European Green Bonds – Initial Pricing Insights

The regulation on the voluntary EU Green Bond Standard has been in effect since the 21 of December 2024, opening the door to the first EU Green Bonds (EuGBs) to be issued at the beginning of 2025. European Green Bonds are often referred to as the “gold standard” in environmental project financing frameworks. This label ensures that 100% of the net proceeds from EuGBs are invested in economic activities aligned with the EU taxonomy for sustainable activities. Furthermore, it addresses greater standardisation and transparency for both pre- and post-issuance reporting. Issuers of European Green Bonds are required to produce pre-issuance factsheets, post-issuance allocation reports and impact reports. Both pre-issuance factsheets and post-issuance allocation reports must be verified by an approved external reviewer, providing additional quality assurance.

Corporate reporting on EU taxonomy-aligned activities remains patchy, with many existing green bonds aligned with established market standards such as the International Capital Market Association (commonly known as ‘ICMA’) providing limited information on EU taxonomy alignment. While several green bond frameworks remain silent on EU taxonomy alignment, some have stated their intention to align their green bond programmes with the EU Green Bond Standard, or report that the issuer believes they are already in compliance with the most recent documents at the time of the framework. Even with some well-intended intention statements, bond investors have no guarantee that the green projects financed are in compliance with the EU taxonomy standards. Consequently, EuGBs provide a solution in this regard, given such bonds provide assurance that the activities financed through the green bond instrument are fully aligned with the EU taxonomy, which may result in higher demand compared to existing Green Bonds that do not carry the EuGB label.

We are now a few months into 2025, and I was curious to see if there were any notable pricing dynamics for European Green Bonds. Thus far, we have seen five EuGB deals priced. The distinction of being the first-ever EuGB issued goes to Italian utility A2A SpA, which introduced the first EuGB deal at the end of January. Shortly thereafter, French transport authority Île-de-France Mobilités followed with a €1 billion deal. Towards the end of February, ABN AMRO became the first bank to issue a green bond compliant with the EuGB standard. In April, the European Investment Bank followed suit with another EuGB bond deal as the second SSA entity to do so, an event anticipated by the market given their involvement with the label. Finally in May, Spanish utility Iberdrola issued the fifth with a €750 million deal.

Source: Bloomberg

All deals thus far have featured healthy order books and were priced with no new issue concession (the extra yield or discount issuers typically offer to investors when they are releasing a new bond for sale). Some deals even priced through the secondary curve (i.e. sold at a better price than existing similar bonds in the market), hinting that some bond investors were indeed hunting for EU-labelled green bonds. For example, the inaugural European Green Bond from Île-de-France Mobilités received orders worth €5.9 billion for its €1 billion EuGB deal, with final pricing inside the issuer’s secondary curve. When assessing a price premium linked to the EuGB label, it is essential, however, to consider the wider market context, as focusing solely on individual deal dynamics can be misleading. The aforementioned deal was priced in a context where French SSA supply had been well-supported with high spreads relative to peers and good momentum for French government bonds at the time of issuance.

Similarly, the A2A EuGB issued at the end of January received an order book of €2.2 billion (bid-to-cover of 4.4x) and was priced 5 basis points inside fair value. Initially, this might indicate stronger demand for EuGBs. However, investment-grade euro utility bonds have been placed with an average 4.7x bid-to-cover ratio and priced, on average, 4 basis points inside fair value, suggesting that demand for the A2A bond cannot be wholly attributed to the EuGB label.

In general, primary market activity in the first quarter of 2025 met steady demand for new paper given healthy and continuing inflows into the investment-grade asset class. Furthermore, all EuGB deals were of higher credit quality or were companies with predictable cash flows, which was also favoured at the time, as many bond buyers were positioning their portfolios to favour higher credit quality. In an environment characterised by tight credit spreads, the reduced opportunity cost for owning safer credits over riskier bonds resulted in these EuGB deals being well-received by the market. Therefore, the absence of a new issue premium might not be entirely due to specific demand for EuGBs; rather, they benefited from a market environment favourable to the issuing companies. Hence, it is still too early to quantify the impact of the new European Green Bond label on pricing.

What about trading patterns of EuGBs? In early April, we experienced a major market event caused by the U.S. tariff announcement, which led to a repricing of risk given the implications of tariffs on global trade and economic growth. I was curious to see how EuGBs performed during the latest market weakness. As I noted in a previous blog, I believe that the greenium is driven by: (a) a scarcity element, i.e., issuers with a well-established green bond curve tend to see their greenium reduced compared to issuers with only one green bond; and (b) a stickier investor base in green bonds, which tends to increase the greenium in times of general spread widening, although during spread compression, the greenium tends to decrease. Following this logic, I would have expected EuGBs to outperform comparable bonds without a EuGB label during market sell-offs. EuGBs are rare securities for which sustainably-minded bond investors can assign a higher value and express a preference over other comparable bonds.

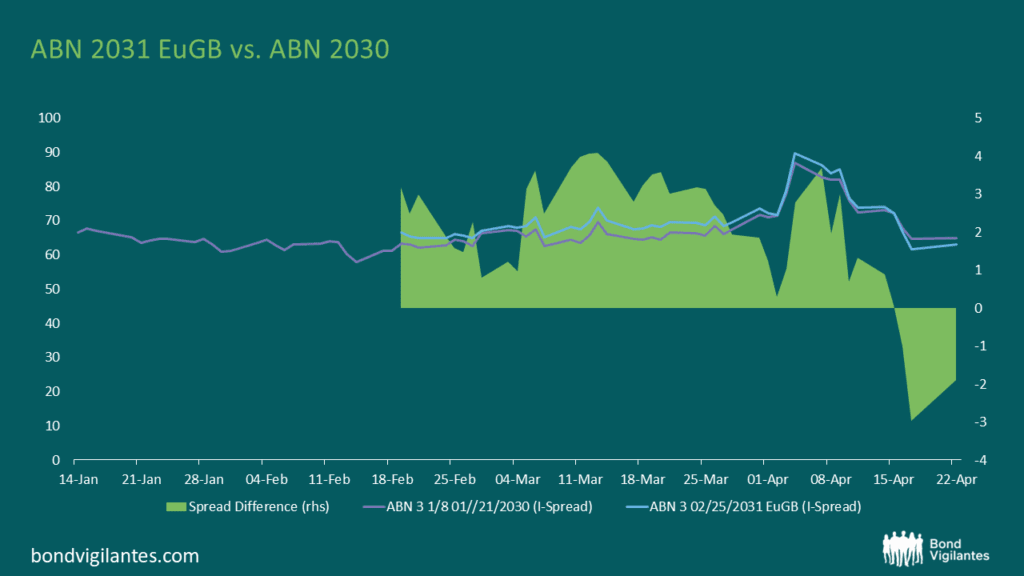

To assess this, I aim to find the closest alternative bond to the EuGB and compare trading patterns. In the example of Dutch bank ABN AMRO, I use the ABN 2030s, which are bonds issued for General Corporate Purposes (GCP) but otherwise share similar bond characteristics to EuGBs, such as currency, payment rank, duration, and amount outstanding.

The chart shows that the EuGB from ABN has shifted from a spread discount to a spread premium against the non-green ABN 30s, a pattern one might expect in an environment of higher volatility. However, I am cautious about interpreting this too definitively. After all, we are examining a bond pair that is of very high credit quality due to its senior preferred ranking in the capital structure, in addition to the solid credit profile of the underlying issuer. Differences in spread remain marginal, and we would expect dislocations to become more material if we examine bond pairs of lower credit quality that are exposed to larger spread ranges.

Source: Bloomberg

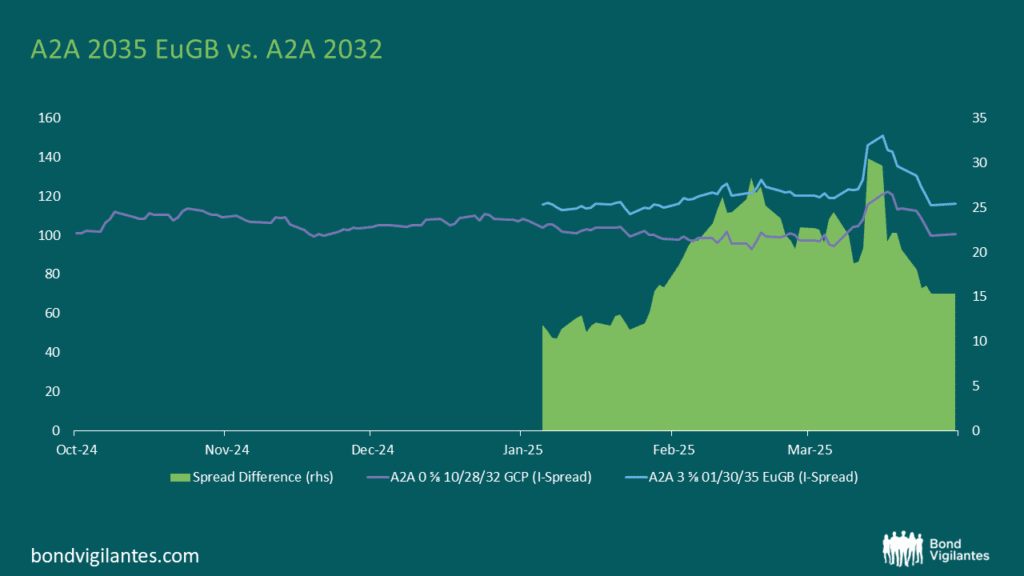

Let us therefore consider the lowest-quality issuer of EuGBs, the Italian multi-utilities company A2A, which carries a BBB credit rating by major agencies. The A2A Group is well-insulated from direct tariff threats but would be exposed to a worsening macroeconomic environment that could affect its unregulated activities. A2A is a frequent green bond issuer, with a majority of the bond curve issued as green bonds. The closest GCP comparator to the A2A EuGB are the A2A 0 5/8 10/28/2032 bonds. While bond characteristics are similar, it is noteworthy that the 2032s are a somewhat lower beta instrument due to their one year shorter duration. Additionally, it is a bond that was issued back in 2020, so liquidity is assumed to be somewhat poorer compared to the recently issued EuGB 2035s.

Source: Bloomberg

Since issuance in January, the A2A EuGB continues to trade wide against the GCP 32s. Something I found noteworthy was that the EuGBs sold off more than the GCP bonds, which can partly be attributed to the 2035s being a slightly higher beta security compared to the 2032s and, therefore, might be relatively less preferred when uncertainty is on the rise and the economic outlook worsens, causing credit curves to steepen. Another explanation might indeed be the higher trading volumes in the 35s due to their newer vintage. What can be said is that the EuGB status of the 2035s did not add any protection element during the sell-off against the comparable 2032s.

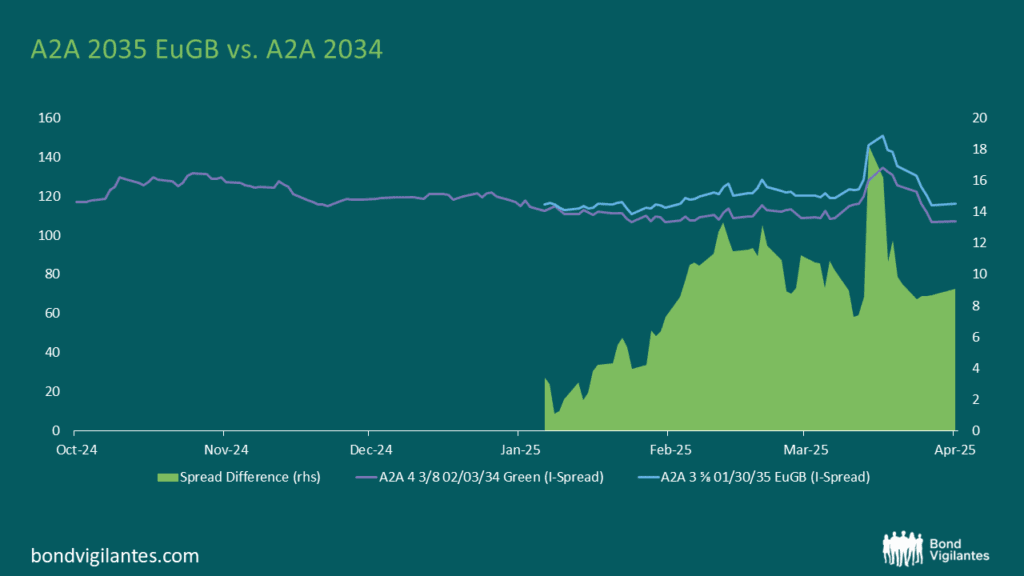

Next, we examine the A2A 2034 Green Bonds issued in 2023 based on the company’s February 2022 Sustainable Finance Framework. A similar picture emerges, whereby the recently issued EuGB underperformed the A2A 2034 green but not EU-labelled bonds, indicating that the “Green Gold standard” did not make a meaningful pricing difference in this case despite the EuGB fixing certain framework weaknesses that persist in the older 2022 framework. In A2A’s February 2022 Sustainable Finance Framework, “bioenergy plants” are referenced as a possible project within the “Renewable Energy” category, without any supporting technical criteria. Strictly speaking, under the EU Taxonomy, this could not be deemed as “Aligned”, and under the Paris-Aligned Benchmark (PAB) Exclusions framework, a lack of disclosure regarding the critical 100g CO2e/kWh metric, a threshold which bioenergy plants can exceed, puts the bond at risk of being misaligned.

Source: Bloomberg

Interestingly, as part of the EuGB pre-issuance documentation, A2A has dropped all mention of “bioenergy plants”, instead opting for a different subset of Taxonomy Aligned generation activities. In this case, the PAB exclusion criteria applying to Sustainable funds is no longer at risk of violation, and full Taxonomy Alignment is a given. For now though, at least according to pricing, it doesn’t seem bond investors have noticed the quality difference.

Time will tell what, if any, premium bond investors are willing to assign to top-quality green project financing bonds. The answer to that will determine whether issuers feel sufficiently compensated for the additional cost and risk of fines for non-compliance that come hand in hand with the European Green Bond quality standard. For now, in my experience, fixed income markets remain inefficient in assessing the quality of green bond frameworks, which provides a value opportunity for active fund managers who can capitalise on the mispricing of green project financing bonds.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.