Is US exceptionalism fading away?

In the wake of Donald Trump’s election victory last year, economists have adopted an increasingly bullish outlook on the US economy, especially in contrast to other global economies. This surge in optimism has led investors to set extraordinarily high expectations for the US market, creating a scenario with limited room for positive surprises but ample potential for disappointment.

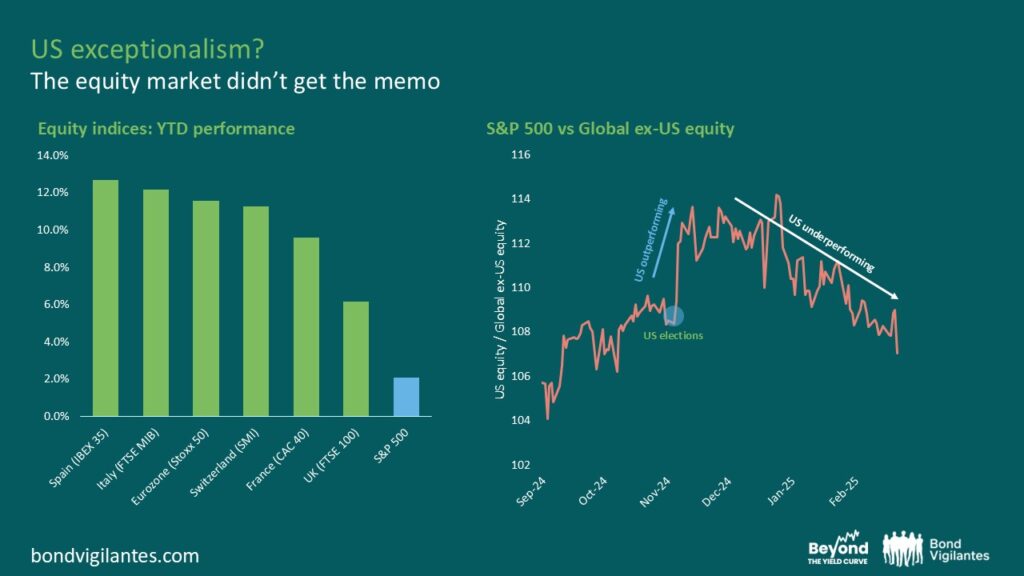

This disappointment is now beginning to take centre stage. While the US economy continues to perform well, it is not surpassing the lofty expectations set by investors. Consequently, the US equity market is underperforming relative to most peers year-to-date, and the outperformance it had generated since Trump’s election has now been entirely erased. See chart below.

Source: Bloomberg, 24 February 2025. Tickers: LHS chart: IBEX Index, FTSEMIB Index, SX5E Index, SMI Index, CAC Index, SPX Index. RHS chart: SPXT Index, HU124709 Index

What about the bond market?

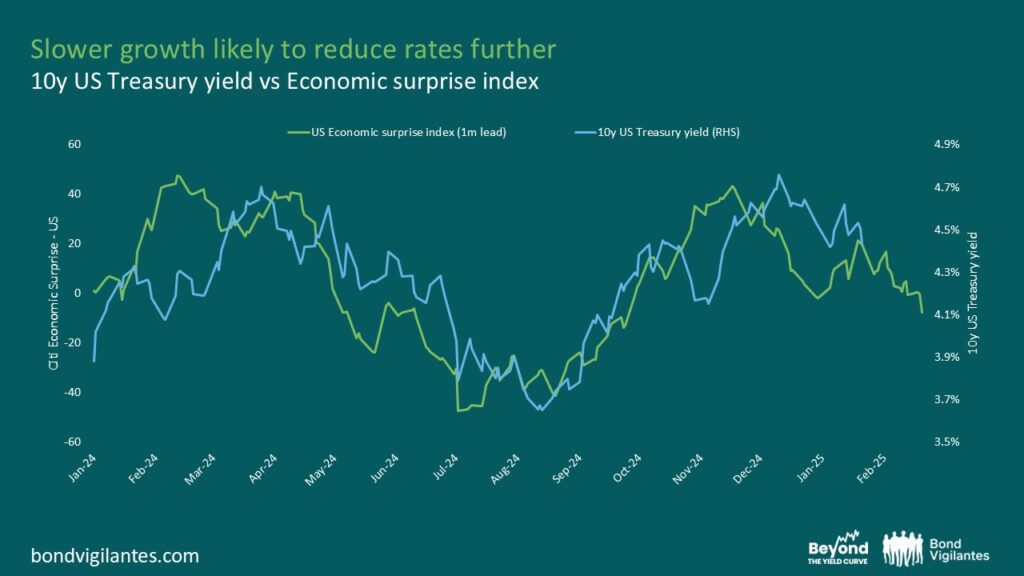

At the beginning of the year, bond investors also held high expectations for the US economy, which translated into expectations of “higher for longer” interest rates. However, as these strong expectations have gradually diminished, interest rates have declined, thereby supporting bond performance. The chart below illustrates the US Economic Surprise index (blue line) versus the 10-year US Treasury yield (orange line), with a one-month lag.

Unless the macroeconomic environment undergoes a sudden shift, it appears we are on track to return to a 4% yield on US Treasuries, and potentially even lower if momentum remains weak or deteriorates further.

Source: Bloomberg, Citi, 24 February 2025. Tickers: CESIUSD Index, USGG10YR Index

The key point is that US exceptionalism does not necessarily guarantee strong performance for US equities and weak returns for bonds. In financial markets, the critical factor is the reality versus expectations. The higher the expectations, the lower the odds of success, and vice versa. Today, given the initial widespread optimism about economic growth, the odds of success appear to favour bonds over equities, particularly those in the US.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.