Why the Bank of England will pause tomorrow

If you looked at the post-referendum changes in sterling versus the dollar, or the movement in gilts, you’d be forgiven for thinking that Brexit was done and dusted. The 10 year gilt yield has bounced back to around pre-referendum levels hovering around the 1.4% mark (in August 2016, 10 year gilts rallied to historical lows of 0.5%), while the front end of the yield curve has moved higher. Similarly, from a currency perspective, GBP real effective exchange rates have bounced considerably from their post-referendum lows.

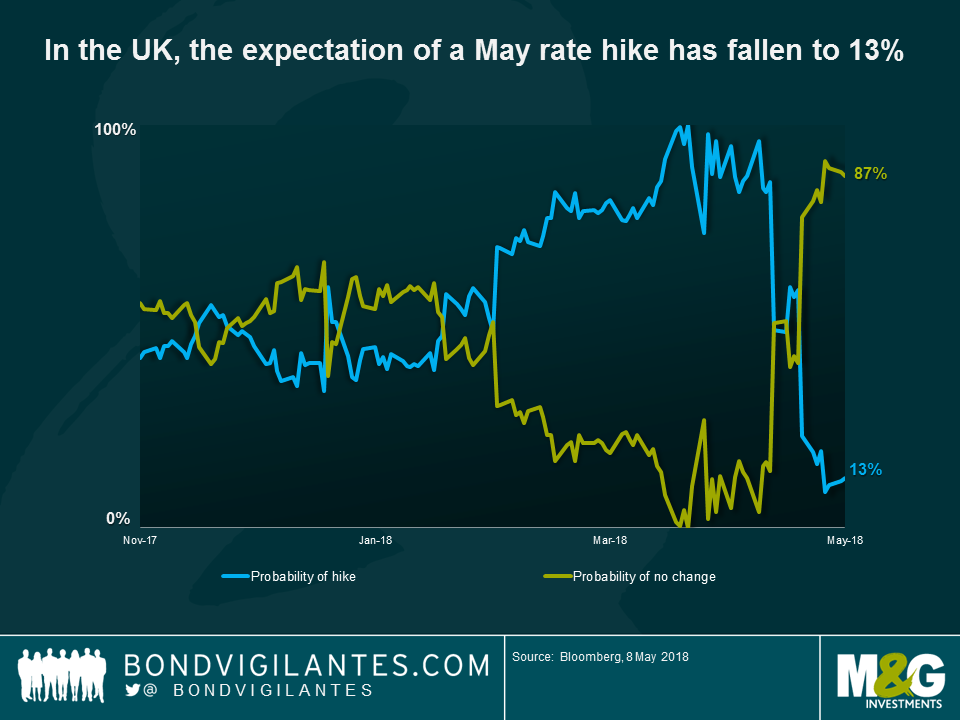

On the surface, this perhaps suggests that Brexit concerns have abated. Indeed, up until last month, the market was pricing over a 90% probability of a rate hike at tomorrow’s meeting (which would be the first time rates have been above 0.5% since March 2009). Scratch a little deeper however and there are still signs that there’s a raincloud hanging over the UK, which is why the Bank of England (BoE) may pause tomorrow, explaining why the market’s rate hike expectations have fallen off a cliff.

Initially economists and the market priced in a doom and gloom Brexit scenario, but after the currency depreciation and big gilt curve moves, the economic data held up into the end of 2016. As the political discussions have dragged on with definite details sparse, ‘Brexit boredom’ has perhaps been the result. Through 2017, front end gilts traded sideways in a 40 basis points range, with this range limited to just 15 basis points from September (the market priced in a reversal of the BoE’s post-referendum ‘emergency’ rate cut, which was indeed reversed in November) through to the year end.

For the best part of this year, with rate hike expectations growing, it has paid to be short duration in the front end. But the trajectory has recently changed. Just as the market had decided to underweight the politics and the gilt curve had become sensitive to central bank rhetoric once again, more of the economic hard data has started to turn. The near-certainty of a May rate hike was first called into question, when during an April interview with the BBC, Mark Carney explicitly stated that he was “conscious that there are other meetings over the course of this year.” Since this warning, the economic data has followed suit. CPI at 2.5%, retail sales of -1.2% and Q1 GDP at 0.1% have all been below expectations. Last week, in the final run up to this week’s meeting, all of the UK’s PMIs (manufacturing, services and composite) fell below expectations.

If the May hike is off the table, then when do the BoE move next? Central banks remain data dependent, but are increasingly intent on hand-holding, providing signals and guidance to the market. What this has meant in recent practice is that both the FOMC and BoE have tended to move rates at meetings which are followed by press conferences, where they can verbally articulate their changes. This is why the market is pricing in a low probability of a move by the BoE in June, but a greater chance of a hike at the quarterly meeting in August. To my mind, even August may prove too soon, if the consumer squeeze and hesitant investment environment continues.

Brexit uncertainly is still an issue. It’s very much on the political radar and is on the economic map now too; the market had just been temporarily lulled into a false sense of security. Without supportive economic data or political clarity, any move upwards in rates could easily prove to be a ‘bad’ hike.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox