Sustainability-linked bonds: should you wish for the worst?

This month has been an active one for new issuance in emerging markets, including a huge increase in ESG-labelled bond issuance. Sustainable, social and green bonds are being marketed actively by issuers and currently meet robust demand on the back of both inflows to emerging markets (EM) and the continuous development of ESG strategies.

Less common, sustainability-linked bonds (“SLBs”) have nevertheless continued to emerge as a credible, forward-looking way for investors to buy into an issuer’s ESG improvements. SLBs see their bond coupon subject to the issuer’s meeting a sustainability performance target: the coupon increases by X bps (in general 25 basis points) per annum if the issuer does not meet its target. We wrote last year about the need to look beneath the surface of sustainability-linked bonds before investing.

Since Brazil-based Suzano issued the first ever EM sustainability-linked bonds in September 2020, a couple of Brazilian issuers have also tapped the market. In line with Suzano, logistics business Simpar issued a SLB with a coupon step-up (25bps) based on greenhouse gas emission targets. Simpar is highly rated (AA) by one leading ESG external provider, so the SLB may be less susceptible to any accusation of greenwashing. Klabin, a pulp and paper company, issued a slightly different – and interesting – structure with three distinct coupon step-ups (totalling a 25bps increase) based on three distinct performance indicators (water consumption, waste use and the reintroduction of wild species into the ecosystem) to complement their existing green bond programme.

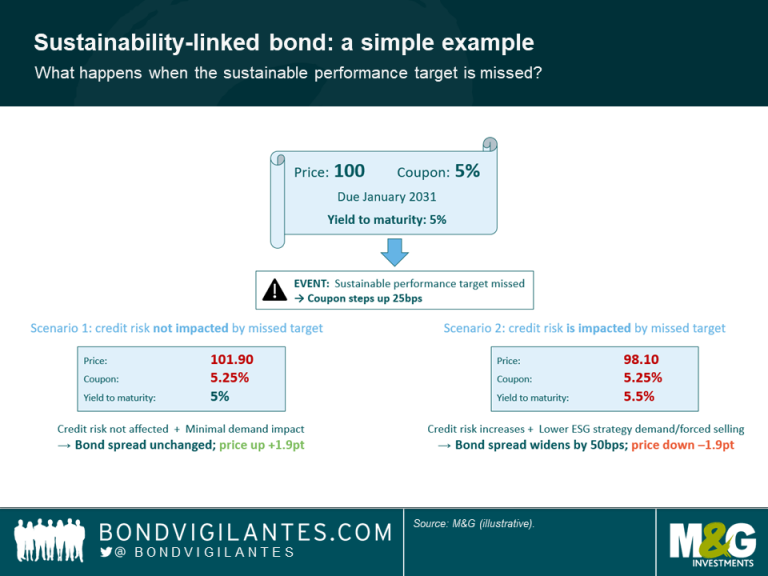

The paradox of SLBs is that investors may wish the issuer to fail to meet its sustainability targets to get a higher return on the bond. This may not be a politically correct question in a world in which all investors claim they have “ESG in their DNA”… yet it is a very relevant one when looking at the economics of SLBs. Using a trivial example, a 10-year sustainability-linked bond with a 5% coupon which trades at par (100) and yields 5% to maturity will see its bond price increase by about 2% after the coupon increases by 25bps, assuming investors still require a 5% yield compensation for the credit risk. Arguably, one would still make a profit if bond spreads widened by less than 25bps (i.e. the coupon step up).

To be part of the cynical – and rather bold – camp wishing an issuer not to meet its sustainability targets, one must make the assumption that credit risk is not (or is very little) influenced by the company’s key performance indicator (GHG emissions, water consumption, etc.) set in the sustainability-linked bond documentation. Said differently, in our 10-year bond example one must expect the 5% yield (in similar market conditions) to stay unchanged after the company’s failure to meet its sustainability targets (see scenario 1 below).

From a purely ethical standpoint – putting aside the economics of the investment – responsible investors may claim that profiting on the company missing the targets is simply owed compensation for the company not participating in the sustainable effort due. Some may also simply regret the lack of improvements as they care about the ESG outcomes of their investments.

A different approach – which is not incompatible with an ethical stance – is to think that failing to meet the targets might impact credit risk, and hence the yield required by investors. In a world in which regulation has become increasingly tight on environmental standards, any company taking climate change lightly is at the mercy of operational disruptions in the future and the risk of fines and lawsuits. Forward-looking credit research takes such factors into consideration and rating agencies now incorporate ESG factors more effectively. This is where SLBs become very interesting for investors: they incentivise companies to perform a necessary business transformation. If successful, investors hold the companies that have transformed appropriately within their business environment – a positive for alpha generation and a positive for risk management; if unsuccessful, investors get some compensation through the coupon step-up. In a “normal” bond, an issuer that does not engage in the transformation required may see its business suffering and its credit profile deteriorating, ultimately impacting credit spreads over time without getting a coupon step-up as mitigating compensation. Returning to our fictional SLB example, failing to meet the target may well result in credit spreads widening by more than 25bps over time (see scenario 2). And if it does not, it probably meant that the sustainability target was not relevant or material enough for the business risk – it then raises the question of how ambitious was the performance target.

On top of credit risk implications over time, an issuer failing to meet a sustainability target may also see bond technicals weakening through lower demand from ESG strategies, which may become unwilling to hold an issuer missing their sustainability targets. SLBs are a new market and only time will tell how asset managers react to a missed target but, based on the recent very large books for new SLB issues, it is fair to assume that many investors would be disappointed and/or that some forced-selling pressure would occur for those with strict sustainability mandates. In late 2020, a number of very large European asset managers decided to remove exposure to green bonds issued by State Bank of India after it was made public that the Indian bank would finance the Carmichael thermal coal mine in Australia. It’s hard to see State Bank of India coming to the market with a new green bond any time soon. Sustainability-linked bonds may well face a similar threat in the future if they don’t deliver on their targets. To those wishing for the worst, be careful what you wish for.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox