Credit markets – cracks in the ice?

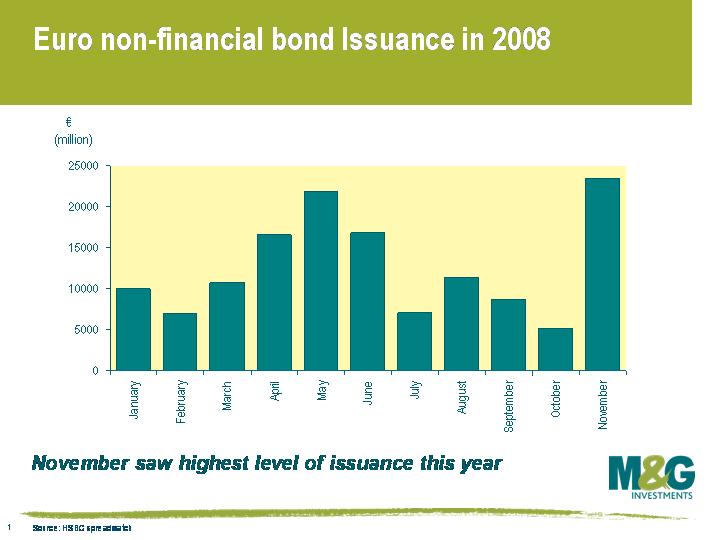

For all the talk of frozen credit markets, the figures showing new issuance may come as a bit of a surprise to some. November has been the most successful month for new non-financial deals this year (see graph on left). Companies have managed to issue new debt in spite of extreme risk aversion, risk aversion that can be seen in the huge sell off in equities and credit spreads hitting all time wides.

For all the talk of frozen credit markets, the figures showing new issuance may come as a bit of a surprise to some. November has been the most successful month for new non-financial deals this year (see graph on left). Companies have managed to issue new debt in spite of extreme risk aversion, risk aversion that can be seen in the huge sell off in equities and credit spreads hitting all time wides.

One of the main factors behind November’s issuance levels was desperation, and we’ve seen that companies must offer a considerable discount to attract new capital. BMW for example, which is A rated, printed a €750m 5yr deal and had to offer investors a yield that was 6% in excess of 5 year government bonds. (Incidentally we thought this offered good value and bought some for a few of our funds).

What’s been interesting to see is that levels of demand for the new issuance have been very strong, and the prices of the new deals have tended to trend higher in the secondary market – of the 23 substantial issues that were €500m or larger, 21 are trading at tighter spreads. And whilst the majority of paper has come from well regarded, less cyclical sectors such as utilities and telecoms, some less favoured sectors (as the example of BMW showed) have also been able to issue. What was very much a sellers market only 18 months ago is now a very different place – and we’re saying that on a day that the iTraxx Crossover index hit a record high of over 1000 bps, implying default rates of over 50% over the next 5 years in riskier credits.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox