Where is UK growth going to come from? Our take on the IFS Green Budget

The IFS (Institute for Fiscal Studies) Green Budget hit the headlines last week with its forecast that, over the course of this parliament, the UK tax burden is set to rise to its highest level in 30 years. The IFS has calculated that by 2020 the proportion of national income raised through taxes will increase to 37%.

I was at the presentation, and the more concerning issue for me was the rather gloomy picture the IFS painted of UK GDP growth over the next couple of years. The UK economy grew by 2% last year, and the IFS expect growth to slow to 1.6% this year and 1.3% in 2018. Andrew Goodwin of Oxford Economics talked the packed Guildhall through the components of GDP and explained where they see the future weakness.

Consumer spending

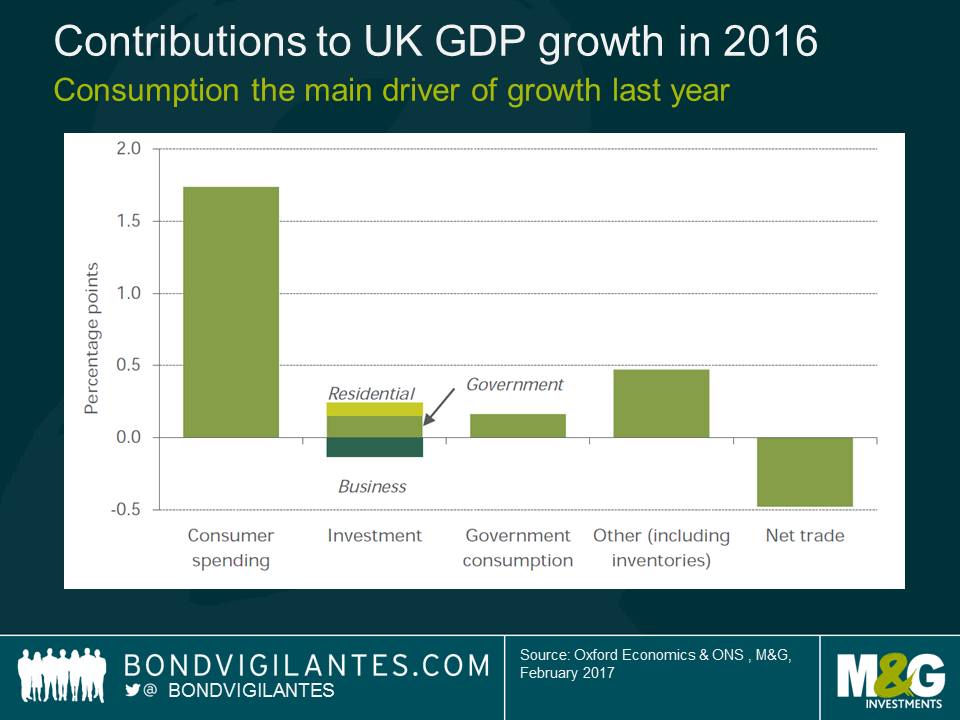

The chart below – contributors to GDP growth in 2016 – clearly shows that the lion’s share of growth came from consumer spending last year.

The IFS contend that consumer-driven growth is unlikely to persist as consumers will be subject to a substantial squeeze in their real incomes (driven by flat wages and higher inflation) and will be unable or unwilling to borrow in order to keep spending.

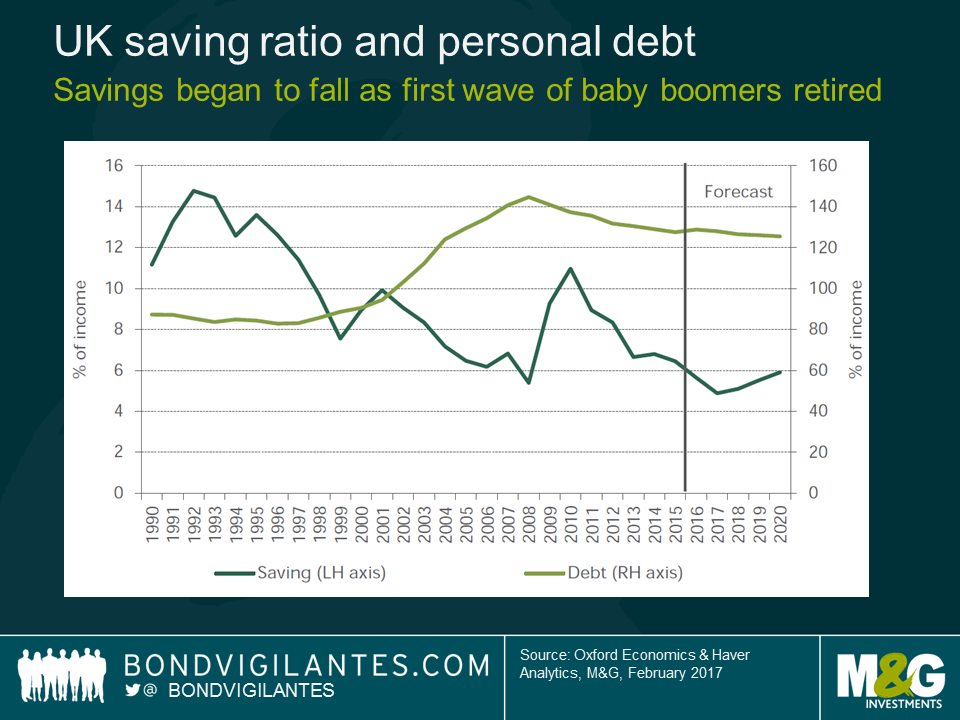

I think there is definitely something to this argument, especially for those of employment age who already have historically high levels of personal debt. However, as the IFS themselves pointed out in a later presentation (on the pressure the NHS is likely to come under), the impact of shifting demographics will be key. I foresee these demographic changes being a major contributor to UK consumption growth in the coming years. I don’t think it’s a coincidence that the savings ratio began its recent decline around the same time that the first cohort of baby boomers reached the retirement age.

The 2011 census showed that in that year alone the number of people reaching 65 jumped by 30%. This trend of the post WW2 generation ending their working lives (saving for retirement) and beginning to draw their pensions (spending those savings) has a long way to run. It makes a lot of sense to me that the “grey pound” will help consumer spending stay buoyant in UK for some time yet.

I think it’s also worth remembering that 52% of voters believe that life will be better outside the EU. Whether they are proven to be right or not, why would one expect them to cut back on consumption in the short-term? They will likely only reduce consumption when (and if) the economic consequences of Brexit begin to hit home.

Investment

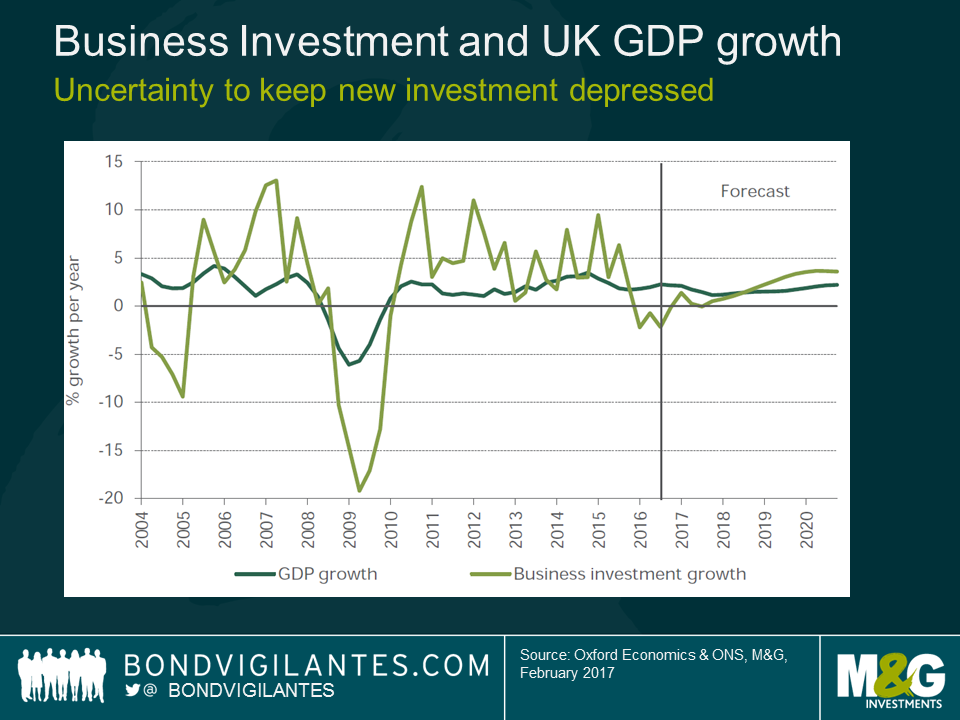

The IFS expect business investment to remain subdued due to “Brexit risks”. I don’t have any argument with this view. The inherent uncertainty of going through a period in which the UK will renegotiate its global trading arrangements will likely cause a pause in investment, until there is some more clarity.

Government spending

In short, austerity is here to stay. So we can’t expect an increase in government spending to contribute meaningfully to GDP any time soon.

Net trade

The presentation highlighted that, even with a roughly 20% devaluation in the pound, non-oil exports actually fell year on year. The suggestion is that, thus far, UK exporters have kept the prices they charge abroad the same. UK companies have preferred to increase their profit margins rather than attempt to increase market share by cutting prices.

I beg to differ on this forecast. Assuming no further sterling weakness (which I admit isn’t a given), a profit increase driven by a currency translation effect is a one off. Firms wishing to maintain this profit growth overseas will likely begin to reduce prices in an effort to capture a greater market share. If the strategy works we should begin to see UK exporters’ increased competitiveness come through in higher export volumes, rather than just in higher profit margins over the next few years.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox