The growing opportunity in corporate bond markets

Conventional wisdom suggests that equity markets are more diverse and better-performing than bond markets, particularly from an active investor’s perspective. However, the evolution of the highly dynamic corporate bond market counters this view. Over time, credit markets have matured to become an increasingly significant asset class, now offering a far broader range of investment opportunities than in the past.

Historically, companies have mainly financed their activities with debt, equity, or a combination of both. Equityholders have responsibility for the operation of the firm through the election of a board of directors. The dividends that shareholders receive in return for an allocation of capital are not guaranteed and are paid at the discretion of the board. In contrast, bondholders are promised a coupon and thus know the rate of return on their investment. Bondholders have no rights of control on the company unless there is a missed coupon payment on the bonds, in which case bondholders have the right to foreclose on assets or force insolvency.

The decision to increase or decrease leverage depends on market conditions and investors’ appetite for debt. The last 20 years have generally favoured debt financing, as interest rates and bond yields have fallen and investors have gained greater access to capital markets. Investment grade companies, in particular, have increased debt issuance, while the market has also opened up for lower-rated bonds. BB and B rated companies have been raising capital through sizeable new issues of debt and equity.

In plain terms, investors looking for a combination of income and capital returns start with a choice between investing in the three main investment classes – cash, bonds and equities. Traditionally, each asset class is perceived to be progressively more risky and therefore offers more opportunity for superior investment returns. The table below describes the generalised risk characteristics of these three asset classes, with bonds appearing to be a ‘happy medium’ between cash and equities. Importantly, given the vast range of available bonds, risk and return characteristics can differ substantially within bond asset classes (for example, bond managers have a choice of investing in either low or high credit quality, and/or short- or long-term issues). This is why the traditional perception of fixed income is too simple. Within fixed income, the corporate bond market is not just an important asset class, but one that provides excellent opportunities for investors if suitable to their personal investment circumstances.

Traditional asset class perceptions

| Asset class | Credit quality | Term |

| Cash | High | Short |

| Bonds | High to low | Short to long |

| Equity | Low | Long |

In reality, the ‘happy medium’ bond market offers diversification via two dimensions: term (more commonly known as duration) and credit risk. In terms of term risk, bonds can be purchased with cash or short-term like characteristics (eg, paying a coupon that is linked directly to short-term interest rates, such as floating rate notes). Alternatively, fixed income securities can exhibit more equity-like characteristics if issued as long-term instruments paying regular coupons and maturing in the distant future (eg, in 15 years or more).

Fixed income’s second diversifying dimension is credit risk (the risk that a company may default on its debt obligations). The variety within the fixed income asset class, in term and credit risk, provides an extensive range of investment opportunities within which it is possible to generate attractive risk-adjusted returns.

Evolution of the UK market

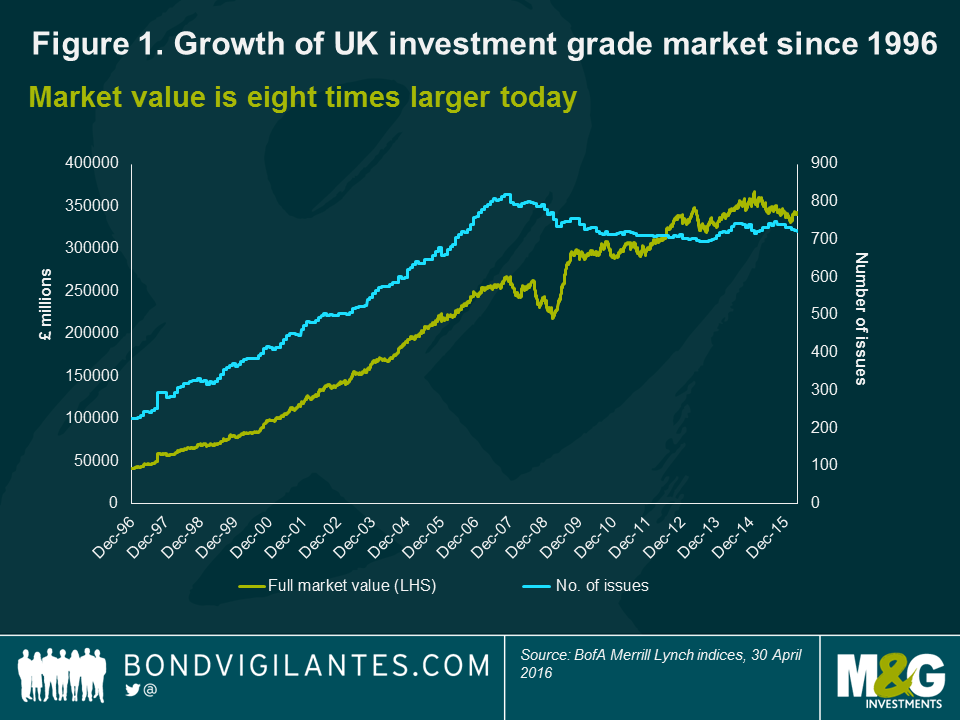

Over the past 20 years, the sterling investment grade (IG) bond market has grown in size and depth, as shown by the evolution of the Bank of America Merrill Lynch Sterling Corporate Index in Figure 1.

Developments of note include:

- In terms of the face value of debt outstanding, the market is eight times larger today than in 1997.

- The number of companies funding themselves via the UK corporate bond market has more than doubled, from 120 to 274 issuers, over that time.

- The number of issues in circulation has increased, with sterling issuance in 2016 three times larger than in 1997.

This huge growth in market size provides fertile ground for active investors and the increase in the number of issues available is a large benefit for those seeking diversification.

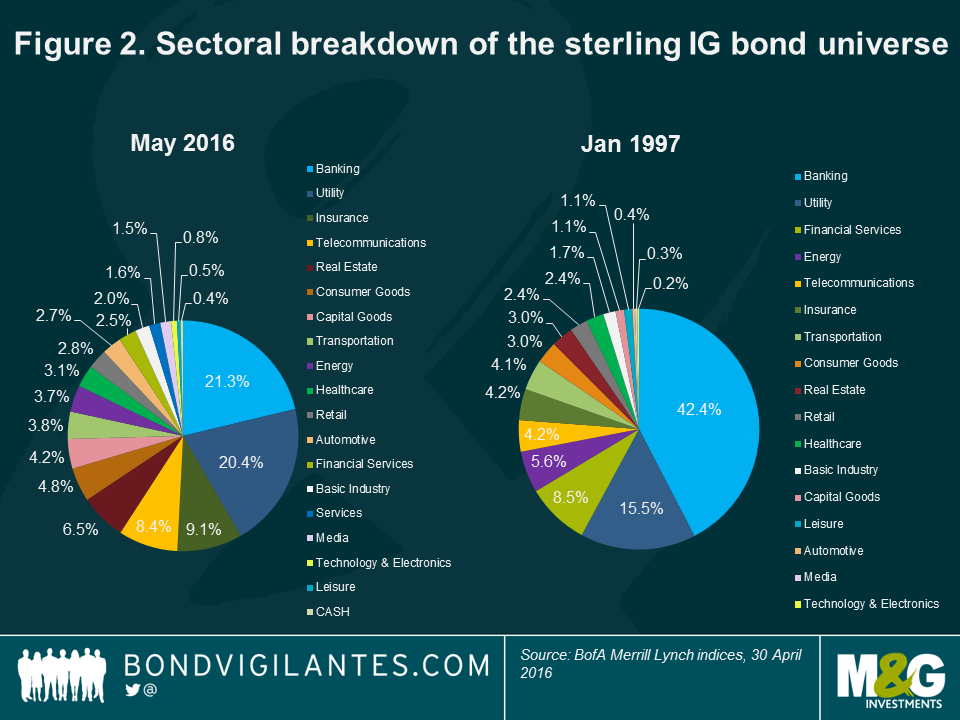

Having an increasing number of issues and issuers to choose from is positive, but this should ideally occur alongside an improvement in the variety of underlying sectors. As can be seen in Figure 2, the investment universe has evolved – from being dominated by a few large sectors to a much more diversified market, offering the investor greater choice. A prime example is the area of banking and financial services. Where previously these sectors made up 51% of the UK IG corporate bond market, this has halved and now represents just 24%, which highlights the growing prominence of alternate sectors. Such diversity in sectors again allows for a greater spread of risk or, if desired, the ability to focus on lending to sectors that may be considered to be currently undervalued and hence a buying opportunity.

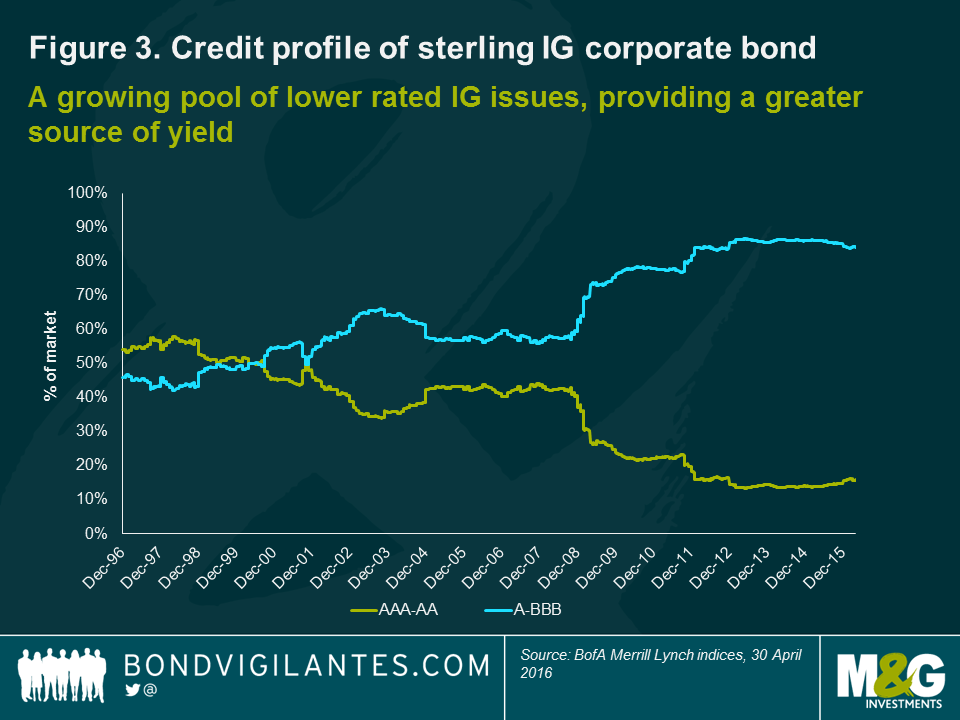

Another dimension that makes the asset class noteworthy is the spread of credit ratings within the investment grade sector. Figure 3 demonstrates how the market has moved from being dominated by high quality, highly rated bond issues in the top half of investment grade, (ie, those rated AAA and AA) relative to the low end of investment grade issues (ie, those rated A and BBB). This is important to investors as riskier, lower rated issues generally offer greater yield. As the probability of default is higher, more value can be added by thorough credit research and analysis. As well as enabling investors to focus on portfolio construction at the aforementioned issuer and sector levels, this also allows them to reduce or add particular types of credit risk at the aggregate fund level.

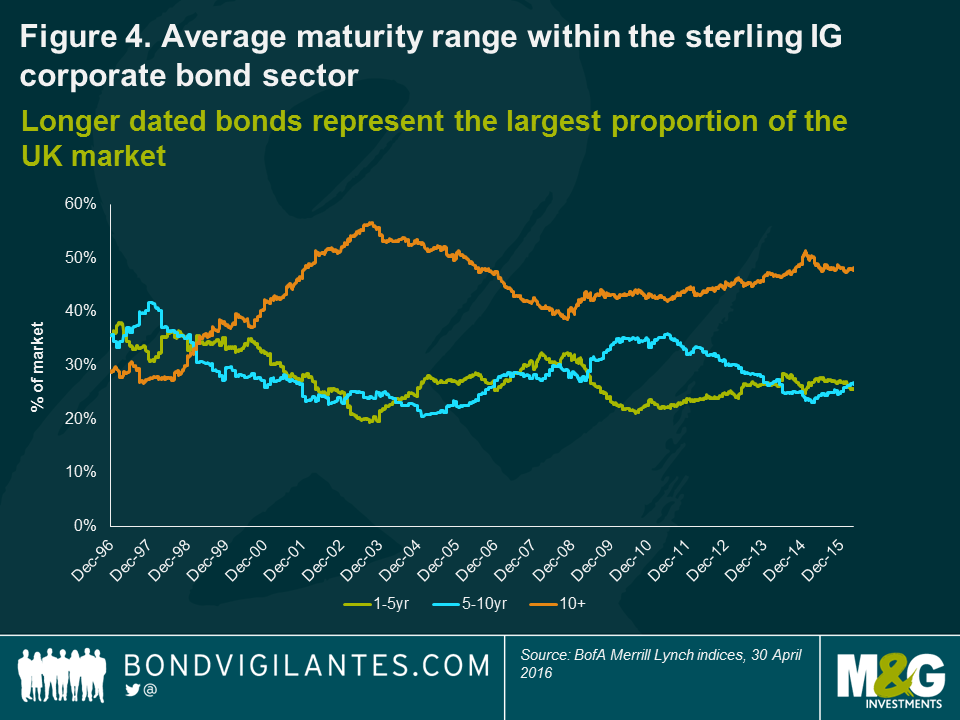

The final characteristic of the UK corporate bond market that has changed over the years is with regards to the term of investments. Figure 4 shows the average maturity range of bonds within the index and underlines how the term has dramatically increased – with 10-year plus issues asserting their dominance over the period. Term is attractive to investors as it makes the security less like cash. Additionally, it enables an investor to express a view on the underlying company. For example, does the company’s immediate future look more attractive than its long-term future? If so, shorter dated bonds may be preferred. Alternatively, if the long-term future is the appeal, it may make sense to choose the more volatile long-term investment in the company’s debt.

High yield – additional attractive opportunities

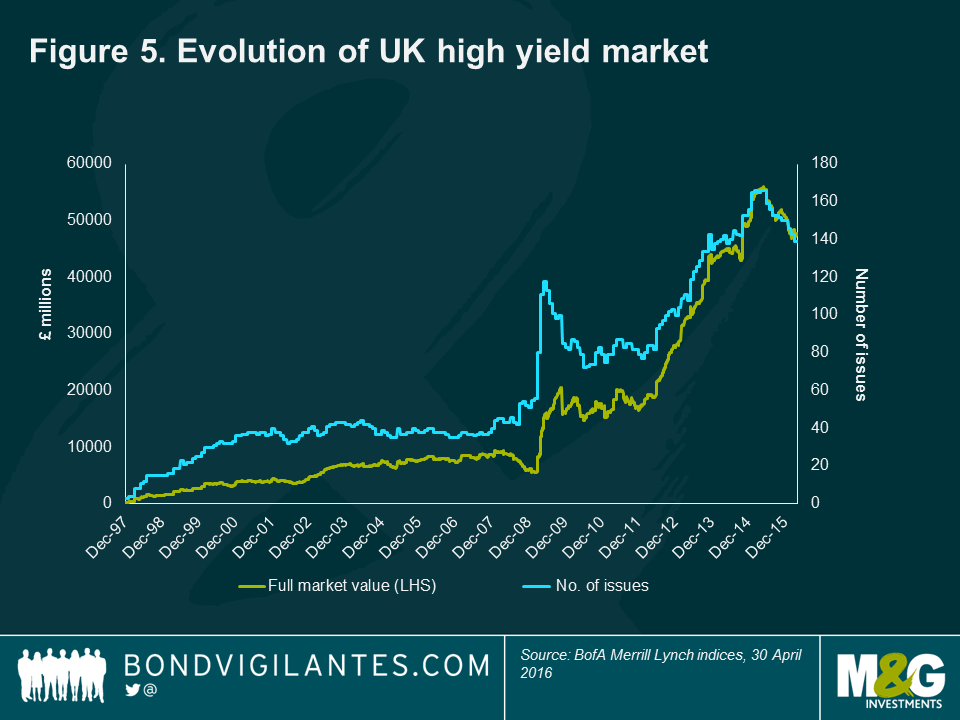

So far, we have focused on the favourable development of the UK investment grade corporate bond market over the last 20 years. However, similar changes have been witnessed in the sub-investment grade, or high yield, bond market. Figure 5 shows a comparable upward trend in both the size and diversity of the BofA Merrill Lynch Sterling High Yield Index.

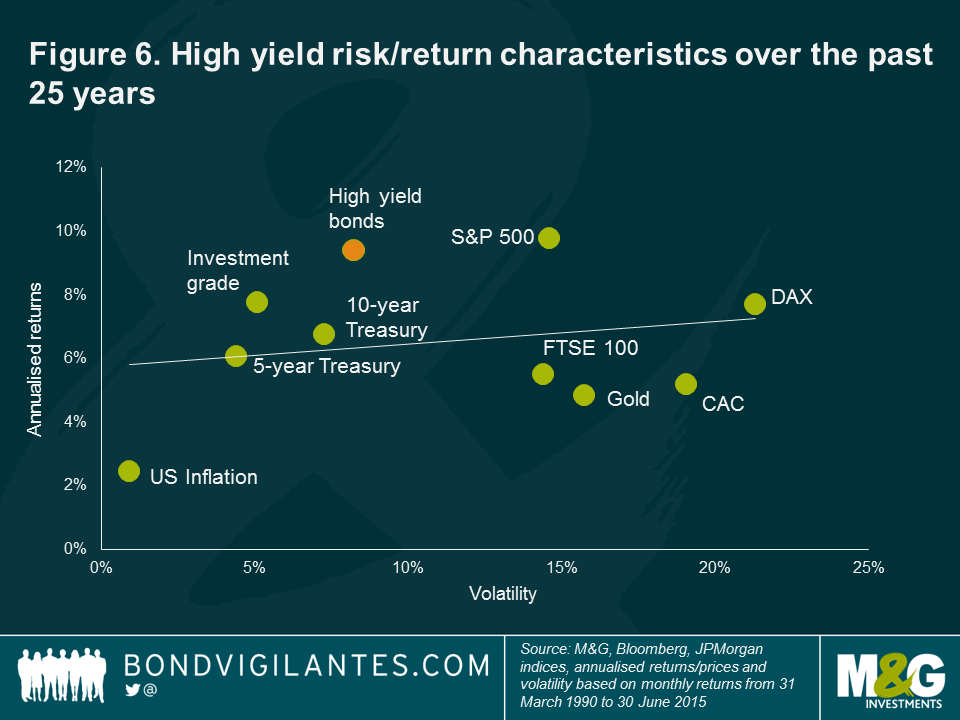

The high yield bond market introduces an even greater range of risk/return profiles available to the corporate bond investor. Given the higher yielding and riskier nature of these bonds, they share even fewer characteristics with traditional government bonds, and instead tend to behave more like equities. This is encapsulated in Figure 6, which compares the annualised return of high yield versus a range of other asset classes, including government bonds, investment grade, and equities over the last 25 years. As can be seen, high yield markets have produced equity-like returns, but with lower levels of volatility. Furthermore, the BofA Merrill Lynch Sterling High Yield Index and FTSE All-Share Index have exhibited a 0.7% correlation coefficient since 1998. As such, in a bond investor’s universe, high yield arguably serves as a credible equity alternative.

Not just a UK story

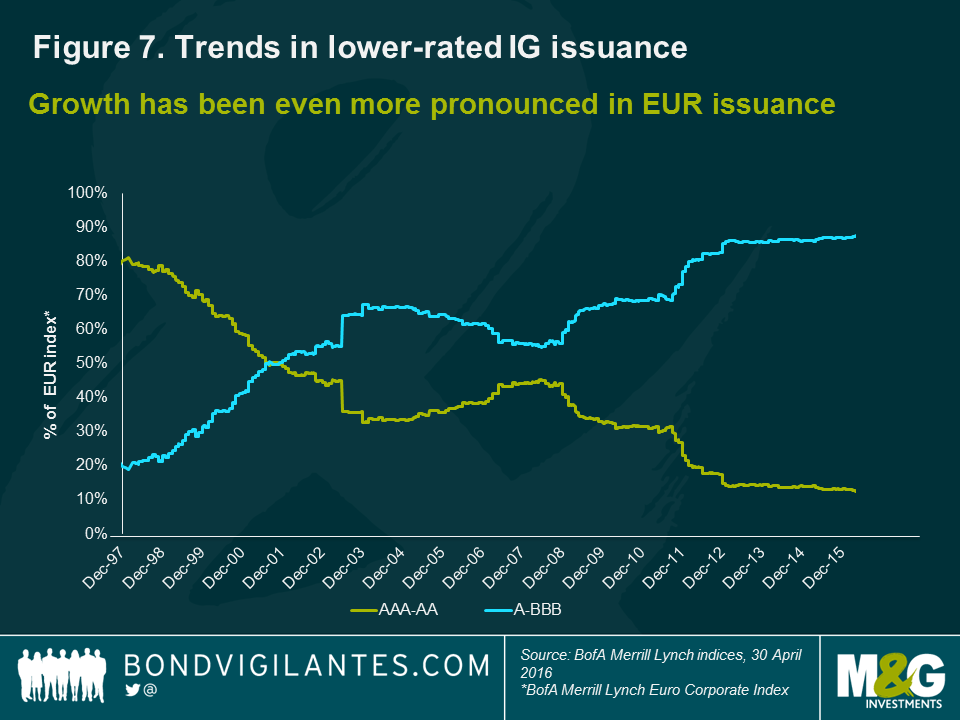

The growth and development of the corporate bond market is not just a UK phenomenon. When we perform the same analysis for the European and US corporate bond markets, a similar story unfolds. The development of the European market, in particular, was significantly aided by the implementation of the single currency, which entered physical circulation in 2002. Indeed, the growth of the lower-rated segment of this market was even more pronounced than in the UK, with A–BBB rated bonds increasing from around 20% of the BofA Merrill Lynch Euro Corporate Index to close to 90% today (see Figure 7).

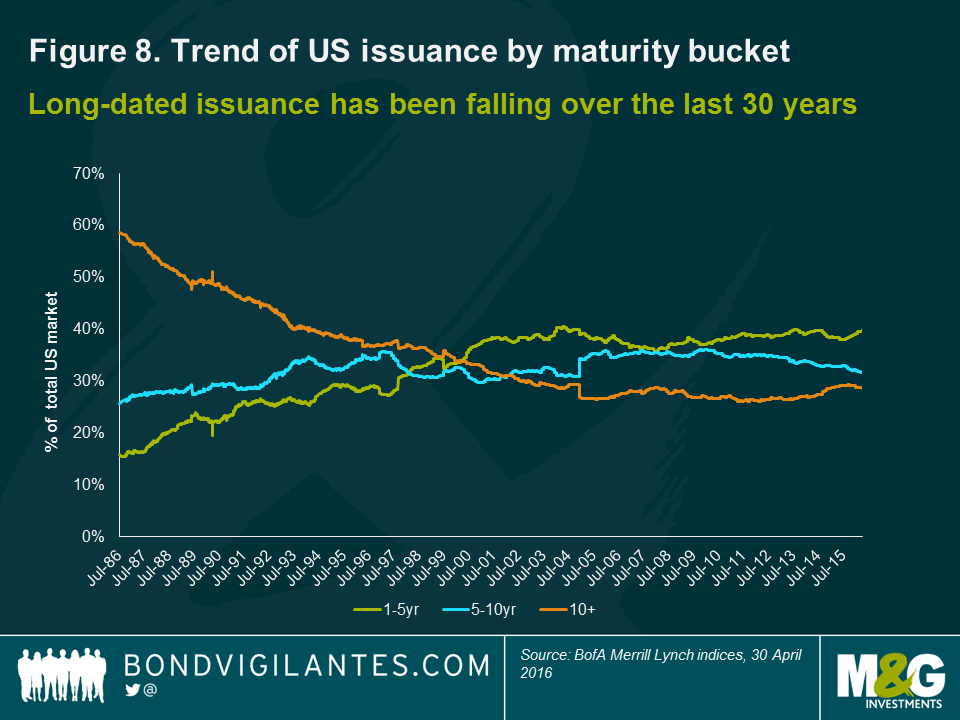

With respect to the US market, the BofA Merrill Lynch US Corporate Index exhibits a similar trend to the UK and Europe, with the number of A–BBB issues also growing significantly. This emphasises once again the growing diversity and attractive investment opportunities that are available in the corporate bond space. Where the US differs, however, is with respect to the term argument. While the UK has witnessed a steady growth in longer dated issuance, the US has experienced the reverse, with bond maturities in excess of 10 years falling from a peak of 59% in 1986 to 28% today. As a result, the three main maturity buckets (1-5 years, 5-10 years and 10+ years) have converged and are now broadly equal (see Figure 8). This is perhaps indicative of a more mature market, although it also suggests that the UK market has potential for further development in the years to come.

Bonds and equities go head-to-head

The corporate bond market has developed from a relatively small, undiversified, high-quality, cash-like alternative, to a large and varied market from an issuer, sector, rating and term perspective. It is nevertheless interesting to take a closer look at how this development compares with that of the equity market.

From a sector perspective, the UK equity universe was already reasonably well diversified, so in this respect the corporate bond market was merely playing catch up. While both markets now offer a diverse range of investment opportunities, if we delve deeper and compare corporate bonds versus equities at an individual issuer level, we can see that in some respects the bond markets offer better diversification.

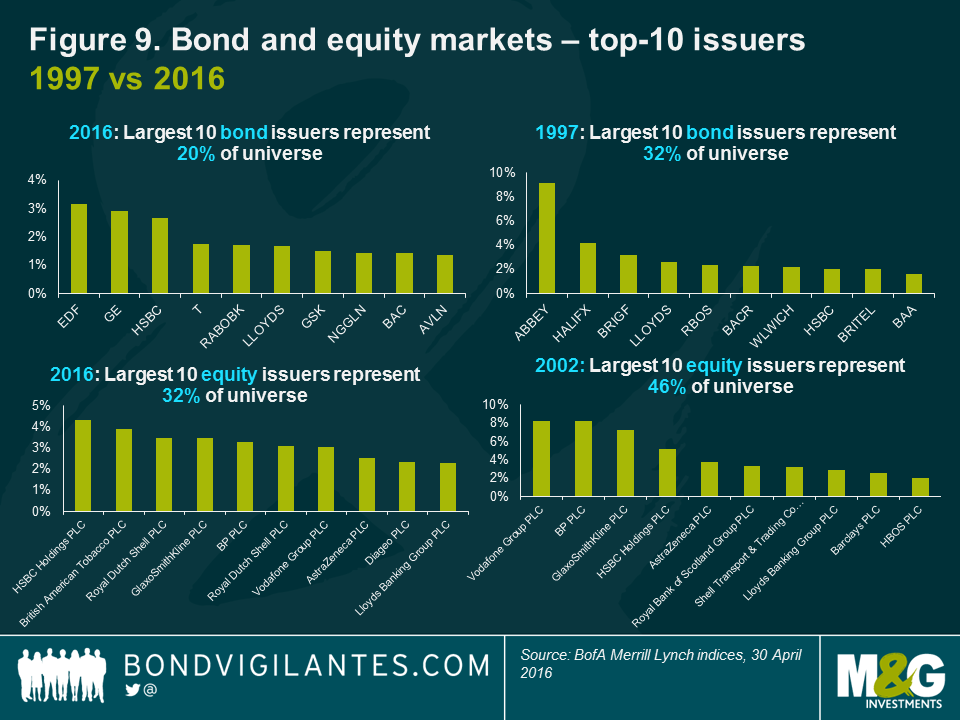

For instance, in 2002 the largest 10 issuers in the BofA Merrill Lynch Sterling Corporate Index represented 32% of the investment universe, while today they account for just 20% (see Figure 9). This is favourable from a concentration risk perspective, especially compared to the FTSE All-Share Index where the top 10 issuer weightings has only fallen from 46% in 2002 to 32% in 2016. This is still a significant proportion of the index, especially as there are 636 issuers in the equity index, compared to only 274 issuers in the corporate bond index. Given the dominance of a limited number of shares and sectors in a typical equity market index, it is important that investors rebalance their equity investments on a regular basis. Failure to do so may result in unintentional stock concentration and high correlations with other asset classes.

CORPORATE BOND LIQUIDITY AND VARIETY

To play devil’s advocate, one of the traditional disadvantages of corporate bonds can be their lower levels of liquidity. The fact that companies issue in a variety of currencies, at different coupons and maturities, can in theory hinder an efficient marketplace. For example, Verizon is one of the largest bond issuers in the market with 77 issues outstanding, across three different currencies. This equates to an outstanding market value of US$93.2 billion versus the equity of just over US$200 billion.

This disparity in issuance perhaps makes the asset class less suitable for a short-term investor who desires liquidity. On the other hand, the fact that so many bonds exist in an imperfect market, provides the active value bond investor with an opportunity to take advantage of anomalies created across the many individual issues.

Additionally, companies will often issue several types of debt from various parts of the corporate structure. For example, banks can issue asset-backed securities, senior, subordinated and junior debt, from either the holding company or through an operating subsidiary. While this differentiation can again hinder liquidity, we believe it ultimately increases the opportunity for active investors to add value through detailed credit analysis and research.

While these sorts of opportunities do also exist in equity markets, it is to a more limited extent. For instance, preference shares are occasionally available, although they are a declining subset of equity markets. The only growing division within the equity asset class is that of voting and non-voting. This has traditionally been used either by management (eg, News Corp) or by the founders (eg, Google, Facebook) to maintain control over the company. However, this division creates little in the way of opportunity for equity investors to add value (and may even be seen as detrimental, as the rights of non-voting shareholders are subordinated to voting shareholders), especially when compared to the ample arbitrage opportunities made available from the slicing and dicing of corporate debt.

A vital sector for borrowers and lenders alike

UK companies have been, and will continue to be, the main engines of sustainable growth in the real economy. Corporate bonds are an important and growing source of capital for those companies. On the other side of the coin, corporate bond markets cater for active investors seeking consistent cash flows and a greater security of capital than shares can provide.

What the UK corporate bond market may have historically lacked in terms of diversity across sectors, credit ratings, maturities and number of issuers, can no longer be said today. The market has developed from a relatively small, undiversified, high-quality, cash-like alternative, to a large and varied market – from an issuer, sector, rating and term perspective. In our view, the range of corporate bond investments now available makes this class a genuine alternative for asset allocators seeking to capture attractive risk-adjusted returns, a preserve more traditionally associated with the equity market.

As an investor or asset allocator one needs to see if the asset class itself is a potentially attractive place to be. The development of the corporate bond market has created a more exciting asset class when investing. Although, historically, equities have been considered to be the dominant asset class, if investors are looking for the best opportunity set, perhaps they should think bonds first, equities second.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox