The new Taper Tantrum – H2 outlook 2020

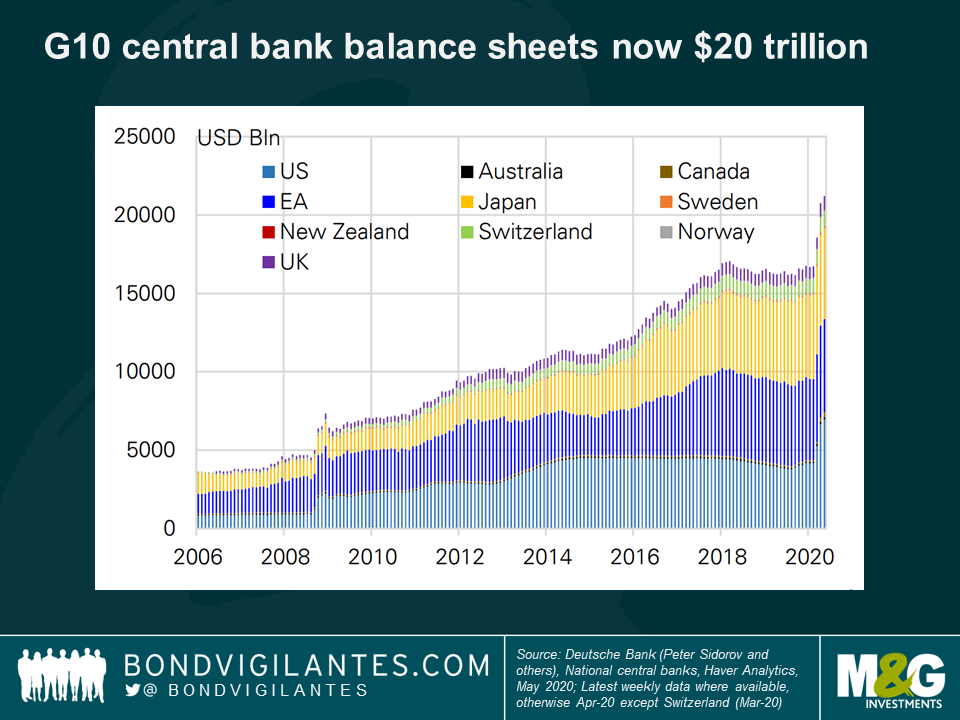

The first half of this year saw one of the fastest and most aggressive market corrections in history, as Covid-19 spread around the globe. Just as unprecedented was the speed and extent of the subsequent recovery, thanks above all to governments and central banks having sent in the cavalry to boost liquidity and plug the consumer confidence gap. Combining fiscal and monetary stimulus, the global policy response is estimated to be $14 trillion and counting. With all this in mind, what’s next for global markets as we enter the second half of 2020 and beyond?

The 2020 Taper Tantrum

The second half will be all about the new Taper Tantrum. The first one was about the Fed’s balance sheet unwind, leading to a surge in Treasury yields as the central bank announced the tapering of its quantitative easing (QE) programme in 2013. This one will be about the end of furlough schemes in developed markets.

Countries are opening up again in order to limit economic damage, especially in the northern hemisphere where governments are keen to support growth through holiday spending. In the absence of a vaccine, this means that an acceleration of Covid-19 cases is almost inevitable, even with measures such as local lockdowns. However, death rates will be lower than they were in the “first wave” for a number of reasons: we now have better treatments (e.g. steroids cut death rates in intensive care units), we have learned lessons on shielding the most vulnerable, and very sadly, many of most vulnerable may have died already in the first wave. Most developed economies should return to some form of normality.

However, despite the recent rebound in employment (look at the US jobs numbers last week), unemployment is still exceptionally high. US unemployment is up 12 million from February, while in the UK we have over 9 million people out of work—more than a quarter of the UK workforce. So far, the economic damage done to individuals has been cushioned to a large extent by furlough schemes, in which the government pays a large percentage of salaries for staff whom would otherwise have been laid off. As a result, with little to spend money on during lockdown, many people have been able to save or reduce debts.

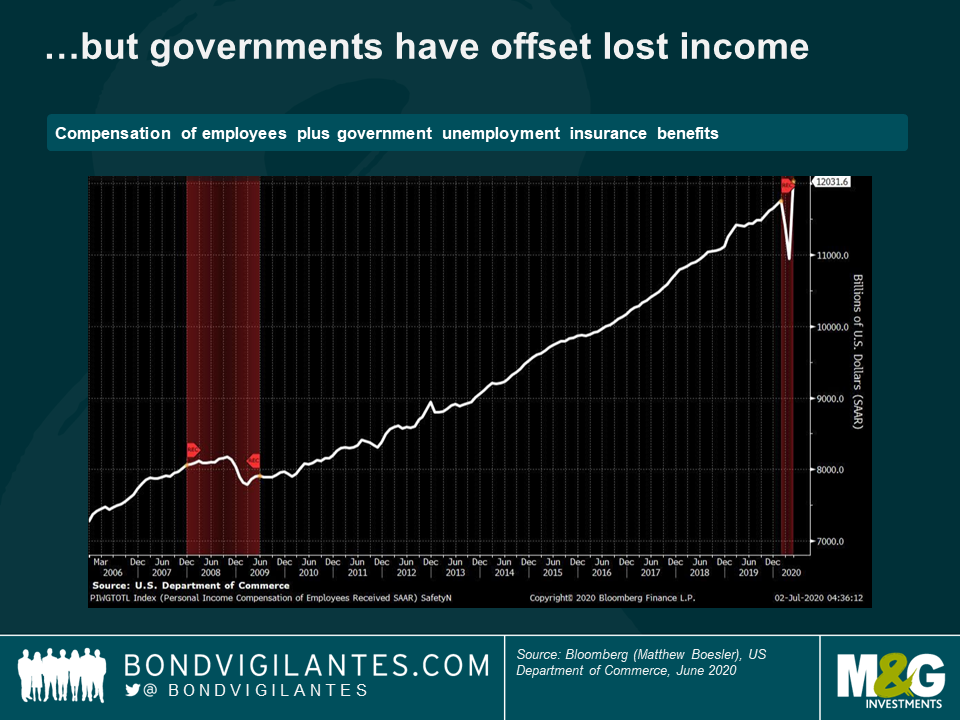

In the US, thanks to the CARES Act, the largest economic stimulus package in US history, we have a situation in which some workers have actually been better off being out of work than they were in their previous jobs. With direct payments to Americans and loans to business, the $2 trillion Bill amounts to 10% of US GDP, and is much larger than the $0.8 trillion Recovery Act of 2009. Adding together compensation of employees plus government unemployment benefits, we have the strange situation in which people in the US are receiving more income on average now than they were before Covid-19.

This is a rather odd recession: they don’t normally send personal incomes soaring.

The danger is in the taper

But what will happen when this stimulus begins to wind down? Government debt levels have exploded since March as tax receipts collapsed and unemployment costs rocketed. Deficits have moved well above 10% for most developed market economies, while debt-to-GDP ratios have generally moved to, or above, 100%. While there’s a lot of debate about whether this matters (see Stephanie Kelton’s recent book, The Deficit Myth, which suggests that we can print money to get ourselves out of the problem; or Eric Lonergan (of M&G) and Mark Blyth’s Angrynomics, which says that having negative sovereign interest rates makes this a time to invest in infrastructure), most governments want to start to taper assistance to the economy later this year. In the UK, this means that government furlough payments will be reduced in August and October, putting some of the wage burden back onto employers.

What happens then? In anticipation of furloughs ending, UK retailers in particular have already announced mass redundancies. How many of the world’s furloughed workers don’t realise that they are actually unemployed? For this reason, plus the continued impact of Covid-19 on global travel and trade along with social distancing nervousness (however reduced from its peak), talk of a V-shaped recovery seems difficult to square with the environment we now face, despite low rates and some continued fiscal stimulus.

Lessons from history

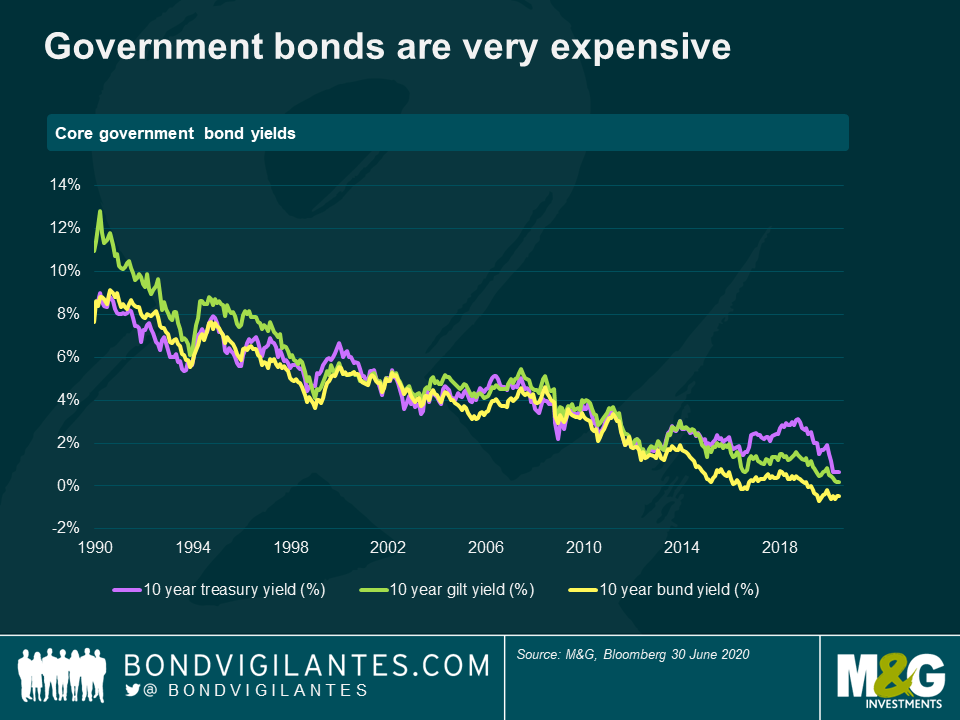

It is likely that there will still be more fiscal stimulus and debt levels will continue to rise from here. How will we deal with them? The usual three options are: grow, inflate or default. The answer is basically the same sort of policies that allowed the UK to deleverage from 250% debt-to-GDP after the second world war. These included forms of financial repression like forcing high bank ownership of government bonds. In the US, it involved pinning bond yields to low levels – like we have seen in Japan since 2016, and in Australia in March this year. Such yield curve control (YCC) is already under active debate within the Fed (YCC is different from QE in that it targets a bond price or yield, rather than simply being a purchase of a set volume of bonds). Might we also see negative interest rates from the BoE and Fed? On a further slowdown it is likely.

We should also consider central bank independence. Former Bank of England Deputy Governor Paul Tucker has warned that, as the Bank is now buying basically the same value of gilts as is being issued by HM Treasury (as well as offering the government a Ways and Means overdraft for lost tax revenue), it is at risk of being seen as the financing arm of the UK authorities.

The return of inflation?

Does this make inflation more likely? The jury is out, and this largely depends on who wins the battle between labour and capital in the recovery. Labour has lost out for decades now. Will Covid-19 change that? The data so far are not promising: the latest research from the US Brooking Institute think tank says that it is the bottom 20% of wage earners that have suffered the highest unemployment rates, so hopes that we would emerge from the crisis wanting to reward low-paid key workers (nurses, delivery drivers, supermarket staff) might be dashed. There’s still a chance of some supply side inflation, thanks to food going unpicked and disrupted logistics. Shopping basket inflation did rise in March, as shops ended promotions and limited product ranges (and this inflation was inflicted disproportionately on lower income households as a result of how lockdowns have pushed them to buy more food while not spending as much on other, less inflationary items and activities). But demand-driven inflation seems very unlikely overall.

Received wisdom is that QE = inflation. Is this true? The money supply expansion is huge – but so is the collapse of the velocity of money (i.e. the speed at which it circulates in the economy). Some argue that the most powerful effect of QE is that on a currency: as money is printed, the currency depreciates and inflation is generated through higher imported goods prices. But what if everyone is doing QE? What if everyone is trying to get their currency down? It has no impact. Famous bear Albert Edwards goes further, to say that YCC will be even less inflationary, since countries like Japan have been able to keep yields low without even having to buy many bonds – the signalling effect is so powerful that there’s not even a monetary expansion.

Positioning for the new taper tantrum

Credit

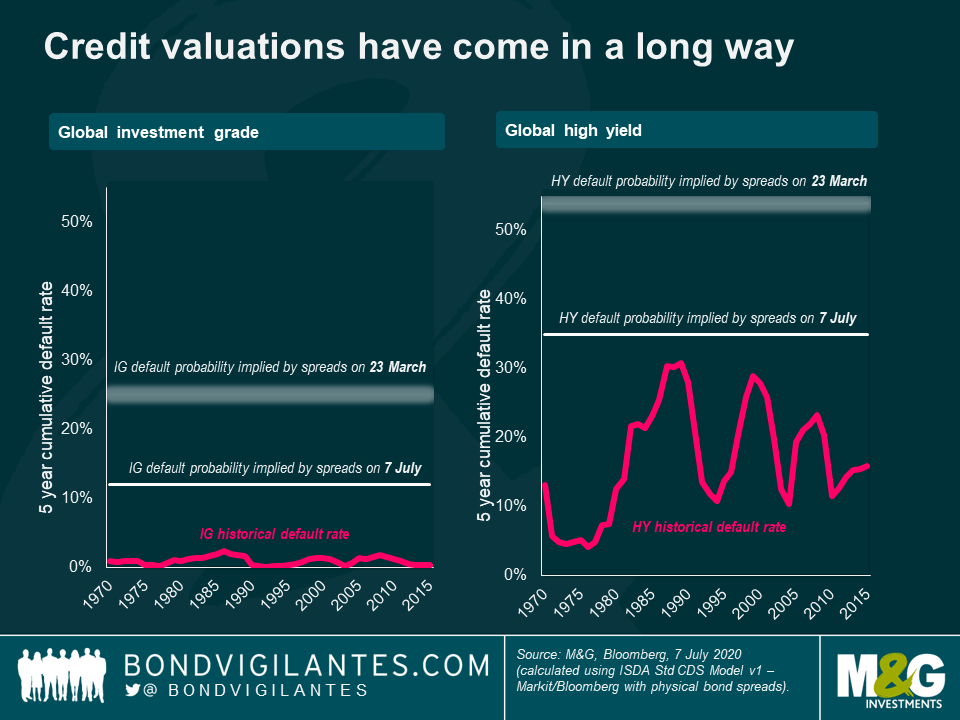

We’ve come a long way since the lows of March, which offered some great opportunities to be overcompensated for default risk as a credit investor. Corporate bonds, which at their lows were pricing in IG and HY default rates of 25% and 54% (23 March 2020) respectively, are now closer to fair value (pricing in 12% and 35% at 7 July 2020). Undoubtedly this has been driven mainly by central bank buying, particularly in high yield where we have seen and can expect to see more defaults.

Despite considerable volumes of issuance, high yield spreads have come a long way. The main reason is not fundamental but rather the action of the Fed, which has for the first time been buying high yield ETFs and high yield bonds which were downgraded after 22nd March. It’s hard to get excited about credit valuations at these levels. There is still some value in investment grade: these companies are the big employers, so it is politically easy (and arguably a decent policy tool) to support them.

The Fed’s support also begs the question, is it right that these companies survive? We have lost the creative power of destruction, where the old makes way for the new. Is capital really being allocated correctly and efficiently? We have seen how growth and productivity stagnates under these conditions in Asia at the end of the last century.

Developed markets

Despite the huge fiscal stimulus we have seen, it is difficult to be too bearish on government bonds now given the yield controlled world we live in. And bonds like bad news: while they are clearly very expensive, they do offer potential upside in the event that negative sentiment returns to markets in the second half. With inflation unlikely to rise significantly in the short term, I don’t mind owning duration.

In Europe, the planned recovery fund and continued Pandemic Emergency Purchase Programme (PEPP) have been supportive. Just as important as the planned spend itself is the sentiment of burden-sharing, when it comes to helping contain EU break-up risk. Despite some resistance to the stimulus plans from the more frugal Euro nations, Italian BTPs and other peripheral bonds have strongly outperformed core government bonds since the announcement. I’m not convinced we’ll see much more outperformance from BTPs since their aggressive rally. Flows are slowing as spreads are compressing, so demand is likely to shift to other high yielding sovereigns in the region that have been less aggressively bought so far by the ECB and investors. For this reason I like bonds like 10 year Netherlands.

Emerging markets

One area in which I do see value is emerging market (EM) debt. Firstly, it offers higher real yields than developed market bonds. Also, EM currencies have lagged the recovery, meaning that some local currency bonds do offer attractive value (you can buy more per dollar). Emerging markets clearly face challenges due to Covid-19, particularly as a result of headwinds to global trade, but greater EM central bank intervention than we have seen before is helping and there are regional pockets of relative value. For example, I would expect Asia to outperform other EM regions, since high real rates make currencies here broadly attractive to investors. Additionally, many of these economies are net exporters and so this should also improve current account balances.

Currencies

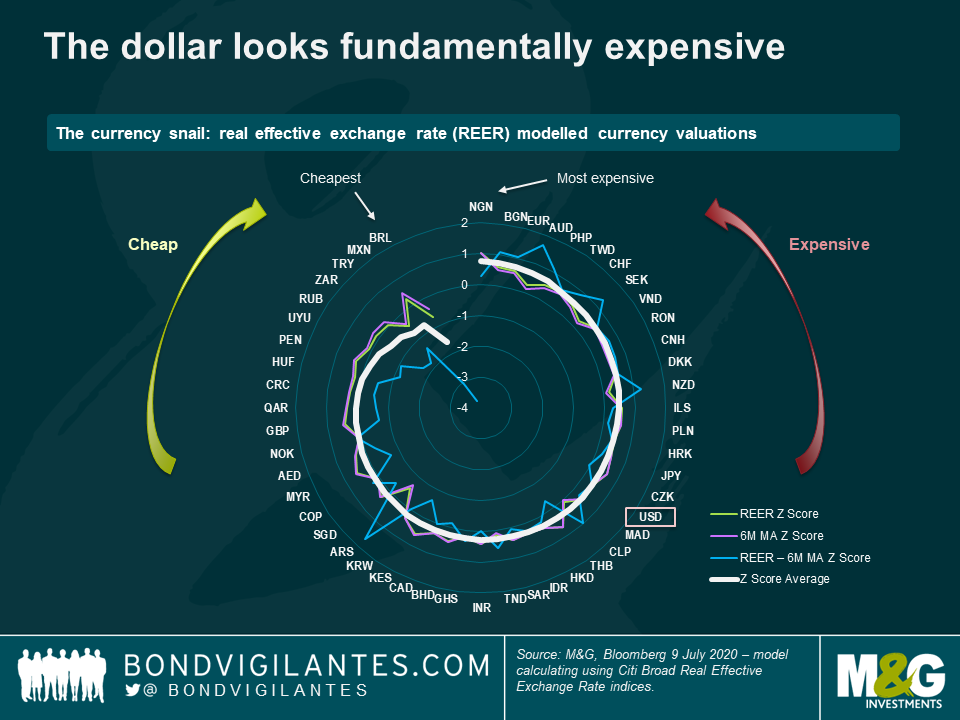

We should see some mean reversion in valuations that moved aggressively in the first half. While EM local currencies looked fundamentally cheap across the board in the first half, going forward I expect to see some more moves based on fundamentals. I therefore anticipate rotating out of some of those currencies that have rallied aggressively (for example the Indonesian rupiah) to those where fiscal and central bank positions are strong, but valuations still look attractive (for example the Russian ruble). I would also favour higher-beta currencies (for example those that are heavily commodity-driven, or with a reliance on external rather than domestic demand) to capture any second half mean reversion. Likewise I am following central bank moves closely: currencies in those countries where central banks have been relatively conservative in expanding their balance sheets (e.g. the New Zealand dollar over the Australian dollar) are where I want to be (though in rates I would favour issuers where central banks are providing strong support).

Unlike many EM local currencies, the dollar looks quite expensive on a fundamental basis. Despite this, I do own some dollar exposure, as it does its job in a risk off environment. On balance though, I prefer the Japanese yen for the better diversification and risk off hedge it offers. With the ECB having removed a lot of downside risk in the region through their aggressive buying programme, I also like holding the Euro. It has become a very cyclical asset (rallying as sentiment improves, the opposite to the way the dollar is behaving), so I hold it against the safe haven currency of the region, the Swiss Franc.

Short term action, long term impact

The focus of financial markets moves quickly. We saw over the first half of 2020 just how quickly. After the deep and rapid panic-driven sell off as Covid-19 spread around the globe, the extent to which asset prices have recovered reveals markets’ new focus: the unprecedented magnitude of fiscal and monetary stimulus. With millions of jobs lost in a few months, there is no doubt to my mind that it is this stimulus which is now driving markets: they are being driven by technical factors, not fundamentals. I think the focus may change just as rapidly in the second half, and it will be to the other side of the coin: what will markets make of the inevitable end of the monetary and fiscal bridge?

Governments and central banks have, on the surface, succeeded in containing much of the financial fallout of the lockdown-driven fall in demand. The danger now is in the taper. In this light, it seems difficult to support the idea of a V-shaped recovery. And the short term response of governments and central banks brings up longer term questions. How will we get out of all this debt? Grow? It seems implausible that trend growth will be higher in the aftermath of this crisis than before. Inflate? Central banks haven’t been able to achieve their inflation targets even in the good times, so what chance do they have of inflating away the debt now? Default? There’s no need to default if you can print your own currency – but we might see some debt jubilees (cancellation of student loans for example), wealth taxes and confiscations, and even the cancellation of government bonds held by the central banks as part of QE. And what happens if the market stops believing that central banks are independent? Could that finally be the catalyst for inflation expectations to return to developed markets and, after decades of losing, will labour win over the power of capital this time round? The actions of a few months bring up these questions and more. We may have to wait for some years to learn the answers.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox