way to seeing its population’s elderly share accelerate. Life expectancy was the best in the world, and together with low birth rates and retiring baby-boomers, its dependency ratio was deteriorating rapidly. Yet despite the demographic bond models predicting rising inflation and yields, the opposite occurred. At the start of the 1990s, Japanese Consumer Prices Index was around 2.5%. By the end of 2009 it was -2% a year. Ten-year JGB yields fell from 7% to 1.3% over the same period. “Ah, Japan is ‘different’, let’s not worry about Japan”, I was told. But just as the models broke down there, they broke down everywhere.

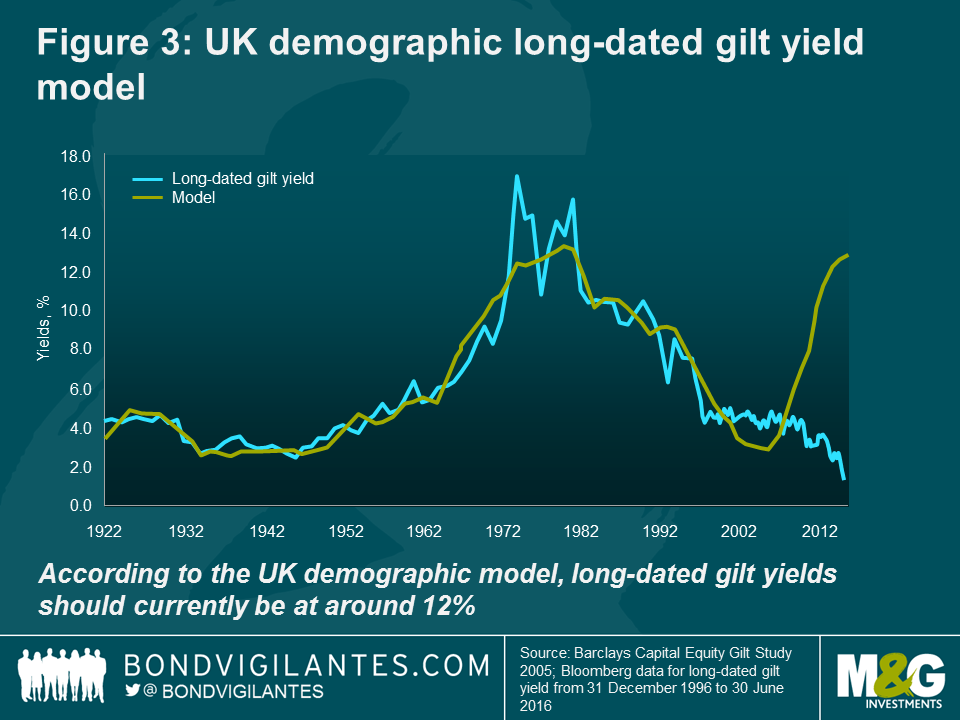

Figure 3 shows a UK demographic model of long-dated gilt yields produced in 2005 (again, the US model looks very similar). The final forecast data point roughly corresponds to where we are now in 2016. Long-dated gilt yields should be…12%. They are currently around 1.3% at 30 years. If gilt yields actually were at 12%, the current 30-year gilt would be priced at 32 pence in the pound, rather than at £1.54. To do a very, very ‘back-of-an-envelope’ calculation, the annual interest cost of servicing the UK national debt is currently about 3% of GDP. If yields were 9.6 times higher, as predicted, the debt service cost would be 29% of GDP (or about 75% of tax revenue, using 2015 numbers). For comparison, in 2016 only Brazil, of the major emerging market economies, offers a yield of over 12%. To get 12% in the junk bond markets, investors would currently need to look at distressed energy names and weak CCCs.

While demographic models worked well in the past, they aren’t much use now

It’s clear then that what looked to be very reasonable demographic bond models 15 years ago, look foolish today as we hit all-time lows in bond yields and live with persistently low inflation and deflation. These are the reasons it all went wrong:

- Globalisation From 1980 to 1990, the KOF Index of Economic Globalisation increased by 7%. In the next decade, from 1990 to 2000 it rose by 24%. It rose by another 11% from 2000 to 2007. China joined the World Trade Organization (WTO) in December 2001. As economies grew more open to trade, the idea that a scarcity of labour relative to the whole population could lead to workers demanding higher wages became a nonsense. Employers could move whole factories to lower-cost countries – and they did, with east coast China becoming the manufacturing centre of the world. This meant both a cap on workers’ compensation in the West, and goods price deflation in manufactured products. In the UK, there was another significant factor in the lack of wage pressure and inflation, although economists argue about the level of the impact: when eight central and eastern European nations joined the European Union (EU) in 2004, the UK permitted the immediate inward movement of workers from those countries (most EU nations did not). More than a million workers did come to the UK, together with an additional 1.2 million workers from the rest of the EU as unemployment there remained high as the eurozone crisis continued. Globalisation and the freeing up of the movement of labour across national borders therefore removed bargaining power for workers, despite them becoming relatively scarce within their own economy, and the lack of an immigration variable meant that the demographic models were wrong. It was as if the vet opened up the snake and implanted a second smaller basketball immediately behind the first.

- Great Financial Crisis (GFC). I’m not sure you can treat the GFC as an exogenous shock to the demographic model. Leverage in US financial markets got out of control due to low interest rates and a hunt-for-yield and retirement assets, and the eurozone debt crisis was at least in part the fault of ageing populations and low growth. Nevertheless, the collapse of banking sectors around the world led to huge cuts in central bank interest rates, as well as a flight-to-quality into ‘safe’ assets like government bonds, depressing yields. Potential growth rates fell as a result of weak banking systems and (arguably) higher debt-to-GDP levels. As unemployment rose dramatically, wage growth collapsed and most Western economies experienced deflation. The final, and ongoing, factor linked to the GFC is the use of quantitative easing (QE). Today, the purchasers of government bonds are largely central banks who are not price-sensitive, unlike the ‘buyers’ strike’ gilt investors of the late 1970s in the UK, or the bond vigilantes responding to out-of-control US budget deficits in the 1980s. Financial repression – the authorities making the private sector own government bonds, for example as part of banks’ capital requirements – has also increased since the crisis.

- Technology. If you’ve read Martin Ford’s Rise of the Robots[2] you’ll realise that competition for jobs is not simply the pricing of worker-versus-worker in the globalised world. Great leaps forward in robotics and machine intelligence, together with the continuous collapse in the pricing of technology, have led to machines ‘eating our jobs’. This is deflationary in two ways – no wage gains for those who are competing with the robots and Artificial Intelligence devices, and a hollowing out of consumption as even higher waged jobs go to machines. Computers don’t buy stuff, so aggregate demand falls. Lower growth, lower inflation, higher bond prices. Robots have joined the working cohort.

- Longevity and under-saving leads to older workers staying in the workforce. As indebted states can no longer stick to their promises regarding pension entitlements or retirement dates, or private pensions and savings prove inadequate, the older cohorts have stayed in the workforce for longer in order to earn money. As health in retirement has also improved, older people have also kept working because they want to and enjoy it, in addition to those who have no choice. So the older cohort used in the demographic models need not be purely consumers, and may also be exerting downward pressure on wages for younger workers in competing with them for work. Additionally, those who stay in the workforce for longer do not yet need to sell down their investments to fund retirements.

- China. Joining the WTO allowed China to trade with the world. Being the lowest cost producer of manufactured goods allowed it to become the world’s biggest exporter. And with those exports it accumulated foreign exchange reserves, which it invested in assets including US Treasury bonds. By the start of 2015, China owned over US$1.2 trillion of US Treasuries. Just as inflation is no longer driven just by domestically generated wage growth, bond prices are no longer driven by domestic investors. These are not closed systems anymore (the UK had capital controls in the 1970s, for example) and the savings markets have globalised. Some estimates suggest that the scale of this buying has reduced 10-year bond yields by about 40 basis points, which is relatively small in the context of the demographic bond model errors, but is nevertheless a factor. It is worth mentioning that China is now a net seller of Treasuries as its economy and currency weaken. Also worth noting is China’s awful demographics given its ‘One Child’ policy. This could be disastrous without the use of robots and immigrants in the future.

In short then, globalisation (both of trade and the movement of people) and technology have reduced the ‘damage’ that an ageing population can do to an economy in terms of causing inflation. And, in fact, they have overpowered demographics to leave bond yields in a different paradigm than any model might have predicted. Budgetary challenges around the provision of pensions and healthcare to older people remain key, however, especially in a globalised world where taxes are more difficult for nations to collect. The simplicity of demographic models was attractive, but what worked in a closed economy failed in a connected world.

[1] Alan Johnson, Please Mister Postman: a Memoir, Bantam Press, 2014.

[2] Martin Ford, Rise of the Robots: Technology and the Threat of a Jobless Future, Basic Books, 2015.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox