Maybe the ‘new normal’ isn’t that new after all

The global investment community is having a collective head scratch about why sovereign bond yields are so low. As I argued here, if you take the rule of thumb that nominal government bond yields are roughly equal to expectations of the real growth rate plus the inflation rate (i.e. nominal growth), then developed sovereign bond yields of sub 3% are suggesting that we’re turning Japanese.

But maybe the conventional wisdom that bond markets are pricing in something never seen before outside Japan is wrong. Maybe, in actual fact, we’ve been gradually ‘turning Japanese’ for quite a while, but bond markets have been very slow to notice.

Rather than thinking about the 10 year government bond yield as representing expectations of the nominal growth rate, consider that the ten year Treasury yield should be broadly equal to expectations of the average fed funds rate over the next decade.

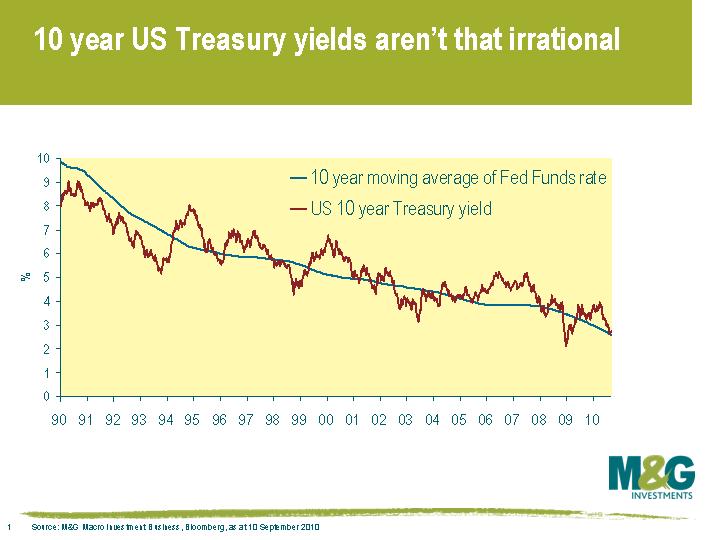

The macro hedge fund team here at M&G uses this concept to get a feel for what’s priced into government bond markets, and look at (among other things) the rolling 10 year average of the Fed funds rate against the current ten year US Treasury yield (see chart). So, when the 10 year Treasury yield is above the 10 year rolling average of the Fed funds rate, then markets are anticipating a higher interest rate environment over the next decade (and presumably therefore are pricing in a higher nominal growth rate over the next decade too). Conversely, if the 10 year Treasury yield is below the Fed funds rate seen over the past decade, then the market is pricing in a lower bank rate environment than that seen in the past decade.

There are two interesting conclusions from this chart. The first is that it seems that the market’s best collective guess of where the Fed funds rate is going to be over the next decade (i.e. the 10 year Treasury yield) is simply to look at where it’s been over the last decade and assume a repeat. The market tends to be slow to react to ‘regime change’, which in the past couple of decades was namely globalisation, and with it, greater competition, lower prices, and the reduced bargaining power of workers in developed countries.

The second interesting conclusion is that the 10 year Treasury yield today is almost exactly in line with the average Fed funds rate of the last decade. So it doesn’t appear that the bond market is pricing in a ‘new normal’ at all, it is simply pricing in a repeat of the experience of the past decade. Given that the 10 year Treasury yield is at 2.8% today, which is where the Fed funds rate has been for the last decade, you should be very bullish on the direction of US government bond prices if you believe that the US is about to enter a ‘new normal’.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox