Does deflation always result in a low and flat yield curve?

We’ve had a huge rally in risky assets since we wrote a comment about Turning Japanese almost a year ago, and while diminished, the risk of a ‘lost decade’ is still very real. I thought it would be worth another look. Now I am not out to compare and contrast the prevailing conditions that led to deflation and QE between Japan and the UK, but what I want to do is ask whether deflation, which led to QE in both countries, necessarily means stubbornly low and flat government bond yield curves, as it did in Japan?

As a brief reminder, the Japanese experience began with the property and equity bubble bursting in 1989, followed by weak growth and deflation through most of the 1990s. As people know, the Japanese response was much slower that what we’ve seen.

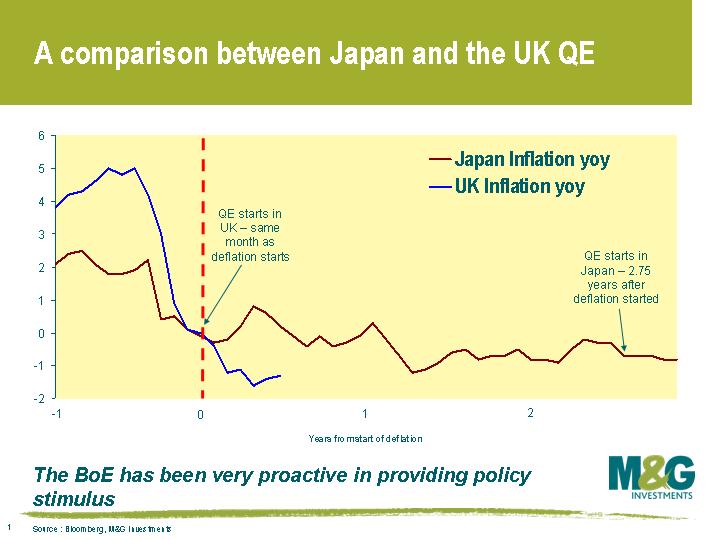

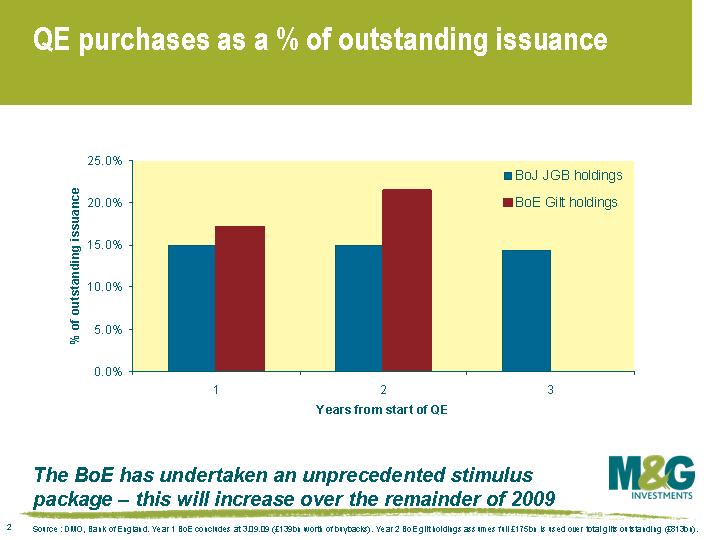

The Bank of Japan (BoJ) hiked rates to 6% half a year before the economy entered recession in March 1991, and cut incrementally towards zero over the next 4 years, well into the country’s contraction. The BoJ waited almost 3 years after entering deflation before beginning QE. And, as a comparison, the Bank of England has bought back a bigger percentage of the gilt market in only six months than the BoJ did at any stage, and has approval to do even more.

As we have discussed in previous blogs, deflation is a dire scenario for central bankers and policymakers, destroying the efficacy of monetary policy. But when the deflationary psychology sets in to an economy and its agents, it could also have horrific consequences for the economy through consumer spending (which represents about 70% of our economy’s output), as people cease spending. Why would we buy a new fridge, say, today, if we know that in 1 year’s time it will be cheaper? It is really with these fears in mind that authorities in the US and UK in particular have reacted so quickly and substantially, and why we are repeatedly told they would “rather do too much, than too little”.

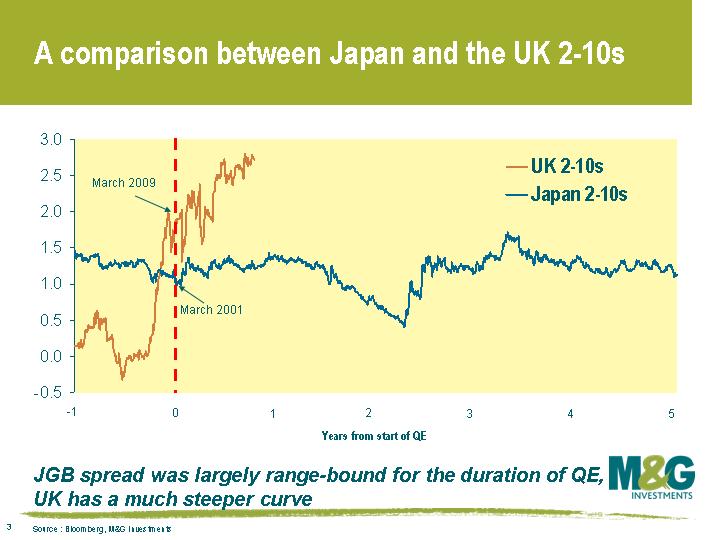

Looking at the difference between 10 and 2 year government bond yields in the UK and Japan when QE started, we can clearly see that the UK curve is substantially steeper than Japan’s yield curve. This suggests that the markets are as yet not expecting the curve to flatten a la Japan. Why might this be? Well, firstly, it may be because unlike Japan, the Bank of England has been quick to react to deflation and has been aggressive in its response. So the markets have perhaps interpreted the level of stimulus as being sufficient to stave off anything like a lost decade of growth due to a fall in aggregate demand leading to a deflationary spiral. In other words, QE may have done enough to reignite inflation.

However, I think a significant reason is to do with the constitution of the two markets, namely the proportion of government borrowings owned by foreign investors. In Japan at the time of QE, approximately 3.4% of JGBs were held by foreigners. This is a sharp contrast to the government bond markets the US and UK. Today, 36% of outstanding gilts are owned by foreigners. This is a huge difference, and it adds to my hunch that deflation, even if it were to persist in the UK, would not necessitate very low and flat yield curves. With only 3.4% of JGBs owned by overseas investors, Japan could proceed with an inflationary stimulus programme and not worry about an exodus of foreign demand for their bonds, or about an influential foreign buyer network demanding higher JGB yields for the (perceived rising) risks.

Japan could print money, thereby putting negative pressure on the Yen without overdue concern about not being able to borrow the requisite funds. Contrastingly, the US and UK are constrained in regards to inflating out of a large debt burden and devaluing the currency, since foreign owners fleeing government bonds would put huge upwards pressure on government bond yields. This is a big issue for the US at the moment, with China owning over $800bn of US Treasuries (see here for full list).

Painful adjustments undoubtedly lie ahead as government expenditure is cut, as taxes rise, and as the nation’s balance sheet is rationalised and delevered. And if this is done sufficiently and appropriately, there is no reason foreign holders will flee the currency or the government bond markets. And we actually take our hats off to the authorities for recognising the dangers of a deflationary spiral that could so easily come from the complete shut-down of the credit mechanism in an economy. Now for the second, and every bit as important part: withdrawing the stimulus at the right time so as to avoid hyperinflation and a collapsing currency.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox