Three reasons why the UK will not raise rates anytime soon

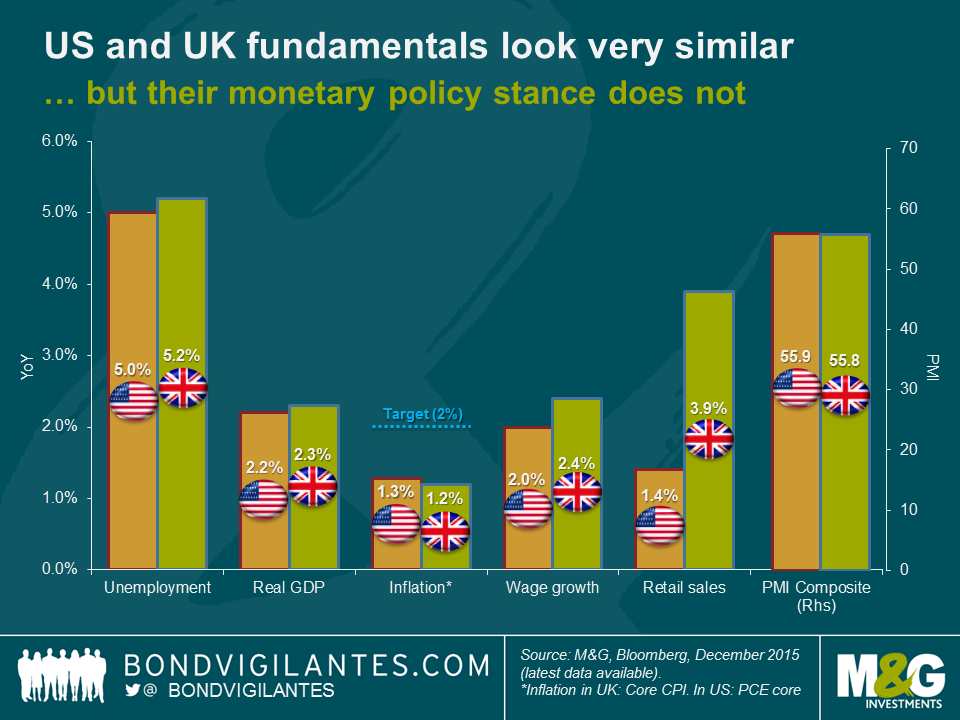

With the Fed recently raising its interest rates via a unanimous vote, I’ve been wondering whether the UK will shortly follow suit. The market seems to think not, pricing in the first UK rate rise in Q1 of 2017, compared to two further US rate hikes in 2016. At face value this huge divergence feels strange; both countries are targeting (and undershooting) a 2% inflation rate, both have similar rates of year on year GDP growth and both have seen significant labour market improvements since the onset of the financial crisis (the UK arguably more so as inroads have continued despite the backdrop of an increasing participation rate, in comparison to the US decline in this measure). Indeed, the large reductions in unemployment rates indicate that the economies are at or approaching full employment, which should in turn bring mounting wage pressures and generate domestic inflation. All solid justification for considering a rate hike, which is why the US has done just that.

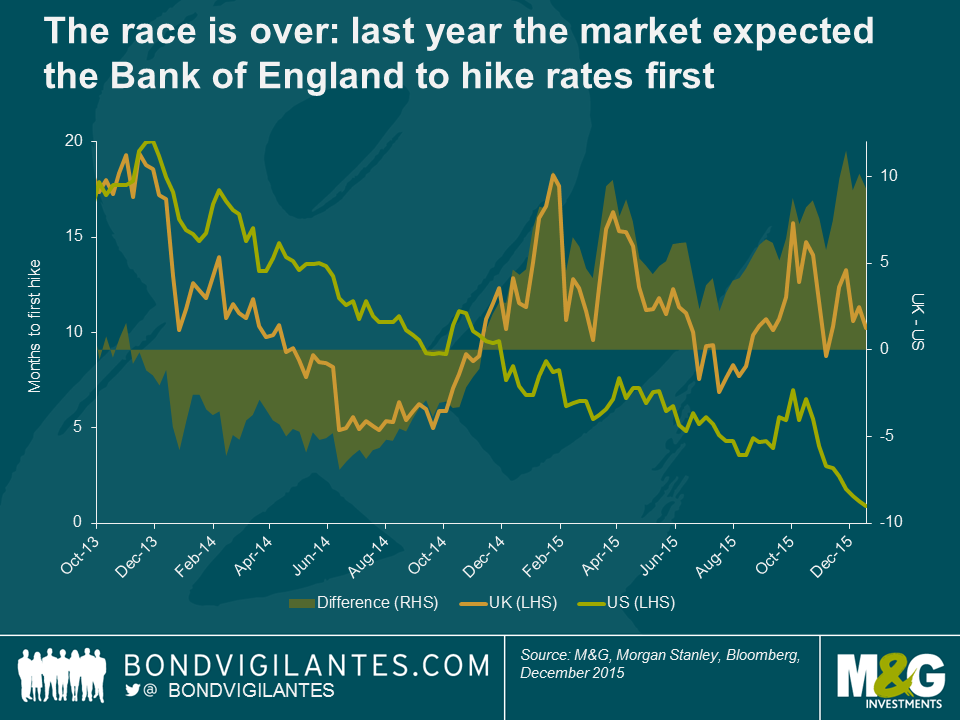

Looking at the graph below, it is clear that up until the end of last year, the market was predicting that the UK would be the first to raise rates. Even this year there were periods where it looked to be neck-and-neck. With the US recently winning the rate-hiking race, why has the runner-up now fallen so far behind?

Though the macroeconomic fundamentals may look very similar, the micro factors paint a different picture.

1) WAGES: Last week I saw Minouche Shafik speak in London. As the Deputy Governor of the Bank of England, appointed specifically to oversee markets and banking, her message was clear: she will not be voting for a UK interest rate hike until she has witnessed a sustained pick-up in wages (Shafik is waiting to witness wage growth that is 2-3% above productivity, which is more aligned with the pre-recession years, which she believes will ensure that inflation returns to target). Here’s the kicker; the latest data release showed that the UK headline (3 month average) wage growth rate fell from 3.0% to 2.4% in October (excluding bonuses, annual growth fell from 2.5% to 2.0%), while productivity rose at its fastest quarterly rate in 4 years, with output per hour rising 0.9% in Q2. Given these numbers, it’s highly unlikely that Shafik will be voting for a rate hike at the next MPC meeting on 14th January.

2) CURRENCY: Both the UK and US have experienced trade weighted appreciation, but this has had a larger impact in the UK where imports and exports constitute a higher proportion of GDP (approx. 30% in UK Vs. 17% in the US). The appreciation of the currency makes imports cheaper and exports more expensive which manifests as downwards pressure on growth and inflation. Given this relationship, it is important to consider the UK’s trading partners. The US is a relatively closed economy in comparison to the UK, whose main trading partner is Europe, where monetary easing remains on the table for the foreseeable future (some market participants are not forecasting an ECB rate hike until Q4 2018). The Bank of England must therefore be mindful of a divergence in policy which could cause the currency to significantly appreciate, otherwise UK imports invoiced in euros would essentially import deflation. Sterling is already up 6.7% year to date. Further appreciation brought on by a rate hike would harm exporters and hamper growth strategies which pursue diversification away from domestic demand.

3) POLICY: It is well known that monetary policy works with a lag, but this tends to last longer in the US due to the greater prevalence of fixed rate mortgages; the UK is therefore granted some leeway with regards to the timing of its monetary policy implementation. Fiscal policy is another consideration, as the Conservative UK government are committed to fiscal austerity while the US are entering a pre-election period and are more likely to see their fiscal deficit increase. The UK policy is likely to be contractionary – which would make the case for further easing rather than hiking- potentially delaying lift-off further. Thirdly, minimum wages in the UK are high compared to its European counterparts and set to increase. If this attracts a greater supply of low-skilled workers via increased migration, wage growth could credibly plateau, ultimately limiting upwards pressure on pay and dashing any hopes of UK inflation hitting its target. Finally, the real possibility of the UK leaving the EU certainly deserves a mention since the referendum – regardless of the outcome – is sure to generate some currency volatility in the build-up and aftermath of the vote (the date has not yet been set, but it has been suggested that this may take place in June or September next year). If the UK does vote to leave the union, this will have wider-ranging repercussions for the economy. This certainly gives the Bank of England reason to pause now, before the referendum result becomes clear.

Despite these three reasons to delay monetary policy lift-off, the UK recovery nevertheless remains robust. Consumption is solid, investment is recovering and productivity is returning. The main piece of the missing puzzle is – as Shafik says – wages. Although UK rate increases may not be immediately trailing the Fed, I wouldn’t be surprised if this occurs much sooner than the market expects.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox