The big story for 2010: sovereign debt worries?

Happy New Year.

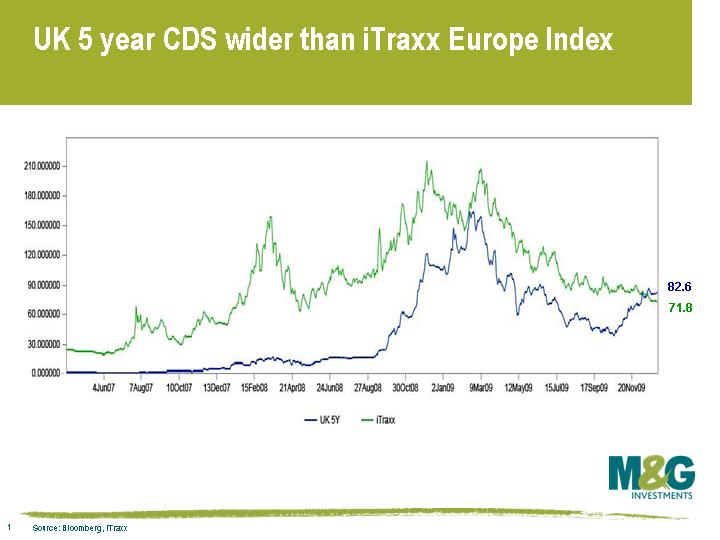

Over the past couple of weeks, the cost of buying protection to insure against a default by the UK government has risen to exceed the cost of insuring a basket of European investment grade companies. The chart below shows that 5 year Credit Default Swaps (CDS) for the UK sovereign are currently at 83bps per year, compared with 72 bps for the investment grade companies, which are all lower rated than Her Majesty’s government and unlike the UK, the last time I looked weren’t allowed to print bank notes to repay their debt. So it doesn’t look right. But noises about a downgrade of the UK continue, and the plans from both the government and the opposition to reduce the debt remain unconvincing.

Elsewhere we’ve had sovereign debt scares in Dubai and in Greece, and yesterday in Iceland the President exceptionally overruled the legislature and stopped a payment to the UK and the Netherlands of £3.4 billion to cover money lost by savers in the Icelandic banks. Fitch downgraded Iceland to BB+ yesterday, although the bigger agencies still have the country in investment grade, but only just. Iceland CDS now trades at 470 bps. The decision by the Icelandic people isn’t surprising, as the payment amounts to around £10,000 per person – a massive burden. I can’t imagine that UK voters would agree to make such a payment to a foreign government should the table be turned, and the Icelandic economy is in a worse state than ours. This article in today’s Irish Independent by David McWilliams is therefore a little worrying, as it probably does reflect the popular view that default is a better option that a strong credit rating or than having to wear a hair-shirt for a decade. Ireland has entered into significant austerity measures (including large pay cuts for civil servants) in order to restore the nation’s finances. McWilliams concludes “Iceland proves there is an alternative – are any (Irish) politicians, from the President down, prepared to listen?”. 2010 could be a year of angry populations and wobbly governments.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox