Bond indices are shifting their attention to China – so should you

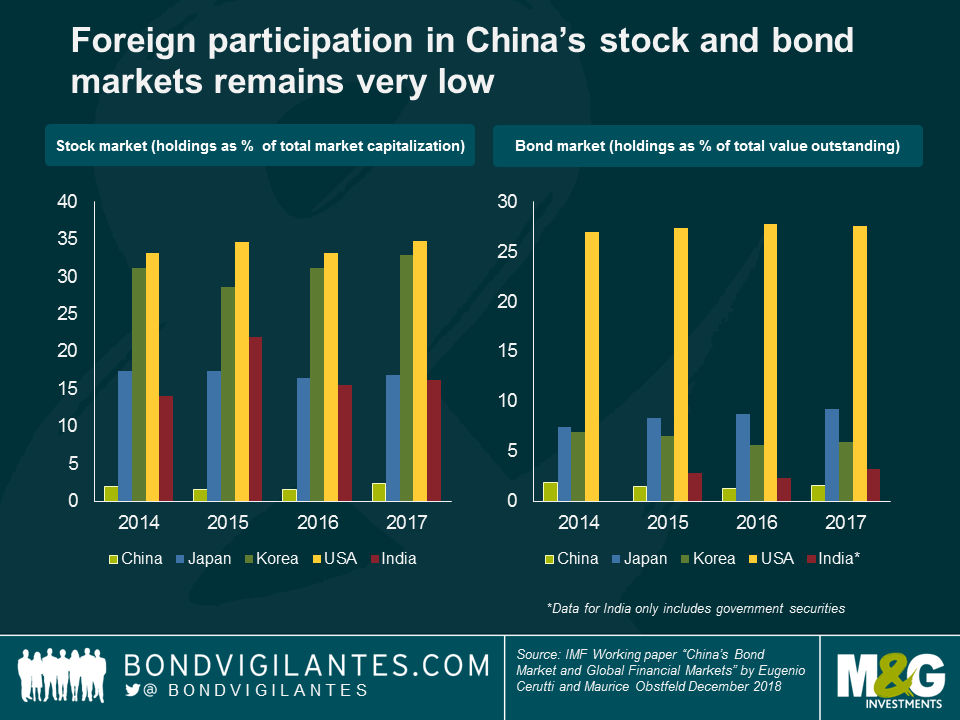

It is widely recognized that China is globally well-integrated from a trade perspective (it accounted for 13% of total world exports in 2017 according to the WTO). Yet in comparison, its financial markets remain in relative isolation. Indeed, despite having the 2nd largest equity and 3rd largest bond markets in the world (currently around $13 trillion), foreign participation in these markets remains extremely low: China still scores below India in terms of foreign participation in its equity and bond markets according to the IMF.

The situation is changing however, and China’s domestic financial markets are slowly beginning to open. This became apparent in 2011, when the renminbi Qualified Foreign Institutional Investor Scheme (RQFII) was introduced. The program allowed qualified investors to access directly the China Interbank Bond Markets (CIBM), where previously relatively strict quotas were in place. More recently, the creation of the Bond Connect (northbound link) program in July 2017 further relaxed the restrictions for eligible foreign investors in accessing the CIBM via Hong Kong. While some operational challenges remain, these initiatives from the Chinese authorities convinced Bloomberg Barclays to include Chinese renminbi-denominated (RMB) government and policy bank securities to the Bloomberg Barclays Global Aggregate Index (including the Global Treasury and EM Local index families) in April 2018. Over time the index provider estimates that RMB bonds will be the fourth largest currency component in the index after the US dollar, the euro and the Japanese yen. This was a big win for the Chinese authorities only a year after MSCI’s decision to include China A shares to their suite of EM equity indices.

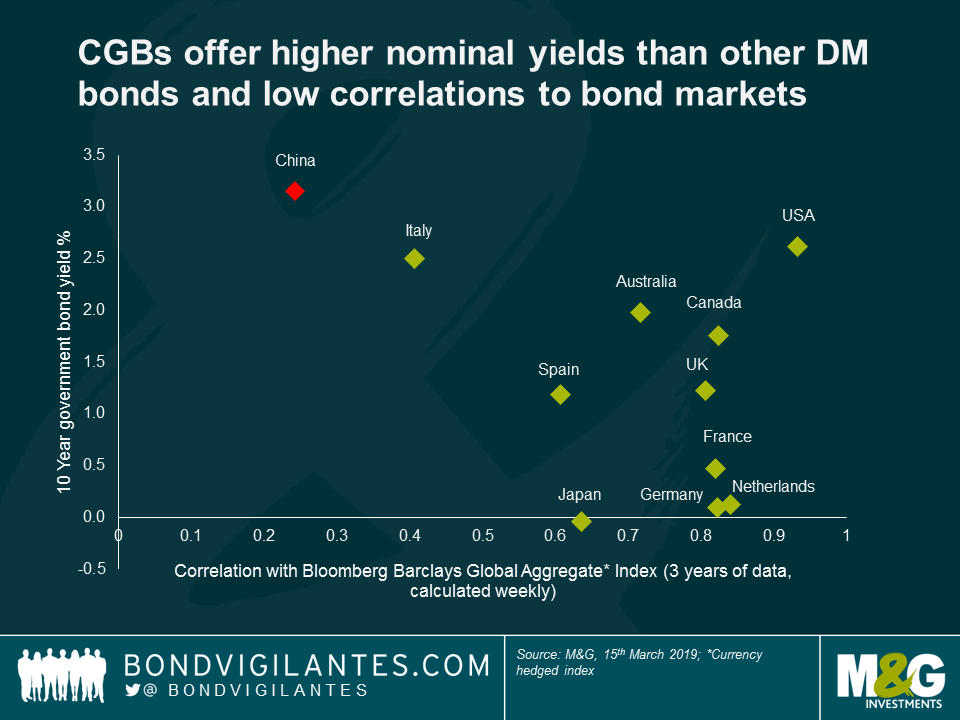

So how should RMB government debt play a role in global bond portfolios? Well, with a current yield of about 3.15% and low levels of historic volatility, 10-year Chinese government bonds (CGBs) seem fairly attractive from a purely risk and return perspective. This seems especially true in today’s yield-deprived sovereign bond world, where many central banks have pledged to keep interest rates at rock bottom levels in the near term. And though the correlation of RMB government bonds may increase over time as the Chinese market becomes more integrated, they currently offer great diversification benefits versus the rest of the Bloomberg Barclays Global Aggregate index. It must be noted though that, from a currency perspective, the renminbi does not currently benefit from the same defensive characteristics as those exhibited by the typical safe haven currencies (for example the Japanese yen, the US dollar, the Swiss franc and to some extent the Euro).

Morgan Stanley Research estimates that up to $100 billion could flow into Chinese bond markets on the back of the index inclusion alone. J.P. Morgan has also put China on “index watch” for inclusion in the GBI-EM indices. Should this materialize, in time CGBs could make up 33% of the GBI-EM Uncapped index and 10% of the GBI-EM Global Diversified index.

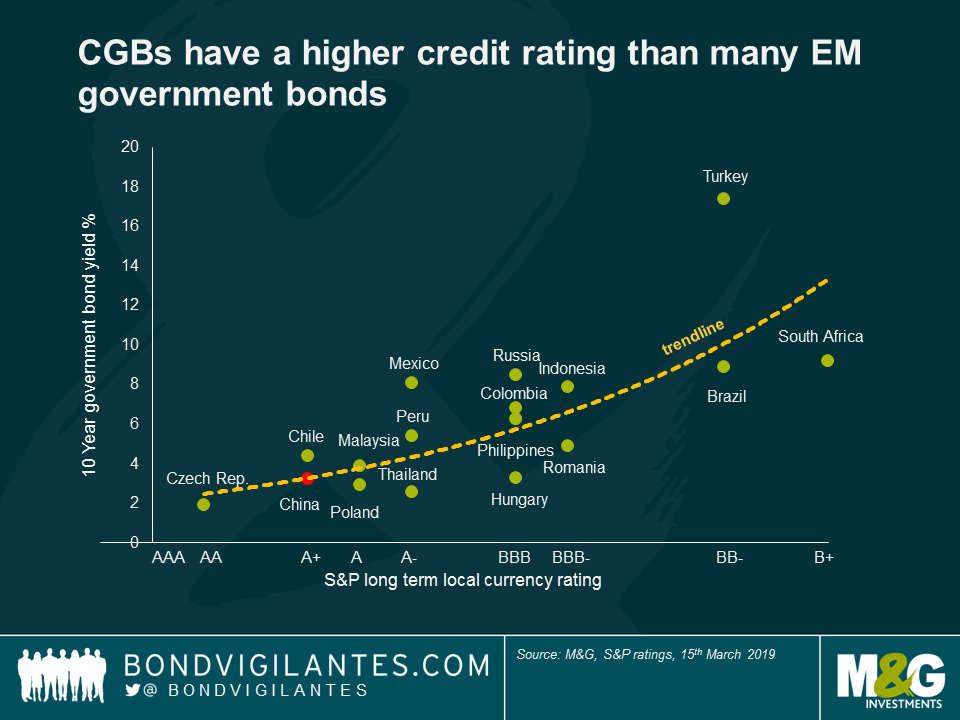

For investors involved in emerging market debt, A+ rated Chinese government bonds sit firmly on the defensive side of the EM sovereign debt risk spectrum (see chart below). Because of this, they may have slightly less appeal strategically for EM debt fund managers (who tend to be overweight the higher yielding EM sovereign names over the long term). On the other hand, as the Chinese authorities gradually step back from the bond and currency markets, CGBs could represent a great opportunity for fund managers to add value through active management.

In addition, the prospect of low inflation and further fiscal and monetary stimulus in the face of the current economic slowdown could also make Chinese government bonds attractive in the near term. It can also be argued that as Chinese financial assets become more mainstream in 2019, the People’s Bank of China (PBoC) will be willing to use a further portion of its $3 trillion of foreign reserves to maintain stability in the currency, as it did last year.

While China’s commitment to opening its financial markets to foreigners is sincere, it is also likely that this will take time. First of all, the authorities will move with extreme caution as more volatile capital flows can represent a systemic risk and a threat to China’s economic and financial stability. In addition to this, the issue of credit markets needs to be addressed further: foreign participation in RMB credit markets is almost non-existent (estimated at 1% according to Deutsche Bank research), because many Chinese corporations benefit from an implicit state guarantee that has kept their funding costs lower and their credit ratings higher than they would be if only market forces applied. Opening China’s credit markets means putting these firms on a level playing field with the rest of the world. This adjustment has already started to take place and led to a record amount of corporate defaults in China in 2018. Additionally, further developments in areas such as corporate governance, transparency and integrity of data will also be required.

Despite these challenges in opening its markets, there are clear benefits to China. Providing easier market access to foreigners will allow a much more efficient allocation of capital in the country. It also comes at a time when China’s current account balance has been on a steady decline and is expected to move towards a more balanced – or even slightly negative – structural position. In this respect, opening the capital account should help rebalance the Chinese economy’s external position. Whatever the outcome for China, as these events unfold it is important for global fund managers gradually to shift their attention towards the East.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox