Jim Leaviss’ view ahead of the second half of 2015 in bond markets

It may only be June as I write this, but it already feels as if we have crammed a whole year’s worth of events into the first six months of 2015.

The year kicked off at a whirlwind pace, with the long-awaited announcement by the European Central Bank (ECB) that it would finally begin its quantitative easing (QE) programme nearly upstaged by the Swiss National Bank’s surprise move shortly beforehand to abandon its currency peg. The resulting move in the Swiss franc, the biggest ever one day move in a major currency, combined with the promise of the larger-than-expected €1.2 trillion ECB package helped push significant parts of the bund market into negative yield territory. In Switzerland, 60% of banknotes in circulation are held in the largest CHF1,000 note, perhaps for ease of storage outside of the banking system – a fact that has presented us with an alternative vision for M&G’s staff canteen: one crammed full of heavy metallic safety deposit boxes rather than Styrofoam lunch containers.

This was not all for January: by month-end, a Greek election and the latest in the country’s endless eurozone in/out soap opera, and a grand total of 14 central bank rate cuts had also been squeezed in.

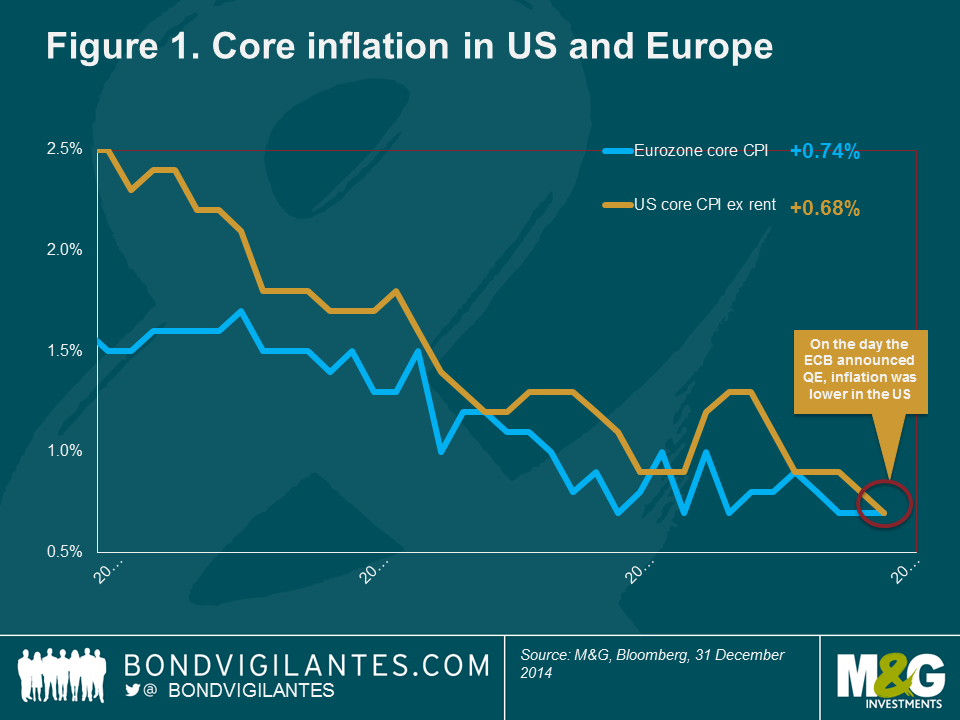

But while markets panicked – and continue to do so – about eurozone deflation, some context can prove illuminating. In this case, as figure 1 shows, on the same January day that the ECB announced its huge balance sheet expansion, US core inflation (on a like-for-like, ex housing basis) was actually lower than in the eurozone and had fallen more quickly. Even so, at that stage, markets still expected a US rate hike in June.

More recently, a government bond sell-off that saw the ‘risk-free’ German 2.5% 2046 bond fall nearly 20% in less than three weeks following a peak on 20 April, has again highlighted the risk to capital that bond investors can face when yield curves rapidly re-price. This has refocused attention on the disparate behaviour of the various fixed income asset classes in such an environment, as well as the importance of duration positioning on bond returns.

The Fed: timing is everything

The Fed (US Federal Reserve) is facing a quandary. After more than six years of close to zero interest rates, it would dearly love to begin hiking, giving it the luxury of having both a brake as well as an accelerator when setting policy. A number of developments over recent months – namely the rally in equities, the growth in the sub-prime auto loans market, and the return more generally of structured credit – worryingly resemble the period 2003-07, during which the Fed kept rates too low. There have also been some early signs of wage growth creeping back into the system, as evidenced by wage hikes for Walmart and McDonalds employees, amongst others. Latest data show US wage inflation running at 2.6% for the first quarter of 2015, up from 1.8% a year earlier.

Central to Fed Chair Janet Yellen’s dashboard of key economic indicators are several employment metrics, including JOLTS (Job Openings and Labour Turnover Survey) and quits (when employees voluntarily leave their current employment, often because they are accepting a new position). These add an extra layer of dynamism to the wider labour market picture. Based on the bullishness of these indicators, a rate hike should soon become a reality. But Yellen and the Fed remember the lessons of the Great Depression well – remove stimulus too soon, and a rapid descent back into recession could be on the cards. The Fed is left gambling that it will be easier to fight inflation by hiking rates than combating deflation in an already zero-bound world. This in turn helps push back the potential risk that higher rates lead to dollar strength, further impacting US corporate profits.

There has been a significant shift in the Fed’s dots charts since the start of the year (as a reminder, Federal Open Market Committee member estimates regarding the long-run Federal Reserve Funds Target Rate as shown in its so-called ‘dots’ chart are helpful when drilling down into how tightening might unfold). The chart provides a guide not only to the direction in which bond yields should go, but also by how much. This shift has brought the Fed’s expectations more into line with what the market is now pricing in (see figure 2). In its current incarnation, it shows the magnitude of term premium (see box on what drives the term premium) and highlights why we remain short duration across our fund range. But this can’t be taken in isolation: the ECB’s liquidity glut is being exported around the world. For a German insurance company needing to deliver guaranteed returns to its customers of, say, 1.5%, it’s a no-brainer to buy 10-year US Treasuries yielding 2% rather than bunds at 0.2%.

What drives the term premium?

Long-dated government bond yields can be split into three components – expected inflation, expectations about the future path of real short-term interest rates, and a term premium, reflecting the extra return that investors require to own a long-dated bond. Typically, term premium is positive, as investors usually need extra yield to compensate them for the risk of owning longer-dated paper. However, term premium on US Treasuries collapsed last year and recent measures show it to have actually been negative in early 2015.

So what drives the term premium? Historically, the most important factor has been inflation – and the perceived risk of unexpected inflation. A low term premium today suggests that investors currently see little risk of this occurring. Demand and supply factors also exert some influence. For example, US Treasury issuance heavily skewed towards the short end of the curve in the early 2000s contributed to a fall in the term premium around this time.

One possible explanation for the collapse in US term premium in recent months comes from overseas. A higher term premium in the US has historically encouraged portfolio flows into US Treasuries from abroad, and vice versa (see chart). More recently, the diverging policy actions of the Fed and the ECB have had a major impact, with a strong European bond rally in 2014 on expectations of QE from the ECB.

The implication here is that longer-dated US bond yields have, at least recently, had little to do with US-specific factors. The impact of the belated arrival of the ECB’s QE is now being exported to the US. This suggests that the Fed is far from being in complete control of its own monetary policy and gives Fed Chair Janet Yellen yet another issue to consider in her deliberations on exactly when, and how aggressively, to finally begin hiking US interest rates.

Europe: better prospects on the horizon

Turning to Europe, it’s fair to say that if you were designing policies to generate deflation, you would have followed the exact path followed by the region’s policymakers in recent years. Europe has adopted the polar opposite of the three arrows espoused under ‘Abenomics’ (in Japan). From a monetary perspective, policy decisions had drained some 40% from the eurozone’s balance sheet by the end of 2013, although more recent decisions have reduced this somewhat to a little over 20% (see figure 3). From a fiscal standpoint, excessive austerity and Germany’s focus on ‘Black Zero’ (its goal of moving from a budget deficit to a small surplus for the first time since 1969) mean there is little appetite or ability to fight deflation in this way. Structural reform has been equally slow.

But there is now – finally – some good news, with the introduction of potentially limitless QE, the likelihood of less fiscal austerity to come, and some small signs of structural reform. Regarding the latter, Italian Prime Minister Matteo Renzi has to date struggled to make much progress with his ambitious reformist agenda, so any advancement here could prove significant.

The potentially even better news is that the ECB’s programme of asset-backed securities (ABS) purchases has not really begun yet. This may take time to pick up speed, but if it does so, it should provide a good way for banks to get stale loans off their balance sheets, by repackaging them and selling on to the ECB at a profit. This should, in turn, support bank profitability, shrink banks’ balance sheets and enable new loans.

While it is still early days to apportion significant results to the ECB’s QE programme, the eurozone officially moved out of deflationary territory in April, following four months of falling prices. This modestly higher inflation figure, along with a recovery in oil prices, a weaker single currency, and improvement in economic data has created a renewed demand for inflation-linked assets. In our view, despite a strong rally in recent months, European breakeven rates continue to price in too little inflation over the medium term, and so short-dated government linkers offer good value versus conventional government bonds.

Credit: technical, valuations and fundamentals suggest value

QE changes investors’ behaviour, leading them further out along the risk curve against suppressed government bond yields. In recent months, we have begun to find better relative value on a selective basis in the high yield market following the underperformance by segments of the asset class in the latter part of 2014. Importantly, going forward, the ECB and Bank of Japan QE packages should support demand for high yield bonds.

I wrote at the end of last year about my preference for the floating-rate note (FRN) segment of the market. This remains a valid means of taking advantage of further US dollar strength, Fed rate hikes and improving US corporate and banking sector health. I have also been finding value in conventional US corporate bonds. US spreads actually widened in 2014, partly due to huge new issuance and the knock-on effects for energy companies of the oil price collapse later in the year. Investment-grade corporate bonds look attractive at the moment, according to the three key factors of technical, valuations and fundamentals. Meanwhile, liquidity has again been a hot topic in the press in recent months, and is something that investors are right to be mindful of in the present environment (see box on liquidity).

Liquidity: an ever-present challenge

Back at the end of 2014, we wrote about the changing face of corporate bond market liquidity, and how liquidity conditions in today’s world appear increasingly linked to the direction of spreads (decent in times of narrowing spreads, and correspondingly poor as they widen). The topic of liquidity has not gone away since then, and indeed has been exacerbated by the second-quarter government bond market sell-off that has sent bond yields soaring.

A lack of liquidity in and of itself is not necessarily something to be feared, as long as an appropriate level of liquidity management is observed. Liquidity risk is often misunderstood: a bond could be defined as perfectly liquid, should an investor be prepared to sell at a significant discount. Instead, we define liquidity as the ’cost of immediacy of trading’, that is, the ability to execute trades at a reasonable market level.

Like all risks, investors can be rewarded for accepting liquidity risk, charging a premium that can be attractive in today’s low-yield environment. In fact, we see significant value in doing so in certain segments of the markets. In our view, investors in BBB rated corporate bonds are being paid well in excess of the liquidity and default premia that we feel investors can demand for the risks involved in lending to these investment grade-rated companies (see chart).

To mitigate liquidity risk, managers can undertake measures that include (but aren’t limited to) investing in government bonds; holding short duration, high-quality corporate bonds; holding a cash or cash-like buffer; favouring on-the-run (most frequently traded) bonds over off-the-run bonds; owning senior debt relative to subordinated debt; using derivatives like credit default swaps and futures; investing in primary market issuance as a source of supply; and maintaining diversified portfolios with concentration limits.

At M&G, liquidity management is embedded within our investment process. We also have a dedicated risk management team, and a formal governance structure in place that carries specific liquidity management responsibilities.

Emerging markets: sovereigns look safer than corporates

It should be no surprise to hear us describe ourselves as longstanding China bears – a standpoint that seems entirely consistent with the slower growth we have seen coming out of the country.

I have been wary of emerging markets (EM) for some time based on a number of themes, including the strengthening US dollar as well as slowing Chinese growth. But as usual there are two sides to every story. Emerging market sovereigns, having largely borrowed in local currency rather than US dollars, are not in terrible positions and have some control over their own destiny. The picture is somewhat less rosy for EM corporate issuers, who took greater advantage of low US dollar-denominated borrowing costs and, in so doing, have created a bigger market than the US high yield market. Many of these have not hedged their dollar liabilities and will be particularly vulnerable when higher rates do take hold.

As usual, the key is to be selective. For example, I have bought some local currency Mexican and Colombian debt since the start of the year due to the aggressive sell-off in both currencies in 2014.

Currency: further US dollar strength on the cards

The strong US dollar has been a big story during much of 2014 and into the first part of 2015, and we expect dollar strength to continue, based on the relative strength of the US economy and likelihood of more imminent rate rises there than elsewhere.

That said, given the significance of the greenback’s rise versus other key currencies, such as the euro, since the start of the year, I took some profits in the currency during the first quarter as the rise in the dollar had been quite extreme. However, over the last few weeks, I have been adding some dollar exposure back as I expect the US Fed to be the first major central bank to raise interest rates, and interest rate differentials are likely to be a key driver of currencies over the next 12 months.

As the dust settles following the UK election result – in which voters and investors alike were surprised to see the Conservative party achieve a parliamentary majority (albeit a slim one) – recent sterling strength may be challenged. In our view, a dovish Bank of England, the UK’s very large current account deficit, and the renewed prospect of an in/out referendum on British membership of the European Union by 2017 will likely weigh on the currency. As a result, we remain wary (read: underweight) on sterling. While it may feel like 2015 can’t yield too many more surprises, in reality, the second half of the year could yet turn out to be equally frenetic.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox