Ramp-Up of Policy Support in China

In the last few days, Chinese authorities have announced a slew of measures aimed at stabilising capital markets and supporting growth in the country. The key policy measures, targeting different segments of the economy, are outlined below:

Stock Market

On the 23rd of January, Bloomberg reported that the Chinese government is considering setting up a RMB 2 trillion ($80 billion) stabilization fund to support the equity market. The report suggested that policymakers could utilise funds in offshore accounts of Chinese state-owned enterprises (SOEs) to purchase A-shares through the Hong Kong Stock Connect links. The regulator may also raise RMB 300 billion onshore to invest in A-shares through the China Securities Finance Corporation and Central Huijin Investment Ltd. Other news reports pointed to some large institutional investors in the country (such as mutual funds and state-owned insurance firms) being guided by the authorities not to engage in net selling activities in the stock market.

Monetary Policy

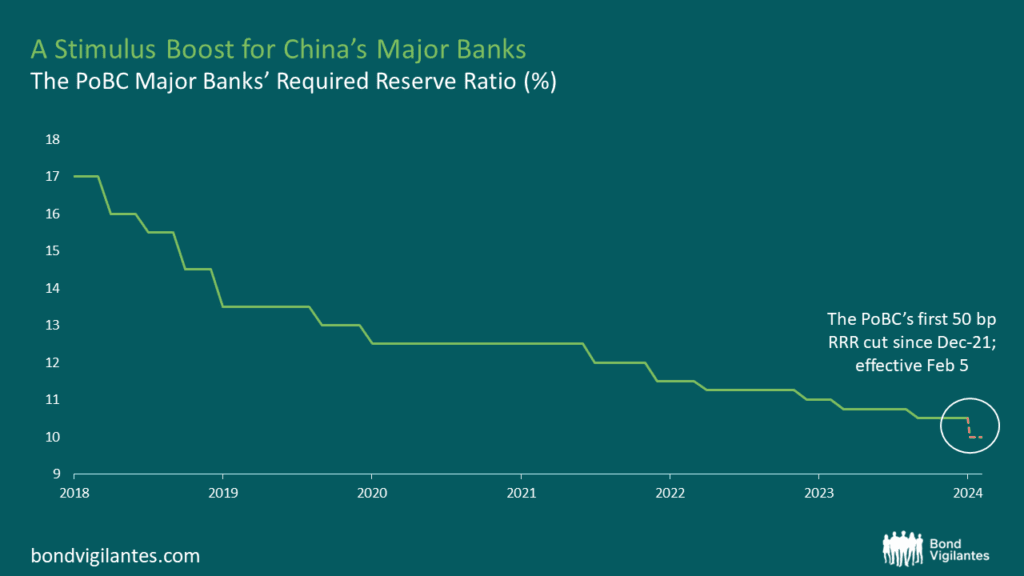

On the 24th of January, the People’s Bank of China (PBoC) lowered banks’ reserve requirement ratio (RRR) by 50bps, larger than the market expectation of 25 bps. The re-lending and re-discounting rates applied to loans for the rural sector and small firms were also trimmed by 25 bps. Marked as the first 50bps RRR cut since December 2021, the cut is expected to unleash c. RMB 1 trillion of additional liquidity into banking system. With the additional liquidity, funding costs for banks will be lowered, supporting expectations of further cuts in the banks’ benchmark lending rates in the coming two months. The PBoC Governor has also indicated that the central bank will have more room for further policy adjustments with the recent narrowing of the US-China yield differentials.

Source: Bloomberg, M&G , as at 29.01.2024

Property Sector

Also on the 24th, the PBoC and the National Administration of Financial Regulation (NAFR) jointly issued a notice to broaden the usage of bank loans backed by commercial properties (excluding residential projects and rental housing) for developers. These loan proceeds can now be used to repay other loans and bonds, with an effective period until the end of 2024. The Loan-to-Value limit has also been raised to 70% from 50%. Separately, there have been media reports that more cities are exploring the use of Pledged Supplementary Lending (PSLs) as funding support to purchase commercial homes from private developers and convert them into affordable housing. The PBoC reintroduced the PSLs, totalling RMB 350 billion, at policy banks in December 2023.

Market Implication and Views

Since the policy announcements, the Chinese stock market has picked up, showing that the policy measures have, in some way, helped to boost market sentiment. These measures are also positive signals that support our expectation that China’s policy stance will remain accommodative this year, even if a “bazooka-style” stimulus is not in the works. That said, with market participants having tired of piece-meal policy measures and an economy still saddled by weak business confidence and continued downturn in the property sector, further follow-throughs in policy support (such as a stronger fiscal stimulus plan), are needed to restore market confidence and stabilise growth beyond the near-term boost.

Specifically on the announced property measures, the reaction in the China property credit market has been mixed. We view the expanded usage of commercial property-backed loans to be only moderately positive to Chinese property developers. This is because only developers with substantial holdings of investment properties stand to benefit from the policy change. Also, for many distressed and surviving developers, a large part of their commercial properties (also “crown jewels”) have already been pledged out to banks to secure loans. Lastly, we think that more time is needed for this policy to take effect as implementation and effective transmission of credit has been historically slow and difficult for these Chinese banks. Nevertheless, we see this, as well as the implementation of the PSLs, to be steps in the right direction and the bias for the regulators, we think, is a continuation of supportive policies to stabilise the property sector.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.