European sovereign debt fears – limited impact on European corporate bond markets

Strong earnings results, low inflation expectations and a view that the ECB will have to keep interest rates lower for longer to support the economic recovery has seen demand for European corporate bonds remain fairly robust.

That is not to say that European corporate bond markets have been unaffected. Those credits that have been most impacted by the sovereign debt worries have unsurprisingly been domestic Greek and Portuguese corporations that have limited foreign earnings. It is clear to me that these corporations will continue to come under pressure from the market due to worries about lower earnings, higher taxes and continued speculation that some nations may leave the Euro. This is likely to be reflected in a higher spread for Greek and Portuguese corporate bonds over the equivalent risk-free government bond (which is currently German bunds). Some investors have sought the protection that is offered by credit default swaps (CDS) resulting in more pressure on cash bonds. CDS are seen as an early warning signal for bond markets, alerting investors to structural weaknesses before a crisis hits.

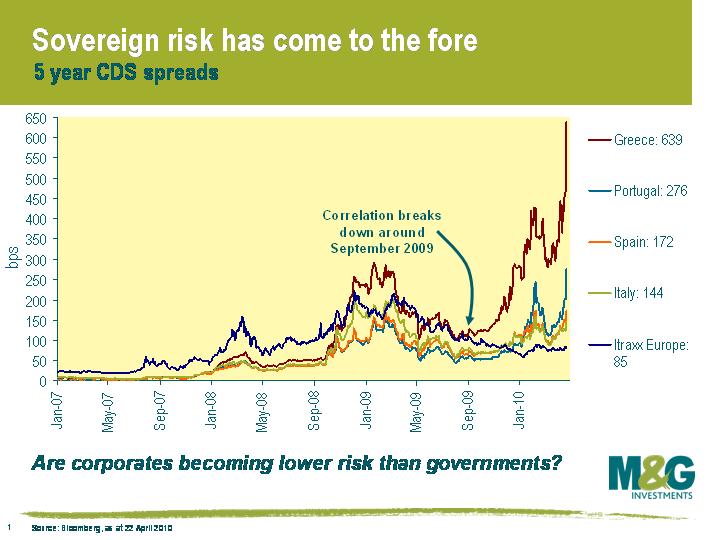

Interestingly, the once strong correlation between sovereign debt concerns and corporate bond markets appears to have now broken down. The iTraxx European index, a measure of creditworthiness of European investment grade credit, has tightened from September 2009. This is in contrast to countries that are located geographically on the periphery of Europe, where CDS spreads have had a tight correlation with Greek CDS. This phenomenon is highlighted in the attached chart. After the financial crisis of 2008 until September 2009, CDS spreads for investment grade credit and sovereign nations were highly correlated. Why is it that the risk of a sovereign crisis is not having the same impact on the European corporate bond market that it had from September 2008 to September 2009?

For me, there are a number of reasons. Firstly, unlike governments, companies have de-levered in the recession by cutting costs, unwinding or selling off assets, and have issued equity to retire debt. Secondly, unlike governments, companies have used favourable market conditions to extend their debt profiles. Thirdly, unlike governments, many companies are awash with cash. Fourthly, unlike governments, many high quality companies have not been affected by political uncertainties.

Given the above, I am not surprised that high-quality European corporate bonds have thus far remained insulated from the worries in sovereign markets. Corporations are operating from a strong starting position, with many having taken the necessary steps to improve their operating finances and balance sheets. Positively for the asset class, lending standards are improving and default rates may have peaked at levels that are much lower than the market expected. Corporate bond yields remain favourable, especially when compared to cash.

Peripheral European governments on the other hand are trying to stimulate weak economic growth, forcing them to borrow more and more. Rising government bond yields are making it difficult to borrow and causing debt servicing costs to increase markedly, as Greece has found out. Political tensions are rising, particularly in those countries where necessary austerity measures are required. Certainly, when economists from the Bank of International Settlements start writing things like “the aftermath of the financial crisis is poised to bring a simmering fiscal problem in industrial economies to boiling point” it is time to sit up and take notice.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox