How Secure is Secured? The new trend in HY issuance

Guest contributor Vladimir Jovkovic, Credit Analyst

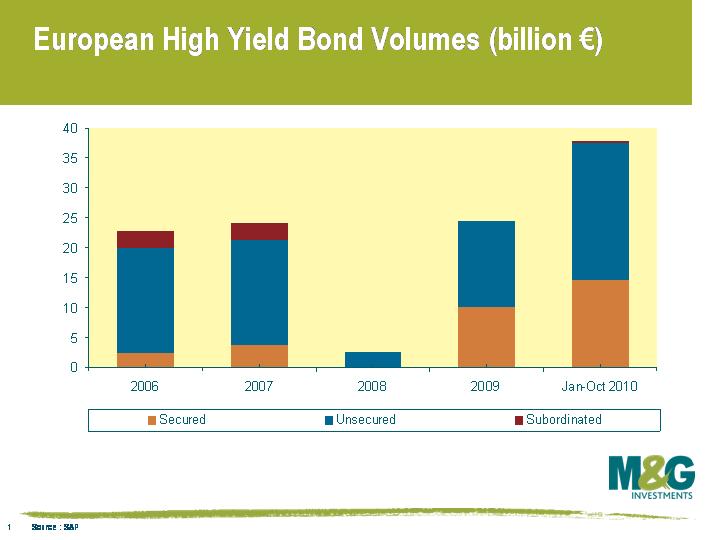

Issuance in the high yield bond market in Europe this year through October has already exceeded the total issuance for the full year in 2009. The novelty since the reopening of the market in 2009 has been the fact that high yield corporates have been looking to refinance senior secured bank loans into senior secured bonds, rather than the more common unsecured bonds. As such, the proportion of secured bonds issued by high yield companies after the financial crisis has been ~40% of total issuance compared with the more muted 10-15% level before the crisis (see chart).

Part of the reason in the shift has been the recycling of loans associated with LBOs into the bond market as the primary loan market effectively shut down. As banks repair their balance sheets and restrict their lending, the public bond market is stepping in to fill the gap.

The question then arises, how will the relationship between senior secured bondholders and senior secured lenders develop? Will lenders continue to have disproportionate control on enforcement of security? Will senior secured bonds create more stability in the high yield market? The answers to these questions will no doubt emerge with time, but meanwhile and more fundamentally, how secure are secured bonds?

For a start, the ‘Senior Secured’ label is not a panacea for bullet proof security. Often the ‘Secured’ label is in fact misleading once you delve into the documentation. Secured bonds often involve pledging security on physical assets (for example plant and machinery), typically with a limit on the proportion of assets and cash flow derived from the assets covered. This in itself will partially define the security of the bond. However, some secured bonds have a security which consists of equity in subsidiaries of the issuer – for example Polish Television Holding which issued bonds secured by share pledges on its stake in TVN, a broadcaster. This is clearly not as secure as security against physical assets; and, therefore, the question then becomes whether these soft security ‘secured’ bonds are justified to have lower coupons compared with unsecured issues.

Then there is the more contentious issue of relative security in structures that contain secured bonds as well as loans. In the case where senior secured bonds partly refinance existing senior secured loans, whether the new senior secured bonds rank pari passu (equally) with the existing secured loans will depend on whether they share the same position in the capital structure and the extent to which the security package shared is the same. It appears that in recent transactions when existing bank debt is partially refinanced with senior secured bonds the loan holders retain control, whilst when both bonds and loans are refinanced together bondholders have an opportunity to share control.

It is also important to consider the inter-creditor deed, which may determine the loss sharing arrangement between creditors and their effective relative ranking on enforcement. The inter-creditor deed has not always been made available to bondholders, which has made it difficult to ascertain bondholders’ precise rights in an enforcement scenario. For example, the inter-creditor could specify that senior secured bond holders are not part of the instructing group for enforcement proceedings, leaving them in a passive position with respect to controlling negotiations, were a default to happen.

With the rise in issuance of senior secured bonds and their greater enforcement rights compared to the more traditional unsecured bonds, making the inter-creditor available to high yield bonds holders makes sense. It appears, at least for now, with recent high yield issuers such as Exova (testing and advisory services), R&R (ice cream) and Polypipe (pipes for construction) that the tide is shifting in favour of higher disclosure. Greater transparency in the market will carry the benefits of improved liquidity and depth of market as bond holders become better equipped to answer the question ‘How secure is secured?’.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox