'Covenant-lite' diet causes no extra spread for hungry leveraged loan investors

In my catch up reading from holiday (Argentina – stunning and very very cheap!), I noticed that World Directories, a European telephone directory company, has re-financed its euro-denominated leverage loan to be ‘covenant-lite’. Covenants are very important for us as bond investors. This is because they impose restrictions on a company’s management by preventing management from undertaking activity that would not be considered bond-friendly. If a company violates covenants, bondholders have the power to restructure the company, impose additional covenants or even initiate bankruptcy proceedings. The trend towards covenant-lite issues in the leveraged loan market (where loans are being issued with weaker covenants akin to those seen in the high yield corporate bond market) is therefore grounds for concern for leveraged loan investors.

Leveraged loans have traditionally had strict covenants called ‘maintenance covenants’. These are covenants that issuers must comply with on a regular basis. These covenants vary from issue to issue, but may include limiting capital expenditure to a certain level, or preventing the issuer from breaching certain financial ratios.

‘Covenant-lite’ issues drop the maintenance covenants in favour of ‘incurrence covenants’. These covenants only refer to pre-determined events, such as the firm taking on additional debt or engaging in takeover activity. Incurrence covenants are more typical in the high yield corporate bond market – so when Apax (a private equity company) bought Travelex via leveraged buyout in 2005, Apax had to buy Travelex high yield bonds back above par value.

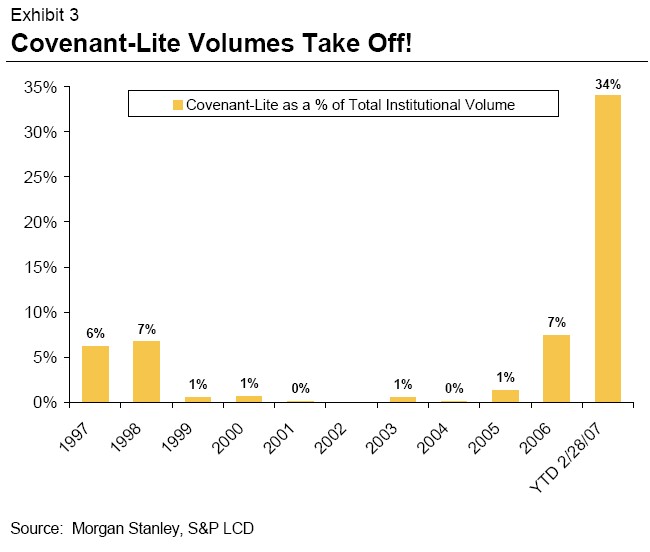

As the chart to the left illustrates (click to view full chart), covenant-lite issuance is a growing trend in the US leveraged loan market – there was more covenant-lite issuance in the first two months of this year than in the previous ten years put together.

As the chart to the left illustrates (click to view full chart), covenant-lite issuance is a growing trend in the US leveraged loan market – there was more covenant-lite issuance in the first two months of this year than in the previous ten years put together.

I expect the rise in covenant-lite issuance to result in marginally lower default rates, since there will be fewer covenants to break and bond holders will not be able to force bankruptcy so easily. However, I would also anticipate lower recovery rates, because once companies do go bankrupt, there will be less left for bondholders. Covenant-lite issuance is a good example of how leveraged loan issuers are taking advantage of the huge demand for the asset class. This is because they are now able to issue loans with weaker covenants, but with very little additional spread.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox