Low yield, low quality, weaker covenants

When investing in companies of a lower credit quality, loss given default risk is the key threat that investors have to assess. Consequently, covenant protection is a crucial consideration before lending capital to a company. We wrote about covenant protection back in 2014 and it’s fair to say that covenant quality in the high yield market hasn’t improved much since then; actually quite the opposite is the case.

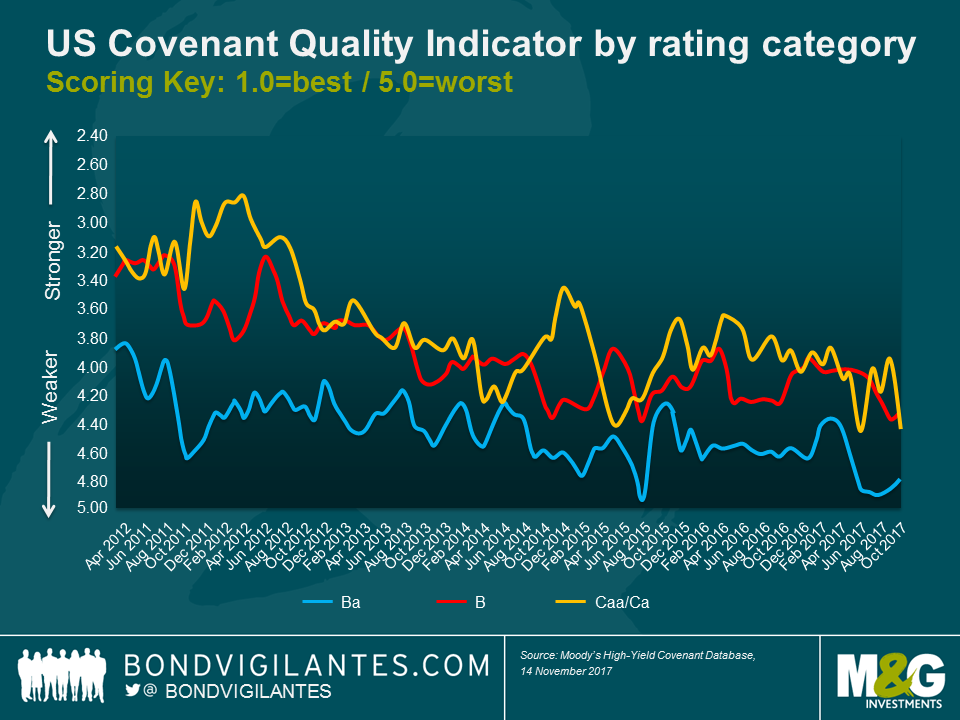

A report recently published by Moody’s confirms that the bond issuers and advisors are on a strong footing when issuing debt, with demand remaining strong for higher-yielding assets. The North American Covenant Quality Indicator, using a three month rolling average, shows the second weakest protection quality for each credit rating category since 2011, with only August 2015 showing weaker values.

Due to scale and lower leverage levels, bondholders generally require less protection for bonds of a higher credit quality. However, for more leveraged companies issuing debt where credit protection should be at the forefront of investors’ mind, bondholder rights continue to deteriorate. In October, two out of the five new “HY-lite” bond deals (bonds that lack fundamental investor protection) came from B-rated bond deals. Granting this amount of flexibility to weaker credit issuers can have a material impact on recovery prospects.

One would think that this might be a direct consequence of the US market being further advanced in the credit cycle, with investors starting to show signs of complacency. Unfortunately, the European high yield market shows a similar trend.

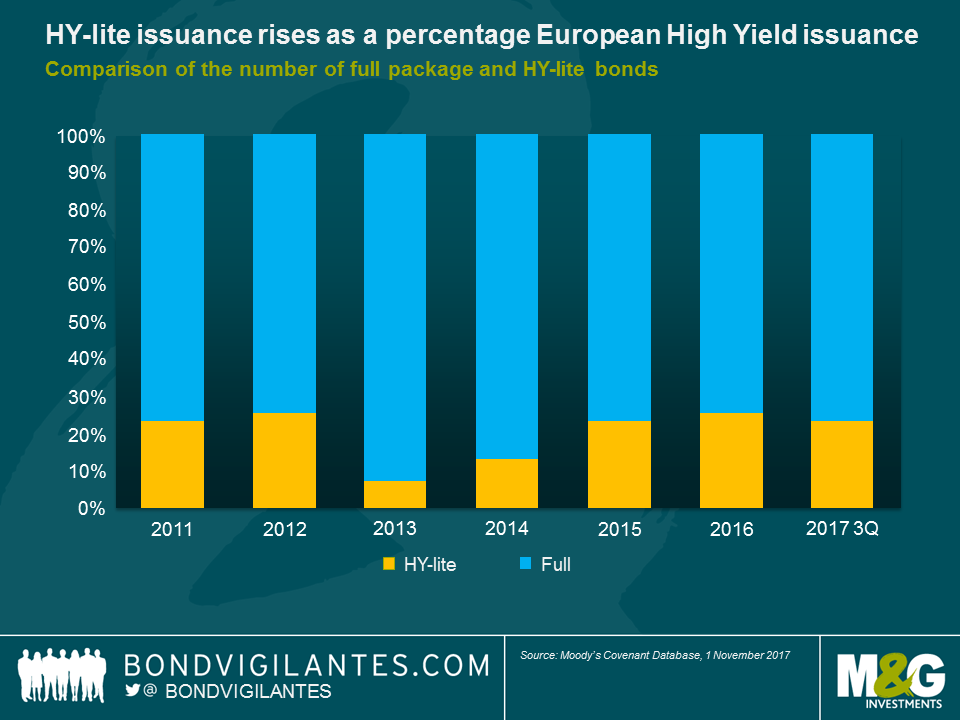

Since 2013, the proportion of so called “HY-lite” bonds has meaningfully increased according to Moody’s. As a percentage of all issuance per year, HY-lite issuance has been rising since 2013, from a level well below 10% to a third of all bonds that come to the market. In absolute terms, investors have actually seen more European high yield bonds with substantially looser covenant terms coming to the market in the first three quarters of 2017 than during the whole of 2015 and 2016.

There is also a significant difference that can be observed between refinancing and new money bonds. Compared to 2013-2014 levels, the size of debt carve-outs is unchanged for refinancings. However, new money bonds show clear signs of covenant erosion where cash leakage baskets have grown from an average of 12% in 2013-2014, to 17% in Q3 2017. Likewise debt carve-out baskets have significantly grown for new money bonds from 16% in 2013-2014 to 25% in Q3 2017.

So is it time to reduce high yield allocations? Not necessarily. Companies still enjoy a favourable macroeconomic environment in a world of global synchronised growth and benign financial conditions. With the US Fed normalising rates gradually from historically low levels and the ECB still in no hurry to hike rates at all, companies can continue to benefit from cheap refinancing conditions for the foreseeable future. Default rates are set to remain low through 2018. Investors, on the other hand, are still able to take advantage of a relatively attractive income stream compared to other bond markets, but credit selection will be vital given a possible increase in idiosyncratic risk factors. Credit spreads, especially in European high yield, do not leave much room for disappointment and the lack of income opportunities in other fixed income markets has increased investors’ willingness to forego stronger covenant protections. In an environment of continued low interest rates in Europe this trend is likely to continue and needs to be watched closely.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox