And for my next trick….deal reached on bank bonuses & lending

George Osborne announced yesterday that the UK’s major banks and the government have come to an agreement over bonuses. Lloyds and RBS have gone as far as limiting cash payouts to £2,000. The deal has been agreed as part of Project Merlin – the government and the banks are attempting to come to some sort of settlement over how the banks should/will behave in the future.

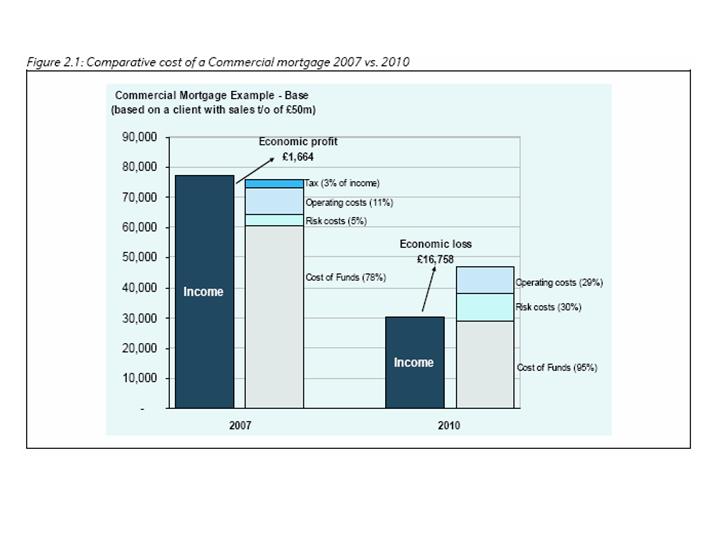

As well as making the bankers’ bonuses disappear, Merlin has also led to the banks committing to lend £190bn to businesses in an effort to support the economy. It’s a noble objective but one which is going to cause the banks further pain. Lending to SME’s has never been a particularly attractive activity and it has become even less so since the beginning of the financial crisis. These charts, submitted to the Independent Banking Commission by Barclays and RBS which were kindly highlighted to us by Tamara Burnell (head of our financials credit analysis team) show the cost to banks of providing credit to companies. They are effectively saying that lending to small and medium sized firms has never been particularly profitable and is even less so now.

The first, from Barclays, shows that they barely made any money from providing commercial mortgages before the crisis and how unprofitable it has become for them.

The second one shows that the cost of funding for RBS is higher than the rate at which they lend to SME’s.

Forcing banks to lend on uneconomic terms at a time when they need to be increasing their capital levels feels a little counterintuitive to me. I understand the rationale of trying to buoy the economy, but putting banks under more stress when they are already weakened just doesn’t seem like the cleverest move to me. Will the bonus caps lead to a brain drain from British banks if the best and the brightest can earn more at their foreign competitors? It also doesn’t take a wizard to realise that is was too much lending that caused the financial crisis and resulting recession in the first place, will more really do the trick?

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox