The quest for the safe haven; one haven that’s justified, one that’s certainly not

A lot of the cash that’s been created over the past few years is sloshing around the world trying to find somewhere to hide. There has been a huge bid for anything deemed a safe haven asset, a bid that has been propelled by an imploding Eurozone and US politicians that are seemingly looking to bring its $14 trillion poker game to a spectacular finale by committing collective hara-kiri.

The problem is that if you take the US out of the picture, there aren’t enough non-shaky AAA assets to go around. Germany and France have about $1.7tn of sovereign debt outstanding, although France is probably the next AAA-rated country to find its credit rating under threat. The UK has about $1.2tn of sovereign debt, and gilts have been big beneficiaries recently, but a double dip recession in the UK (which MPC member Martin Weale recently highlighted as a risk) will cause a U-turn on austerity measures which in turn will place the UK’s AAA rating at risk. After the UK, Canada has about $1 trillion of sovereign debt. After that you’re pretty stuck – Australia has about $0.3tn, Sweden has $0.1tn, and there are a few countries with even less debt.

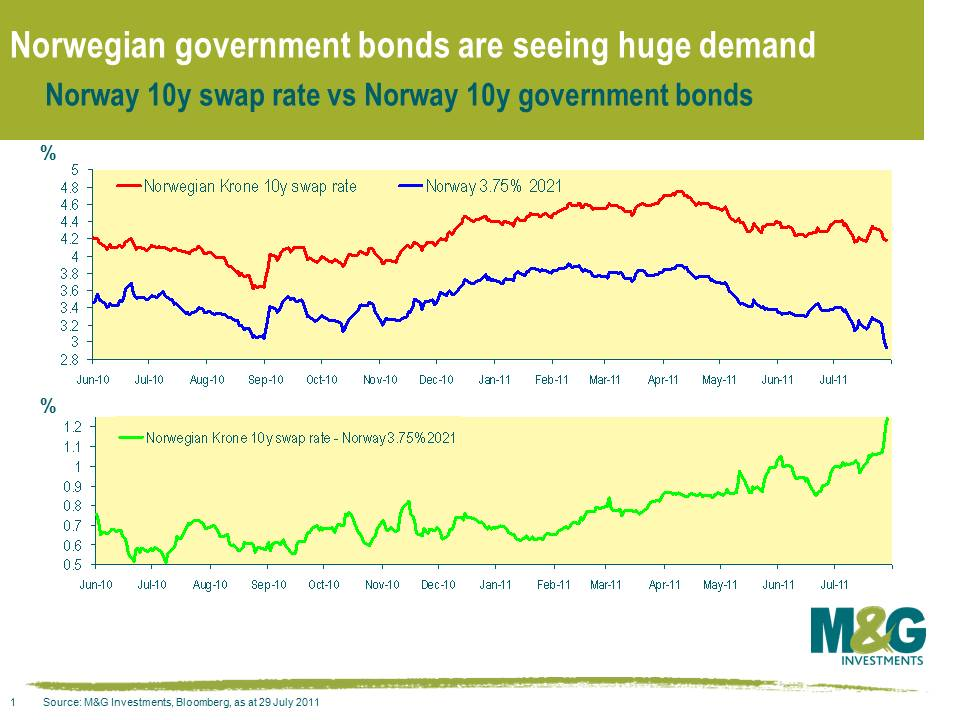

Norway is the safest sovereign in the world if you take the cost of insuring against default from the CDS market, but as you’d expect for the world’s best quality sovereign, Norway has very little sovereign debt. As a result, the demand for Norwegian government bonds has massively outstripped supply, and a large gap has opened up between the yield on Norwegian government bonds and the Norwegian Krone 10 year swap rate. The difference between the cash rate and the swap rate is now at a similar level to that seen in October 2008. We think that the strong bid for government bonds issued by Norway, Sweden and Germany is totally justified though – indeed, we’ve been filling our boots with the stuff over the past few months, and given our well documented ongoing nervousness regarding a number of sovereign states’ creditworthiness, we think that there’s still significant value in the safest AAA markets.

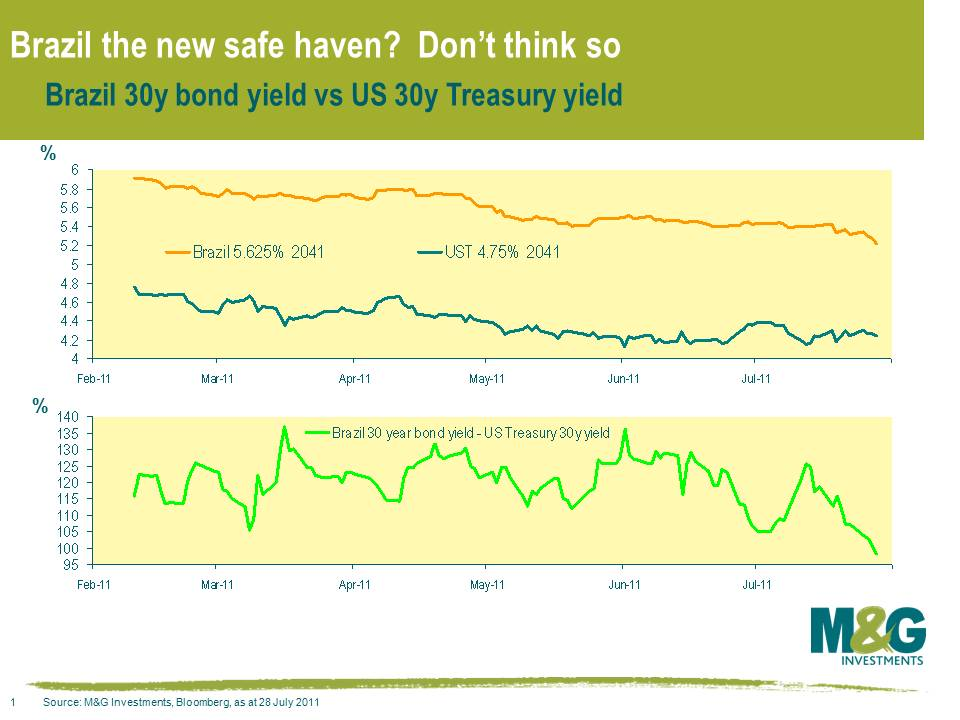

The big safe haven bid has also been hitting some emerging markets, but in contrast to the money flying into Norwegian government bonds, the EM safe haven bid looks plain bonkers. The chart below shows the recent price action of Brazil’s 30 year US dollar denominated government bond, where spreads over US Treasuries have tightened from 140 basis points at the beginning of June to under 100 basis points now. Credit ratings don’t count for all that much these days, but if markets think a risk premium of less than 100 basis points is a fair price for a 30 year bond denominated in US dollars that is benchmarked over US Treasuries and is issued by a country that’s rated one notch above junk status then the market’s smoking crack.

This isn’t to say that emerging markets as an asset class are poor value. Much of what has driven financial markets over the past 15 years has been a direct consequence of emerging market countries maintaining artificially undervalued exchange rates. The global current account imbalances that have resulted from these policies go a long way to explaining the behaviour of various asset classes over this period. These global imbalances have lessened since 2007, but they still persist. Developed countries need a sharp devaluation versus many of their emerging market counterparts to restore competitiveness, restore economic growth, and ultimately help reduce debt levels. Overheating emerging markets need their currencies to appreciate, and EM currencies should (with a few exceptions) continue to rally versus developed market currencies.

But buying long dated Brazilian US$ denominated bonds is not how to implement this view. We think that the implied default risk from a number of emerging market bonds is far too low – an implied default risk that has been squished by the huge flow of money into EM debt and a relative lack of supply – and we have selectively put on trades across a number of our bond funds that reflect the view that some areas of the hard currency EM debt market are getting dramatically overvalued.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox