Long US Treasury bonds are overvalued by 250 bps. Discuss.

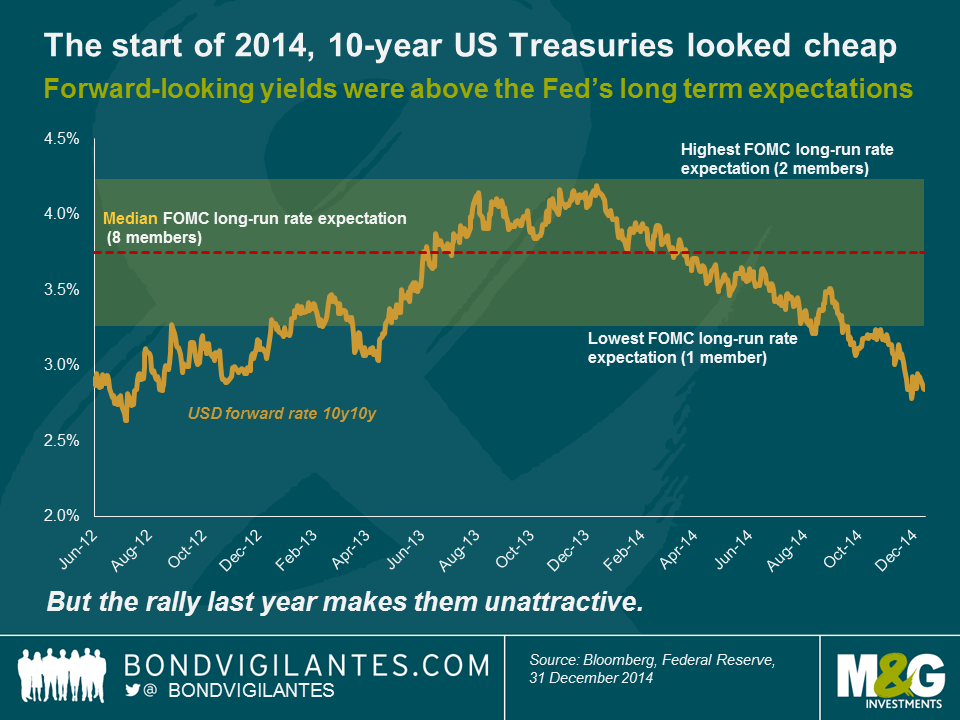

As we started 2014 the US Treasury market was expecting 10 year yields to be at 4.13% in a decade’s time. This 10 year 10 year forward yield, derived from the yield curve, is a good measure of where the bond market believes yields get to if you “look through the cycle”, and disregard short term economic trends and noise. I wrote about it here and suggested that we were approaching the top of the yield cycle. The reason I thought this was that the FOMC members tell us (through a range of point forecasts, one for each FOMC member, known as “the dots”) where they think the long term Fed Funds rate will end up – in other words looking through the cycle. As mathematically a long bond yield should equal the sum of all the overnight rates over the life of a bond, the FOMC’s long term expected Fed Funds rate should have a good relationship with the long term US Treasury yield. In that blog I did also say that there should then be an adjustment for a term premium – the additional yield that a bond investor would demand for lending to a government for 10 years with all of its uncertainty and credit risk rather than lending overnight. We’ll come on to that, but you can see that since January 2014 forward bond yields have collapsed from that 4.13% to around 2.75%.

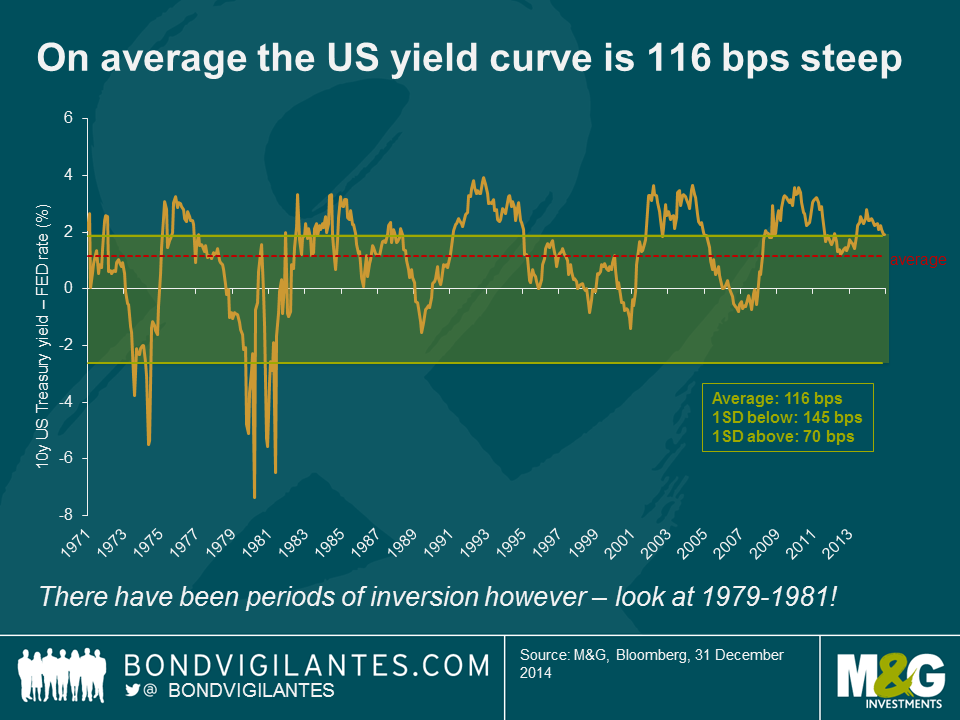

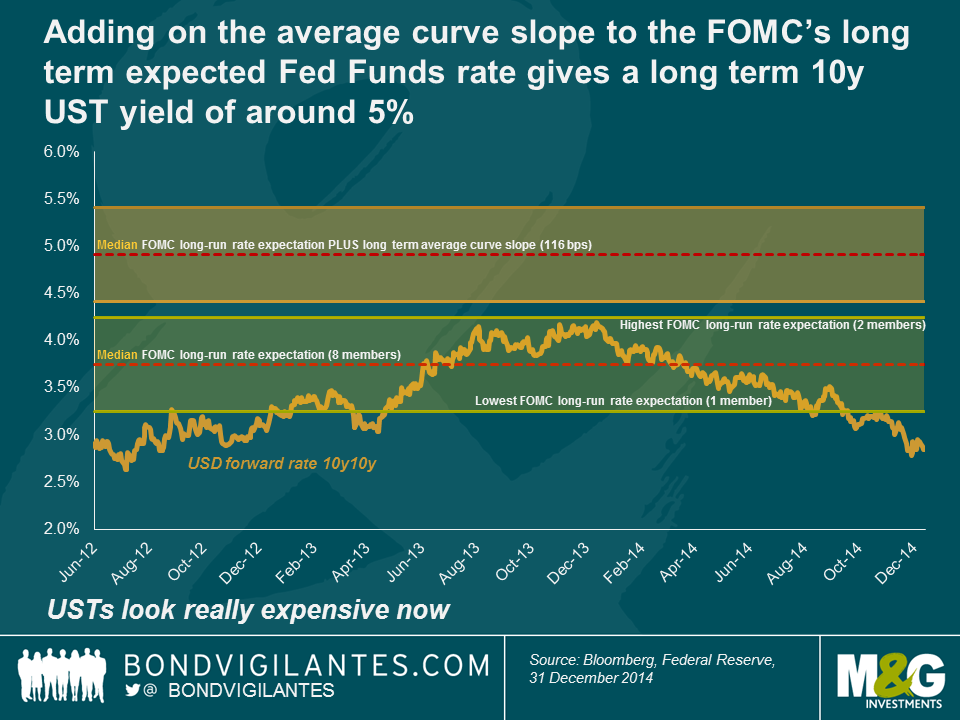

The 10 year 10 year forward yield at 2.75% is below even the most dovish member of the FOMC’s expectation of the long term Fed Funds rate (the lowest forecast is 3.25%). On the face of it we’d suggest that there is little value in long Treasuries at the moment. But it’s even worse than that. Let’s look at what the typical yield pick-up is between Fed Funds and the 10 year US Treasury. Going back to 1971 the average spread between the two instruments is 1.16%. There have been periods of inversion, where Fed Funds is above longer dated yields, most notably at the start of the 1980s when Paul Volker decided to kill inflation by hiking rates above the CPI rate, and thus made long dated bonds investable again. The spread between the Fed Funds rate and 10 year bond yields is largely about term/risk premium, but it might at times reflect a central bank regime change (like Volker) or expectations of a turning point in the rates cycle (here’s the excellent New York Fed’s Liberty Street Economics blog on drivers of the term premium in the US Treasury market). On the whole though the curve is positive, with a 1 standard deviation band of +70 bps to +145 bps.

It therefore follows that as a measure of “value” the Fed’s long term expectation band isn’t enough; we should add on the typical curve slope (116 bps) to the FOMC members’ expectations to reflect the risk premium. The chart below shows that this obviously makes long dated US Treasury bonds look even more extremely overvalued – around 200 – 300 bps overvalued. This is a capital overvaluation of somewhere from 15% to 25%.

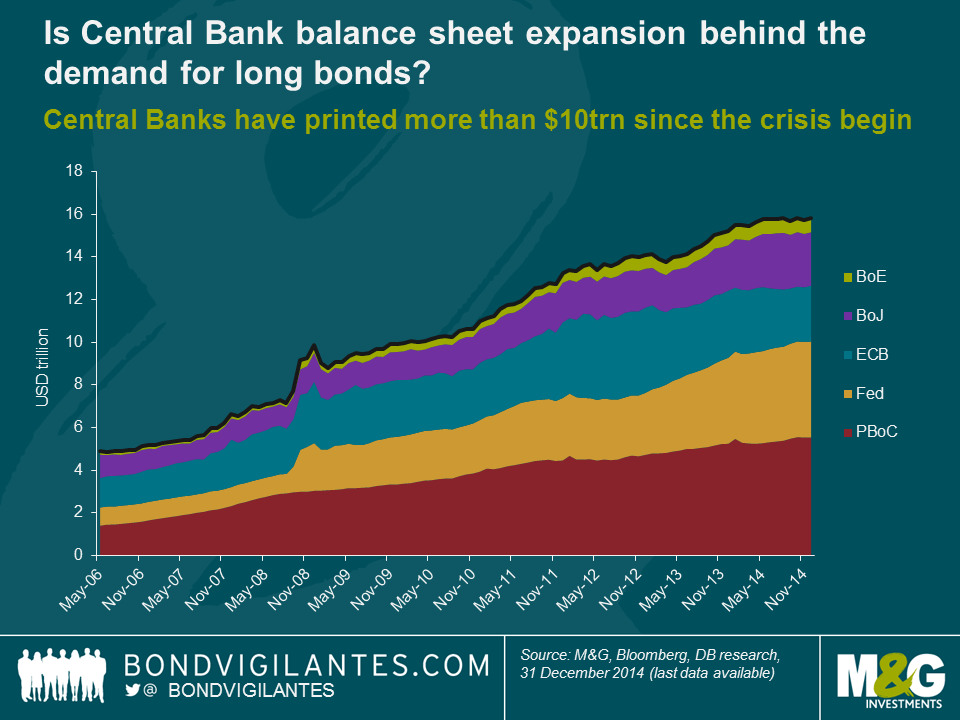

So what scenarios make today’s forward bond yields look reasonable? Most obviously the Fed could be getting things very wrong. Maybe we are in “secular stagnation” (permanently low growth and inflation due to demographics and the debt overhang) and the Fed Funds rate from 2024 to 2034 isn’t going to be 3.75%, but 1.5% or lower. That would work. Additionally the curve might be much flatter in future than historically – perhaps driven by pension fund demand for long dated fixed income given the huge hole that has opened up in America’s pension schemes. But it’s quite hard to imagine the massively inverted yield curves (-600 bps in 1980/81) of the Volker years given the low starting point for yields. Finally – and this is Deutsche Bank’s Torsten Slok’s most likely explanation – maybe value doesn’t matter anymore. The expansion of central bank balance sheets has created more than $10 trillion of new money since the Great Financial Crisis, and it is this money looking for a return of any kind in a zero rate world that has, and could continue to, drive yields down. Of the 5 central banks I’ve put on this chart only two have called an end to QE, and one – the ECB – has barely got started yet. On most valuation measures though, there’s not a lot to like in the US Treasury market. Although I wouldn’t go as far as Chinese credit rating agency Dagong on this (“Russian Debt Safer than US”).

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox