Don’t take the strength of the consumer for granted

For many, the default position has been to assume that the US consumer is in a position of strength: the labour market looks strong, wages are increasing and there is therefore potentially sustained pent-up demand from the pandemic. But are we taking the strength of the consumer for granted?

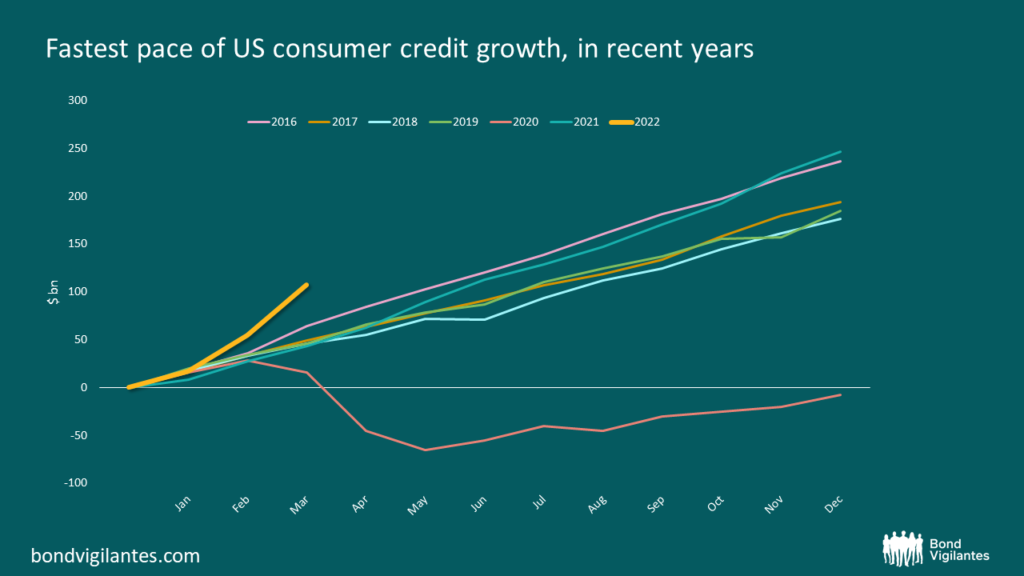

At first glance (and simply as food for thought), the chart below – which shows that consumer credit in the US is increasing at the fastest pace in recent years – is perhaps an indication of an economic rebound. However, it got me pondering: do people access credit when they’re feeling rich or when they’re feeling poor? So is this subsequently a sign of economic strength or weakness?

There’s a seasonal pattern to consumer credit (which includes credit extended to individuals, via credit card loans) which is to be expected: the pace of consumer spending tends to peak in November / December, given the lead up to big-spend events like Thanksgiving and Christmas, the following quarter (January through until March) then usually sees a decline in credit balances and the overall pace, as consumers ease off spending. As such, the Q4 spending peak is not typically matched or exceeded until much later in the following year. You can see some of this at play in the cumulative data chart below; it’s not unusual to see consumer credit increase by $50bn or more in the final quarter of the year, but it is unusual to see this in the first quarter. However, that’s just what’s happened this year. The current 2022 cycle has broken with the previous trend, as the pace of consumer credit growth quickly exceeded $50bn at the end of February and soared through $100bn at the end of March – a level that’s not usually reached until May/June.

So is this a sign of consumer strength or weakness?I can see the argument both ways. Clearly this behaviour is fuelled by both consumer demand and higher inflation, but which is dominating?

If this trend is fuelled from a position of strength, you can see how consumers may be in good shape and “feeling rich”. With unemployment at its lows, workers arguably have a steady stream of income and therefore the confidence to service their credit card debt and bring forward future purchases. Happy days, nothing to see here.

However, the “bringing forward future purchases” argument is also textbook rationale for how consumers react when faced with inflation. Given the inflationary environment (which we expect to remain for some time, as we blogged about here), the same level of consumption now requires a greater nominal spend – bringing forward purchases is therefore behaviour that’s very much consistent with rising price levels: buy now, while it’s cheaper. Especially if these purchases are staples.

As such, the chart potentially indicates that this is a sign of consumer releveraging, and that instead of this being a healthy sign, it is very possible that excess savings have been worked through and credit cards are stepping in to help fuel current consumption. This is a view that was aired by RBC. When similarly contemplating the plight of the consumer, RBC note that low-income US consumers are at risk right now, having overspent and having used up the vast majority of the fiscal stimulus that was provided to them during the pandemic. Goods spending is significantly above a pre-Covid baseline and the bottom half of the wealth spectrum are spending a greater amount on the basics (i.e. gasoline, food and rent) given inflation.

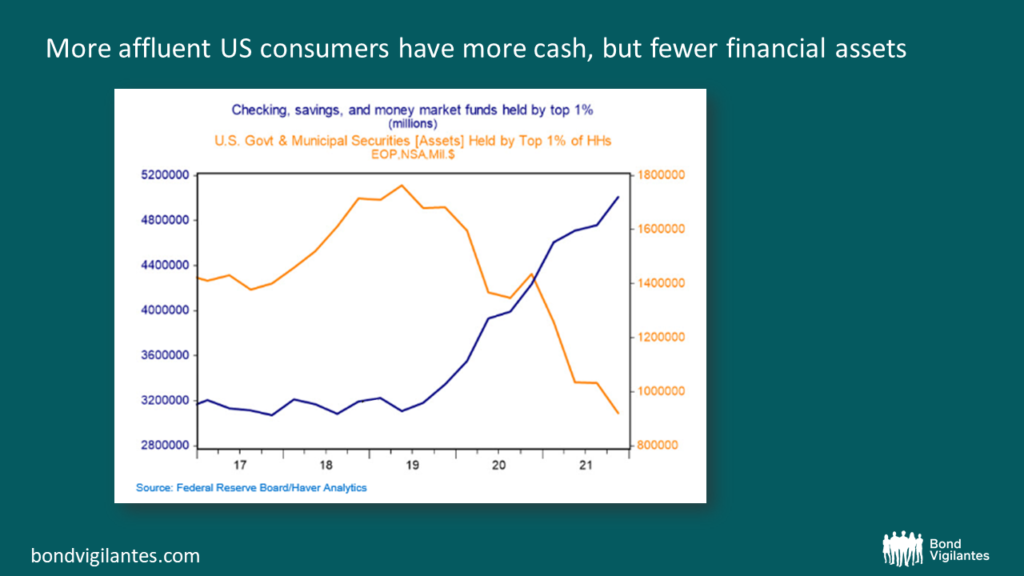

At the other end of the spectrum, there is similar concern about the more affluent consumers as, although it appears that they are sitting on a large amount of cash, it is not expected that this cash will find its way into consumption. Equity markets are down, so there has been a negative wealth effect for the upper income cohorts and Quantitative Tightening may not help this.

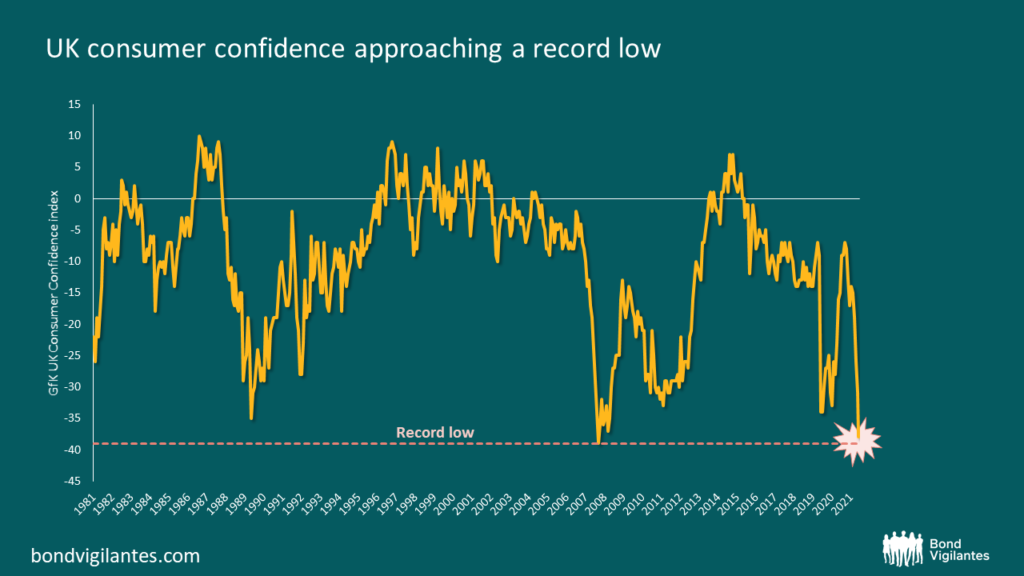

Having these charts pop up on my radar, I’ve realised that it’s not just a US story. Consumer confidence in the UK has also fallen markedly in recent months.

Although balance sheets can still be characterised as healthy,inflation can and present a challenge to this, ultimately leading to demand destruction. Although the current quarter is likely to be robust as consumer spending on services kicks in, the second half of the year may be one to watch, serving as a stark reminder that the strength of the US consumer should not be taken for granted.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.