Two charts for anyone who still believes in ‘decoupling’

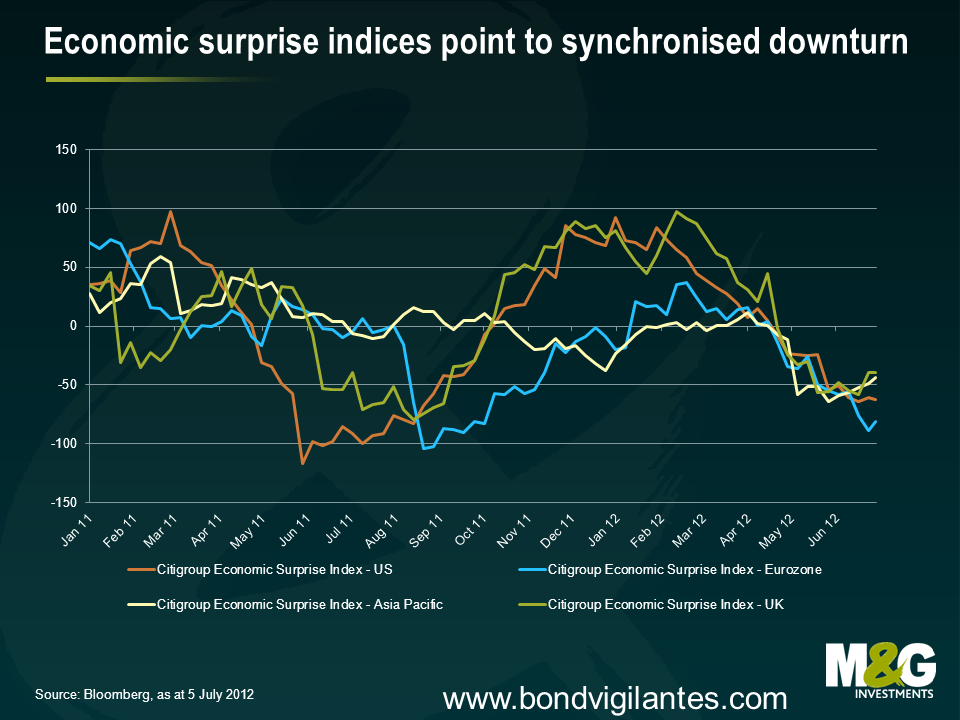

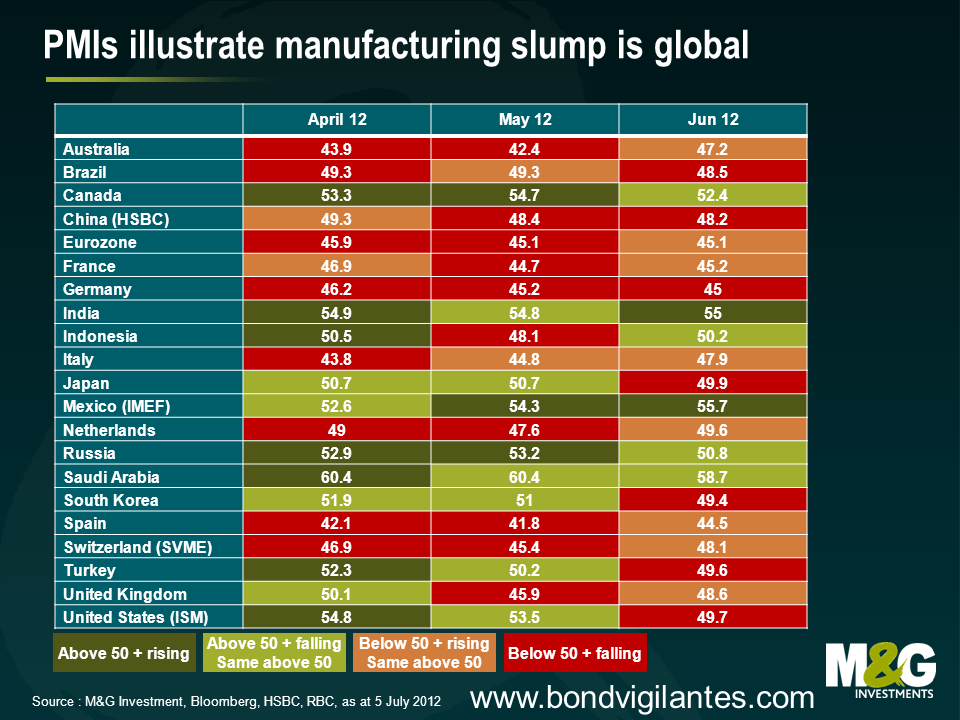

Q2 was a grim quarter, not just for the Eurozone economy but for the global economy. The downturn in Citigroup’s economic surprise indices that began in March picked up speed through to June, while PMIs in almost all corners of the world weakened in Q2 as can be seen by the PMI heatmap.

The good news is that the authorities have begun to respond to the downturn with more stimulus (as seen by yesterday’s actions from the BoE, ECB and PBoC). Some would argue that economic data are all different degrees of lagging indicators, so people may take more comfort from the forward looking financial markets having bounced since the end of June (although I think is misplaced optimism – political and fiscal union remains miles away, and the EFSF/ESM bailout mechanism is deeply flawed).

The bad news is that areas of the bond market are showing severe distress once more. Long dated Spanish government bond yields have jumped again, and yields are right on the intraday record high set on June 18th at the time of writing. Long dated Slovenian government bonds are yielding 7% amid mounting speculation that a bailout is imminent. And two year German government bond yields have again turned negative.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox