A look at housing affordability in the US and UK

In recent months we have blogged about the recovery in the US housing market that is currently underway. This is in contrast to the UK experience, where the housing market appears to be stuck in the mud. We thought a quick look under the bonnet could reveal the dynamics at play in both countries.

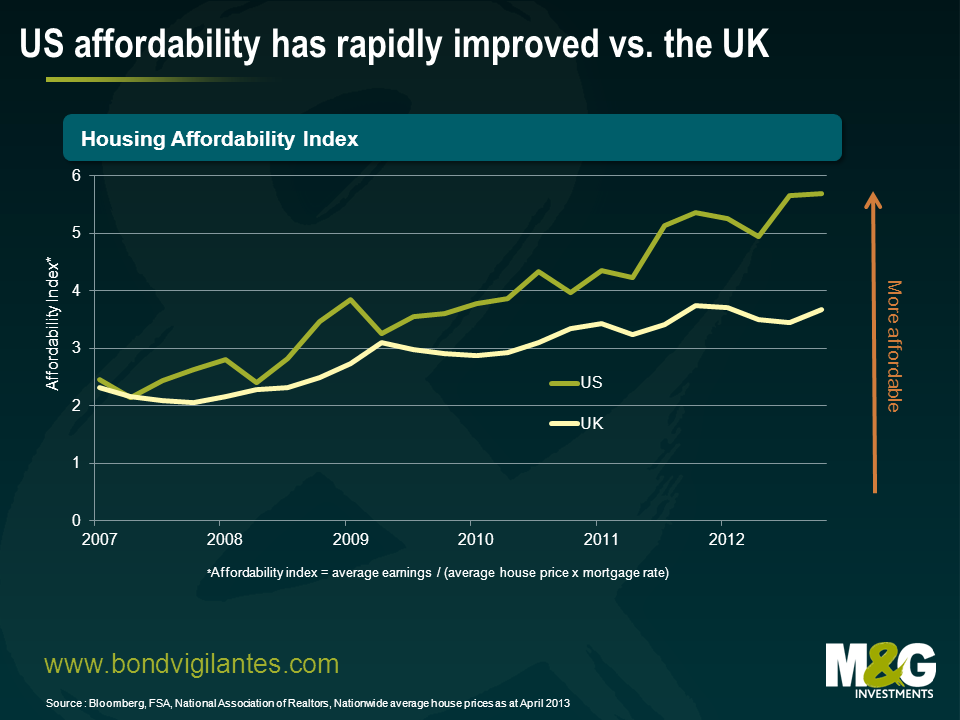

In order to do this, we have constructed a housing affordability index that captures the three main barometers of the health of the housing market; wages, house prices and mortgage rates. By combining average house prices and mortgage rates, we can estimate the typical payments facing a mortgage holder in either country. We have then divided the average wage in both countries by this number. We think that this enables us to get a pretty good read on how affordable housing is in the respective countries.

As the chart shows, owning a house has become considerably more affordable in the US relative to the UK since 2007. There are a number of reasons why this has occurred.

Firstly, US house buyers are feeling rate cuts to a greater extent than their UK counterparts. For example, at the end of 2012 30-year US fixed rate mortgages were 3.35% compared to an average UK fixed rate mortgage of 4.10%. As outlined earlier this month, UK building societies are finding it difficult to pass on any rate cuts because of the impact that such a move would have on their profits. Secondly, wage increases have also favoured potential American homeowners. In the US, wages have risen by nearly 16% compared to an increase of 12% in the UK.

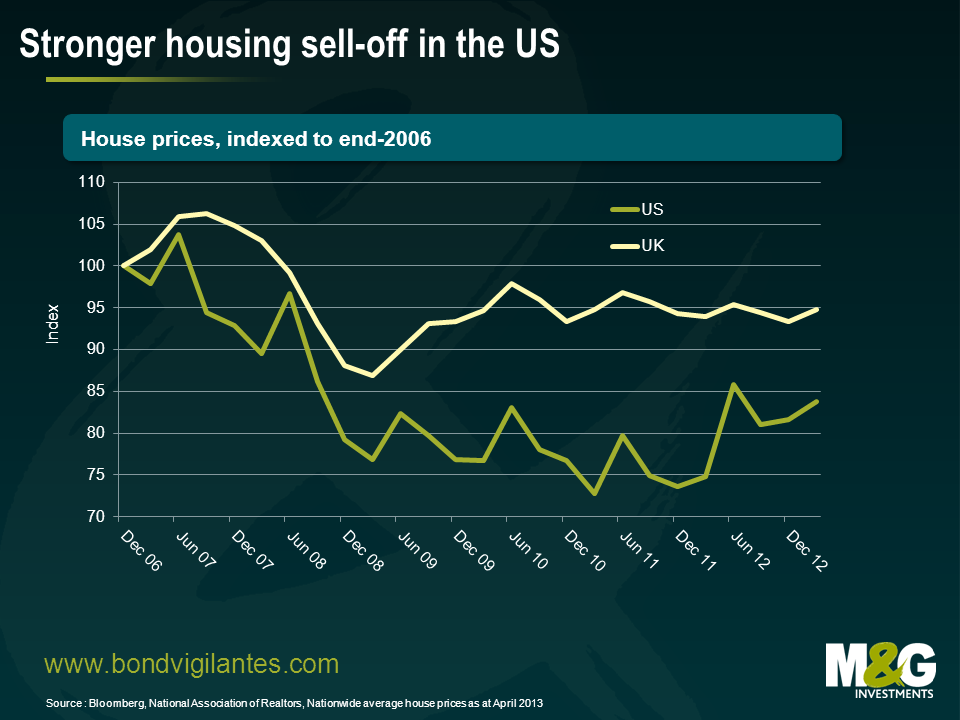

The US has improved on two metrics relative to the UK, but the difference isn’t enough to explain the divergence in affordability between the two markets. The dominant affordability factor has been house prices.

US house prices saw a greater correction, falling by 30% from the peak to trough, while UK prices only fell by 18%. We have now seen US house prices generate solid returns for buyers, with prices now growing at over 10% year-on-year. This is likely to have a significant impact through the multiplier effect on consumption and GDP growth. In contrast, the UK housing market recovered relatively quickly, but since late 2010 house prices have been anaemic.

With the standard variable mortgage rate rising over the last 11 months, limited upward pressure on wages, and stable house prices it appears unlikely that the UK housing market is going to become more affordable for home buyers anytime soon. It is thus understandable that in order to assist potential homeowners, the government has launched its “Help-to-Buy” scheme (following the muted impact of its Funding for Lending scheme) which will come into effect in January next year.

Whether the scheme will work or not will continue to be debated amongst economists. The Help-to-Buy scheme should theoretically impact house prices in a positive way. But this could actually have a negative impact on those looking to buy and potential homeowners may end up borrowing more to purchase a house than they would if the scheme didn’t exist at all.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox