Will the thawing in US-Cuban relations bring havoc to the region’s bonds?

It is August and I should be enjoying a beach holiday, rather than being stuck in London under temperamental weather. To mitigate my despair, I decided to write some blogs on the topic of tourism. Given the ongoing normalisation of US-Cuba relations, I have been looking at the impact that this unprecedented shift in policy could have on the region. Although the embargo and travel restrictions remain in place and still need to be modified by the US Congress, an eventual lifting of sanctions would be a watershed event for the region. US Secretary of State John Kerry could take a few days off in Cuba after his visit this month and see first-hand the challenges and opportunities on the island.

The IMF published a solid assessment in 2008 on the implications for the Caribbean of opening US-Cuba tourism, which had a few notable findings. The liberalisation of US-Cuba tourism is expected to increase arrivals to the Caribbean by an estimated 10%. However, the impact on individual countries differs markedly depending on the composition of their existing tourist base. For example, countries that have the majority of tourists coming from the US are the ones that will stand to lose the most as these tourists head to Cuba instead. In the short-term, Cuban infrastructure could hit capacity constraints with the flood of new visitors. As the increase in number of US tourists displaces non-US tourists, the tourists could decide to holiday at other islands instead, resulting in a benefit from the Cuban effect, such as Dominican Republic.

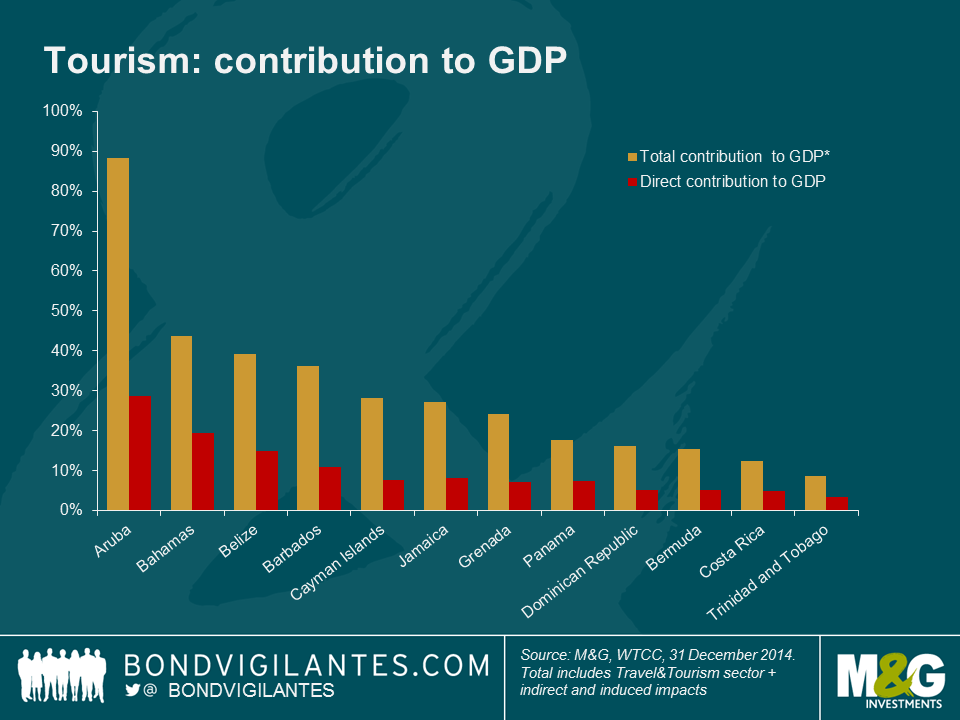

The direct and indirect impact of tourism varies per country, as typically the smaller economies have less potential to diversify. For every Bermuda (insurance) or Cayman Islands (financial services), there are other countries that are struggling to diversify.

While financial investment in Cuba remains difficult given the lack of tradeable assets (to say that defaulted Cuban loans trade by appointment is an understatement), those seeking to benefit from the opening up of the Cuban economy and an increase in tourism could look to real estate related investments as the logical alternative. The increase in trade and tourism with the United States will not only benefit Cuba, but also its neighbours, which are mostly small open economies that depend on tourism to various degrees.

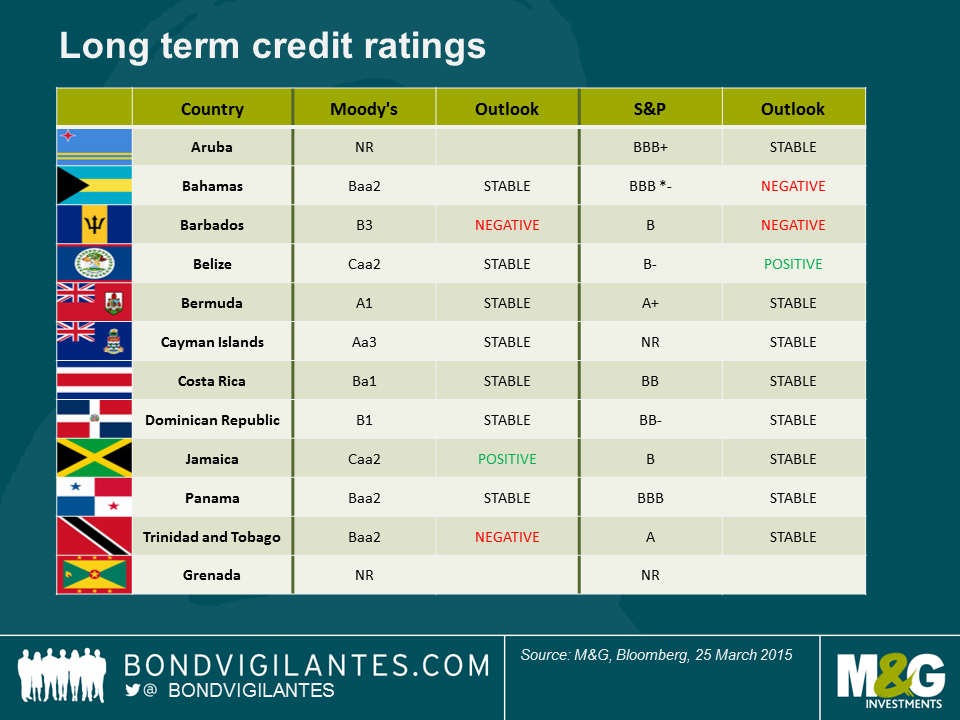

This shows that investors should not paint countries in the Caribbean with the same brush and this can create mispricing and opportunities in the marketplace for assets.

With that in mind, I see the credit trends and ratings skewed to the downside in countries like Aruba and The Bahamas as they continue to struggle to diversify their economies. As debt levels creep up there are also other likely losers from the Cuban opening. On the other hand, I am comfortable with credits such as Dominican Republic, which surprisingly may even benefit from the normalising of US-Cuban relations.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox