Funding for Lending – has the scheme achieved its goals?

As has been widely reported, last week the Bank of England and HM Treasury extended their Funding for Lending Scheme (FLS). The FLS was originally launched in July last year with the intention of stimulating lending in the real (non-financial) economy. Under this scheme a bank or building society borrows UK Treasury Bills and hands over eligible assets as collateral. The fee they are charged (effectively the interest rate) and the amount they can borrow are determined by how much they have increased their lending. The bank or building society can then either repo their T-Bills for cash or, more cheaply/likely, just use them to replace cash in their liquidity buffer. The more they lend the more they can borrow at the lower rate.

The BoE and HM Treasury have hailed the scheme as a success. But on what measure?

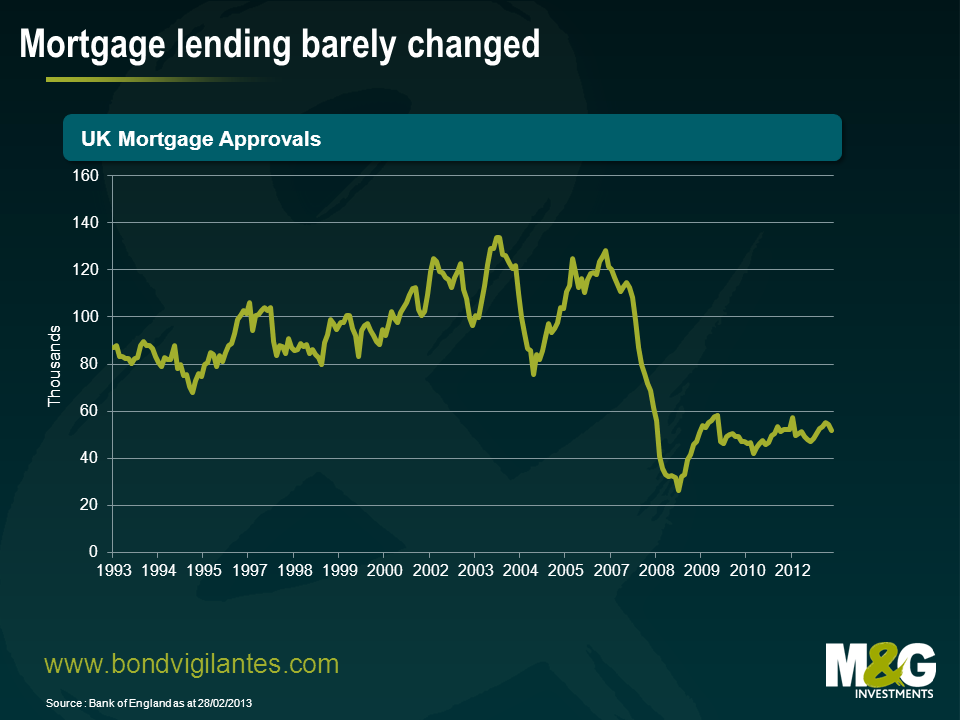

Today we received news that mortgage approvals had another weak month in March, increasing only slightly to 53,500. Mortgage approvals have been flat at around 50,000 per month since early 2010 and, considering last week’s extension to the programme incentivises SME lending more, it doesn’t look like the cheaper funding has spurred the desired increase in lending.

Further, with the average mortgage rate in the UK at around 4% and banks able to borrow at what the Bank of England estimates to be 0.75%, the lower rates clearly aren’t being passed on to the man on the street either. Assuming banks’ net interest margins aren’t the measure on which this programme is judged I think it’s fair to say it hasn’t been a huge success.

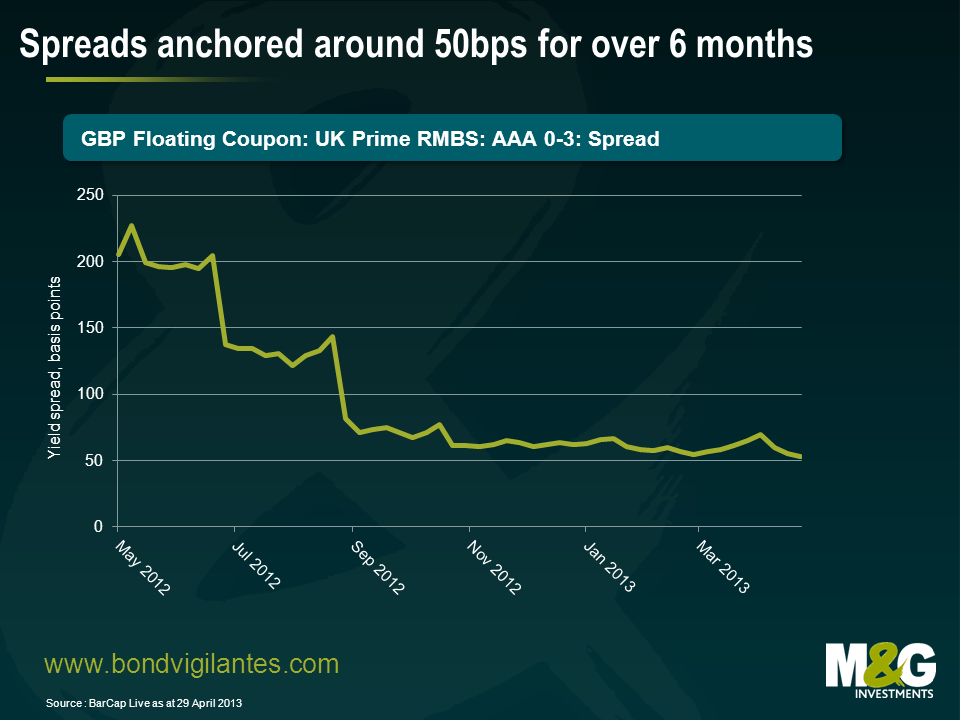

Unless that is, you happen to be an investor in asset backed securities. The UK Residential Mortgage Backed Securities (RMBS) market has rallied significantly since the FLS was first announced. Granted, most risk assets have rallied since last summer – partly down to Mario Draghi’s now famous speech – but I think that the UK RMBS sector has had an extra boost from the FLS.

Rather than issue RMBS, the banks and building societies have preferred to pledge their mortgage stock with the FLS which has provided a technical support for the market. The graph below shows the spread on an index of short dated, AAA, UK prime mortgage deals. As you can see they began their rally last summer and have been hovering around 50bps since the autumn. The lack of supply – we haven’t had a new public deal since last November – has certainly been supportive for spreads.

The Bank of England and the Treasury claim that the scheme has been a success mainly on the grounds that things would have been worse without it. Clearly we’ll never know. Whether things are better or not the FLS appears to have done almost exactly the opposite of what it set out to do. It was established to provide support to the non-financial sector, but as far as I can tell, to date it has actually made the financial sector marginally healthier and better off.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox