Swine Flu II

Exactly one year ago, an outbreak of flu in Mexico led to fears of a global pandemic. ‘Swine Flu’ did indeed spread around the world, however for most countries it had only a limited effect on economic output.

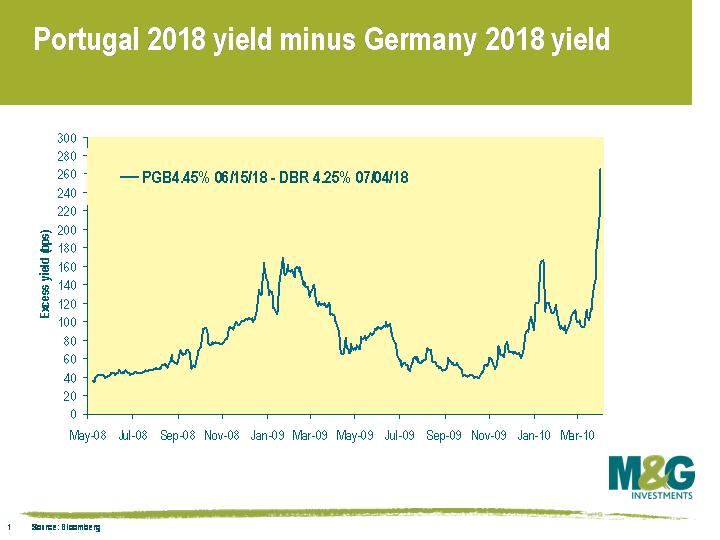

We are now facing something that is likely to prove much more serious. This time the epidemic can be traced to Greece, and contagion is rapidly spreading among the PIGS. At the beginning of April, Portuguese 10 year sovereign debt had an excess yield over German 10 year bunds of about 100 bps. Portugal began showing some worrying symptoms last week, but today things have got a whole lot worse. The attached chart shows the historical yield differential between a German and Portuguese sovereign bond maturing in 2018. The Portuguese bond was issued yielding 40 bps over the benchmark German bund, and today spreads over Germany have lurched to a sickening 260 basis points.

Who’s likely to get infected next? The other PIGS look particularly vulnerable, and Ireland, Italy and Spain are all spluttering today to varying degrees. Ireland has been worst hit, with its 10 year sovereign debt widening 20 bps+ versus Germany, equivalent to about a 2% drop in the bonds’ price. Italian 10y bonds are about 7bps wider, not helped by a weak auction earlier today, while Spanish 10 year debt is off about 5 bps.

But just as with the original swine flu, people may find that this disease can spread beyond the PIGS. Investors have (basically until today) seemed to consider EM sovereign debt to be immune, but Turkey 10y Euro denominated debt has sold off 7bps versus Germany (so it looks like birds can get it too). Meanwhile equity investors have seemed to be on another planet entirely, which may explain why the S&P 500 succeeded in closing at a 18 month high on Monday this week.

We’ve spent a lot of time debating what happens to credit markets if sovereigns continue to deteriorate. This is something we’ve been pondering for a while – see Stefan’s thoughts here from February last year – but sovereign indebtedness has gone from being a small risk to something that’s one of the very biggest risks, as the IMF recently highlighted. Can we have negative credit spreads, i.e. does a company like Telefonica potentially trade through Spain, or can GSK borrow at cheaper levels than the UK government?

We think this is certainly possible in stronger credits – in fact Johnson & Johnson short dated bonds already yield less than US Treasuries. But if the weaker sovereigns get into trouble, to what extent will, say, a high yield German cable company get affected if it only operates domestically…?

(Addendum: S&P has just downgraded Portugal two notches from A+ to A-, and Greece’s long term sovereign credit rating has been downgraded three notches from BBB+ to BB+. It’s all kicking off….)

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox