New issuance hits record levels

We commented in November that growing levels of new issuance suggested that there were cracks in the ice in credit markets. This trend has rapidly accelerated. In the first quarter of this year, there was over €115bn of new issuance from corporates, almost twice as big as the previous record from 2001 and only slightly less than the €133bn figure for the whole of 2008.

Why has there been so much issuance? Part of the reason is that there was a backlog of refinancing that needed to be done in September and October 2008. But a bigger reason for the surge in issuance is that banks are not able or willing to lend, and if corporates are not able to raise finance (or refinance) with banks then they have to seek alternatives. And the only alternatives are issuing bonds to (ie borrowing from) people like us, or by tapping the equity markets via rights issues.

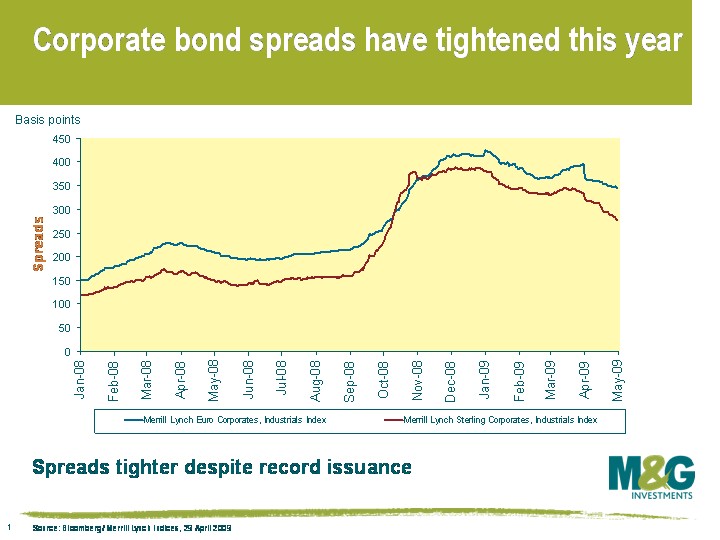

Just as an increase in government bond issuance doesn’t necessarily mean falling government bond prices (see previous blog here), surging corporate bond issuance doesn’t mean falling corporate bond prices. Taking Merrill Lynch indices, euro denominated investment grade industrials returned +4.1 in Q1%, 3.4% ahead of German government bond returns. Sterling industrials returned +4.2% in Q1,which was 5% higher than the return from gilts.

This chart shows how spreads in industrials (i.e. anything that’s not a financial or utility) have tightened over the past three months – euro industrials spreads are at least 100bps tighter than the wides hit in mid December, while sterling spreads are about 70bps tighter. (Note that at the end of May 2007, Euro industrial spreads were just 50bps over government bonds, and sterling 80bps). Spreads remain very attractive in a historical context, and spreads on new issues also continue to be attractive versus spreads in the secondary market.

We expect this flood of supply to continue through this year as companies refinance and banks continue to curb lending. However, we do expect it to fall back later this year and next year. Debt buybacks are already happening, where some companies have been patching up their balance sheets by issuing equity to buy back debt, and we expect this to increase. Many companies simply don’t have efficient capital structures for today’s markets, now that the cost of borrowing is so much higher than it was. Debt buybacks are good news for bond holders, but not necessarily good for equity holders. As companies buy back debt and new issuance falls, credit spreads should tighten fairly rapidly.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox