Tough as Granite – an RMBS case study

This weekend the team were doing more than just our Christmas shopping, we were also saying a fond farewell to one of our favourite investments of recent times – our Granite Residential Mortgage Backed Securities (RMBS).

Granite was the name that Northern Rock gave to the vehicle it used to securitise the mortgages that it originated before blowing up in 2007 – when it was no longer able to fund itself in the wholesale money markets – and eventually being nationalised in 2008.

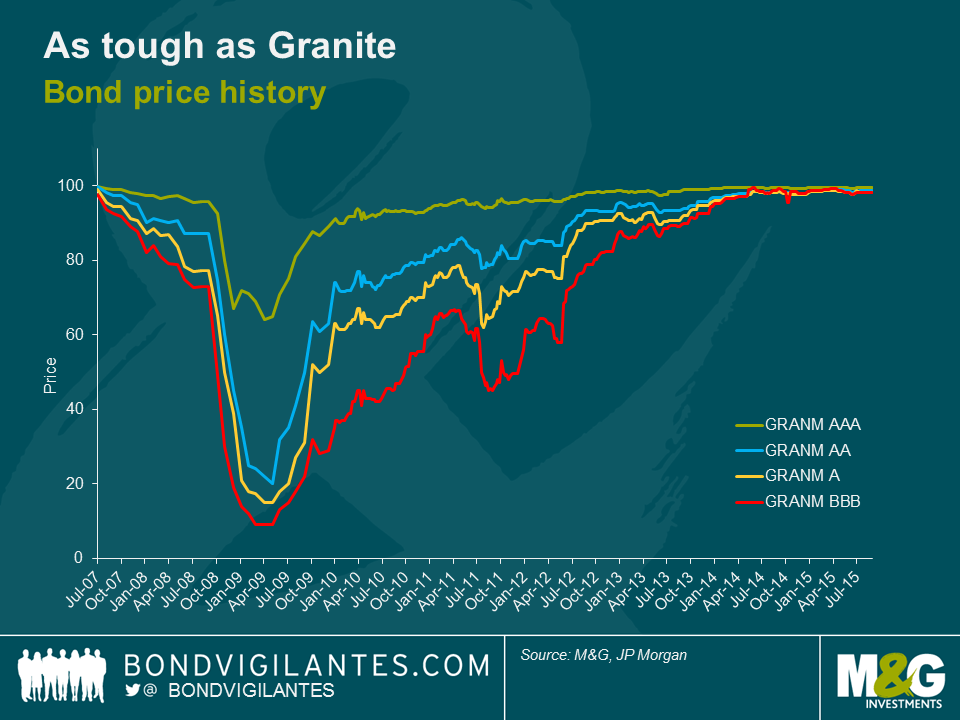

Unsurprisingly the Granite bonds were hit hard in the panic of the financial crisis. Not only were they tarnished by owning assets that were originated by a bank suffering the UK’s first bank run in 150 years, but also because the securities were structured in a similar way to the low quality, sub-prime mortgage backed assets in the US that ignited the whole crisis when they began to implode.

Granite class A’s, the bonds at the top of the stack and therefore the most credit worthy (originally rated AAA by the agencies) fell to a cash price in the mid 60’s in early 2009 and the class C’s (originally BBB) hit single digits at their lows.

After nationalisation, the responsibility for the management of the remaining assets including the Granite structures fell to UKAR (UK Asset Resolution Limited), effectively the UK Government’s bad bank. UKAR was established with the goal of maximising value for taxpayers whilst managing the pools of mortgages issued by banks that the government had nationalised (Northern Rock and Bradford & Bingley).

In November this year, UKAR announced that it had successfully sold £13bn of assets – the bulk of which were the Granite deals – to a consortium of investors. A few weeks later the trustee announced that most of the outstanding Granite bonds would be called at par this weekend with a small remainder in January 2016. Some of the underlying mortgages have been sold to banks that are looking to increase their share of the UK mortgage market and the remainder we expect to be refinanced early next year through a combination of further whole loan sales and securitisation.

We spent a lot of time in the dark days of the crisis analysing the quality of the underlying mortgages, working out if the structure of the bonds would protect us, and ultimately whether we would get our money back. Our analysis indicated that the Granite securities were robust and housing market fundamentals would have to significantly weaken before our investment would be close to being at risk. We thought there was a lot of value in the bonds, and over time Granite grew to one of our largest holdings across a number of funds.

Importantly, I think that Granite highlights that Asset Backed Securities (ABS) can be a great investment if you take the time to understand the structural complexities and the underlying collateral. The broader asset class received a lot of bad press during and after the financial crisis, marred with the same stigma as the far worse performing US sub-prime and CDO sectors. In contrast, the performance of more vanilla RMBS deals has fared much better with very few credit losses experienced to date.

So thank you Granite, it’s been a great ride.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox