The Hangover

It feels a little like the first half of 2008 again to me. People are asking who has it right? The bond market or the equity market? Government bond yields in the UK, US and Germany are the lowest they’ve been in recent history. Yields this low, the argument goes, imply that the bond market is expecting the dreaded double dip. The equity markets on the other hand – after a fairly positive earnings season – are trading back where they were in the mid 2000’s.

Posing this question as a simple disagreement between bond and equity investors is a touch disingenuous. Rather than being in opposition to one another maybe the two markets are actually singing the same song. One should bear in mind that – unlike Vegas – what happens in the credit markets doesn’t stay in the credit markets.

Rudimentary corporate finance theory will tell you that the optimal capital structure of a firm is one which contains an element of debt (due to the tax shield). In practice most firms do finance themselves with a combination of debt and equity. Therefore when valuing a company you should take into consideration the cost of both financing options.

There are many ways to value a firm but, if you use one of the variations on the present value of future dividend methods the cost of capital plays a huge role. Simply put, one discounts the future dividends by the cost of capital. The higher the cost of capital, the lower the value of the firm and vice versa. Here is a short worked example to show the impact of changes in the weighted average cost of capital (WACC). For simplicity I have assumed a growth rate of 0.5% and that firms in the FTSE raise their capital in equal proportions from equity and debt.

Basic Dividend Discount model;

V= D*1+g V: Equity value

WACC-g D: Dividend

g: Growth rate

We can then take the following data and plug it into the model:

| Mar-09 | Aug-10 | |

| BBB Yield (Cost of Debt) | 12% | 5.50% |

| FTSE 100 Forward looking Div Yield (Cost of Equity)* | 4.87% | 3.80% |

| FTSE 100 | 3926 | 5225 |

| Implied Dividend | 191 | 199 |

| Growth rate | 0.50% | 0.50% |

| Debt:Equity | 50:50 | 50:50 |

| WACC ([cost of debt+ cost of equity]/2) | 8.44% | 4.65% |

*Kindly provided by our friends at Evolution Securities

August 2010 – with current WACC

199*1.005 = 4,819

0.0465 – 0.005

August 2010 – with March 2009 WACC

199*1.005 = 2,519

0.0844 – 0.005

The values the model spits out are not that close to actual market levels but I think it demonstrates the sensitivity of these types of models to the cost of capital quite well.

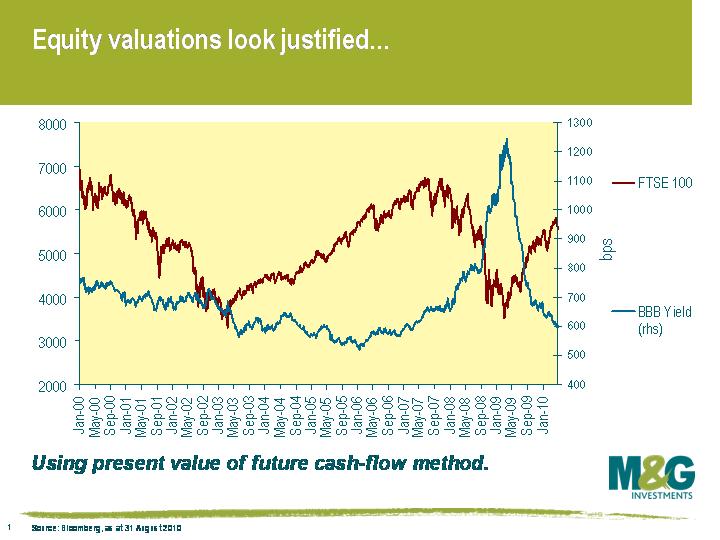

I must admit I have no sense of the number of investors who actually take this approach to valuing equities, its pure text book theory. So let’s look at what has happened in practice. Back in 2008 when yields rose dramatically equity valuations began to drop, as you can see below. Today with yields on BBB’s (including financials) and equity prices back to where they were in the early part of the last decade one could argue valuations look somewhat justified.

Clearly these are absolute yields, they have been driven lower not by increased credit quality, but by near zero base rates and low growth/inflation assumptions. This has the effect of driving down yields on the govvies over which the corporates are benchmarked. Spreads on BBB’s are still in the 200bp region if you exclude financials, which is where they have been for a year or so now. It seems to me that we can’t necessarily take extremely low gilt yields as a sign pointing to an immediate dip in the equity market, they may actually be the reason for its buoyancy. Spreads are the real barometer of the credit markets not yields. As these haven’t changed much over the last year it’s hard to say the bond and equity markets are in opposition. It’s when credit investors disagree with equity holders that the real fun starts.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox