How severe is the current energy sector default cycle?

To date the defaults we’ve seen in the US high yield market have largely occurred in the energy/commodity sectors. To see whether this trend is likely to persist I spent some time comparing the current default cycle with that of the US telco sector in the early 2000’s (see also James’ recent blog for the parallels between today’s high yield market and that of 2001).

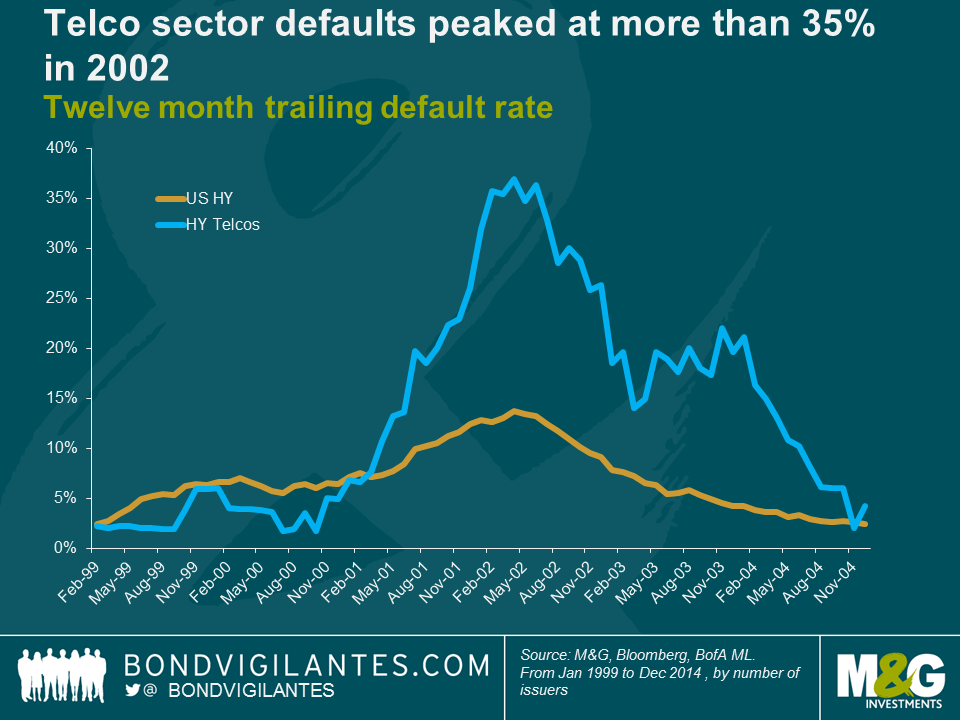

The telco bust occurred slightly later and was around ten times larger than the better-remembered dotcom bust. Following the industry liberalisation in the 1990’s firms in the sector built up about $1tn of debt. This debt was used to finance the construction of huge networks which, as it turned out, there was not enough demand for. Defaults began to pick up in early 2001 and peaked around twelve months later with more than 35% of high yield telcos defaulting as seen in the chart below.

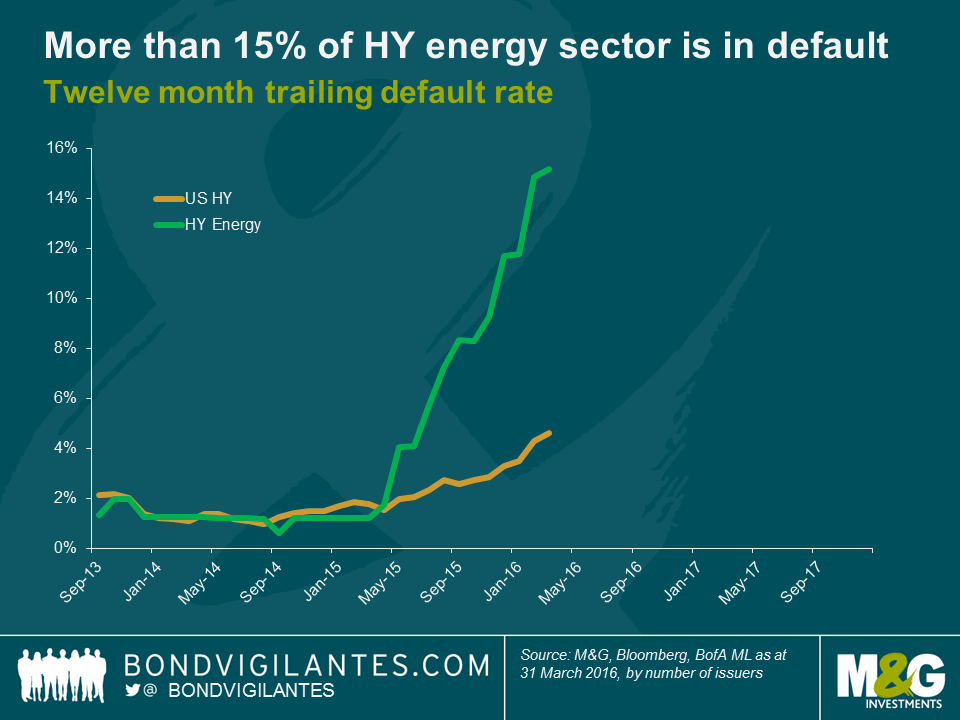

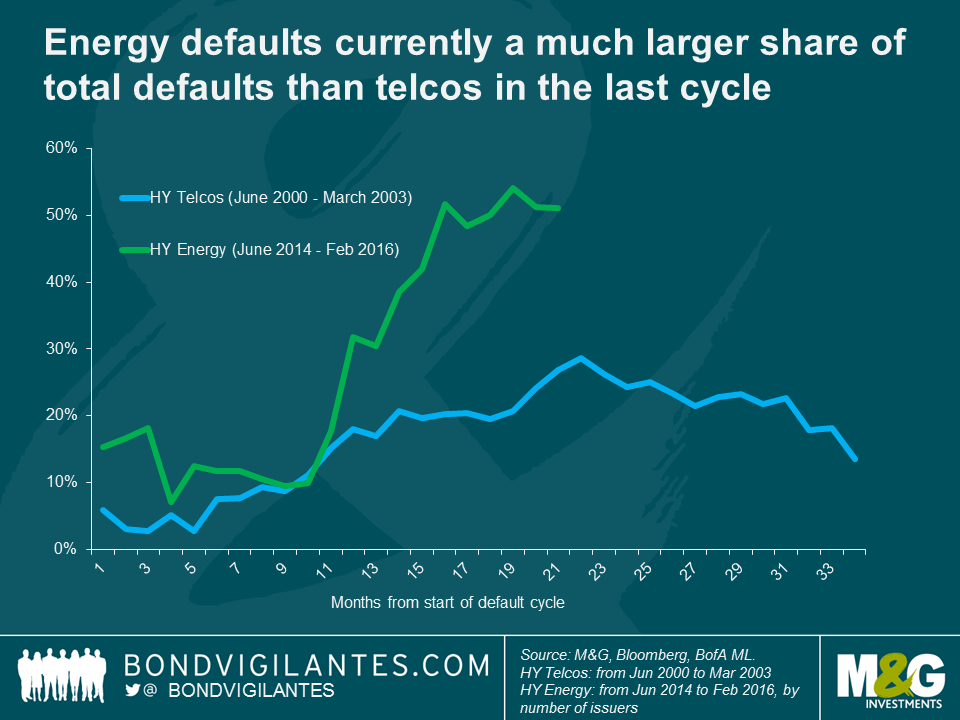

The default cycle in the US energy sector began around a year ago and as at the end of March the proportion of US high yield energy firms in default stood at 15.2%, according to Bank of America Merrill Lynch. There have been 52 defaults over the past year in the US high yield market, of which 26 have been in the energy sector. This represents a much larger proportion of total HY defaults (50%) than did the telco sector at its peak in 2002 (below 30%).

Currently the HY default cycle in the energy market is less severe and a lot more concentrated than it was in telcos at the turn of the millennium. That’s not to say that there isn’t more pain to come, but my intuition is that any significant increase in defaults will likely be constrained to the energy/commodity space.

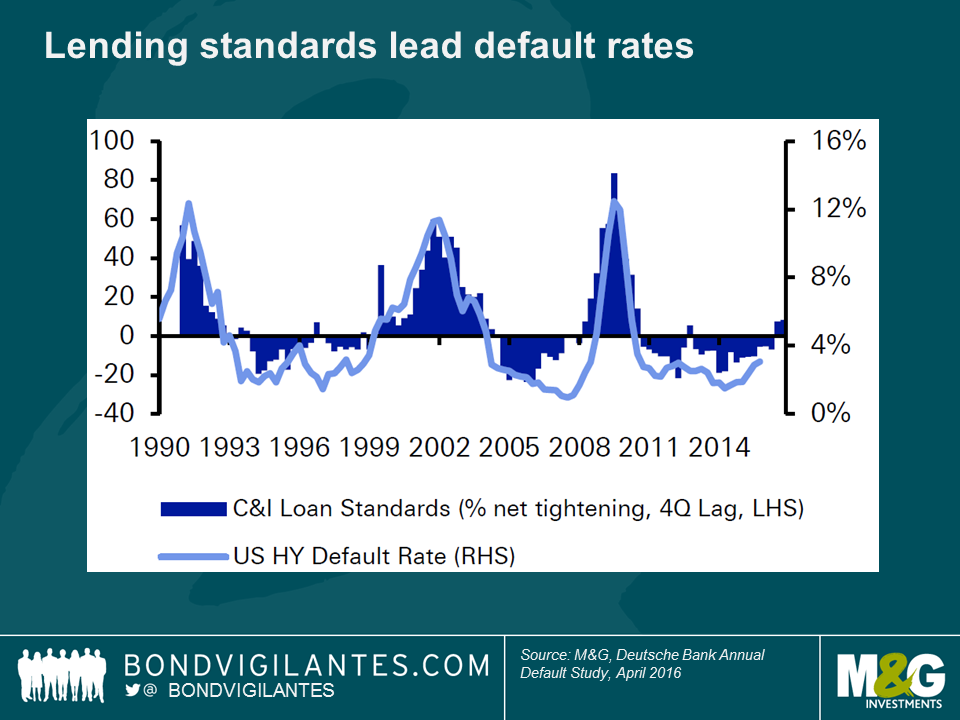

The chart below, shamelessly borrowed from the ever illuminating Deutsche Bank annual default study released earlier this month, predicts a pickup in defaults due to a recent tightening of lending standards. Historically, tighter lending standards (including higher interest rates) have led to a pick up in the HY default rate around a year later and two consecutive quarters of tightening (as we have just experienced) have always led to a significant rise in defaults. Even though lending standards have tightened recently I would make a couple of observations. Standards are tightening following a number of years of being extremely loose and from record low interest rates. Therefore we are coming off a pretty low base. Also, given the lag between tighter standards and higher default rates, a significant rise in default rates could still be some way off.

Finally, and the main reason I don’t see the stress in the energy and commodity sectors translating into more widespread defaults, is that the stress in these sectors has been caused by low oil and commodity prices, which should be positive for other sectors of the high yield market. It’s certainly possible that defaults in the energy sector could affect confidence and spill over into the wider high yield market, which could be one reason we’re seeing tighter lending standards, but on balance I struggle to construct a scenario in which the falling cost of a factor of production harms business. How can lower input prices do anything other than help the profit margins and free cash flow of firms in the wider economy? The lower oil price should also feed through to higher disposable incomes for the main driver of the US economy – the consumer.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox