European High Yield – stay in the game, but don’t bet the ranch.

We mentioned late last year that the high yield market had crossed into cheap territory as credit spreads went over 1,000bps. Historically this has proven to be a relatively robust signal to take a constructive view on the market, and it proved so once again. To use a poker analogy, it was like being dealt a full house – the odds were sufficiently in your favour that, even if you didn’t know exactly what would happen, it was worth making a reasonably big bet.

In what’s been a fairly rocky ride, the European high yield market has seen a total return of 20.1%* so far this year, which compares to a 15.8% rise in the S&P 500, a 10.4% for the Euro Stoxx 50 and 4.8% for the FTSE 100. In all honesty, this has been a stronger result than we anticipated, fuelled mainly by the actions of the ECB (most of this year’s returns coming in Q1 on the back of the LTRO programme) Mr Draghi’s commitment to “do what it takes” and other central bank injections of liquidity in what has been an otherwise lacklustre year for economic growth.

So far so good, but the real question is where to now for high yield? Can we see another few months of double digit returns?

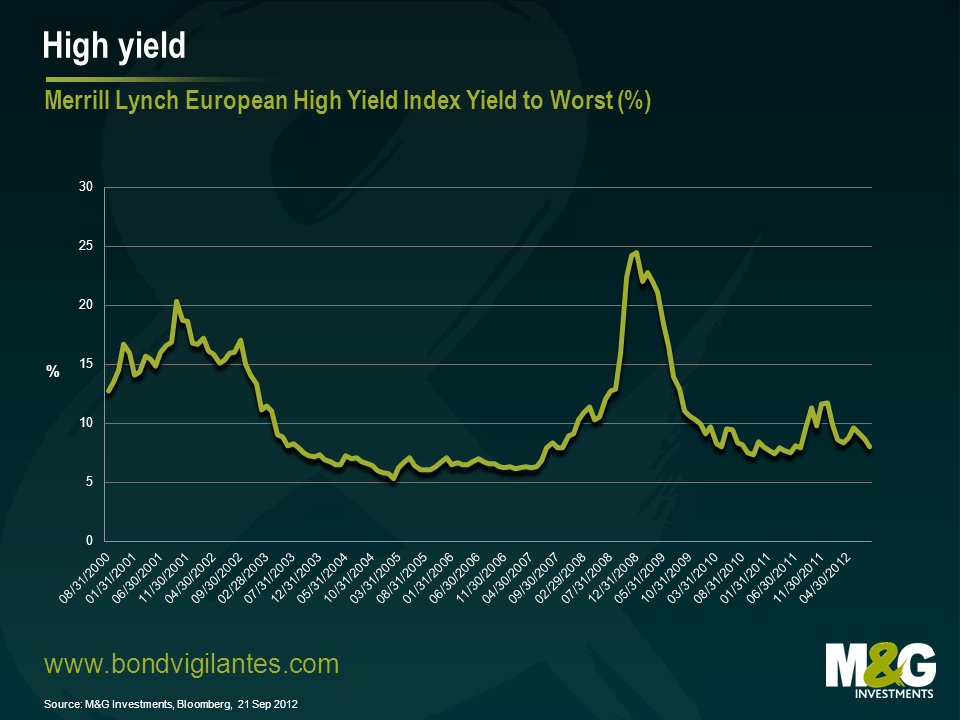

To try and answer this, first let’s consider a few of the key valuation signals. In terms of all-in yields, the high yield market is not too far away from multi year lows. The European market is currently yielding around 7.3% to maturity** compared to a 10 year low of 5.3% in February 2005. There is some scope for yields to fall further on this basis, but the scale of the move will not be enough to generate the sort of capital gains we have seen in the last few months.

This means that anyone who buys high yield assets at this point in the cycle looking for large capital gains will probably be disappointed. To generate a further capital return of around 16%, for example, yields would have to fall to around 2% on average. Does this then mean high yield is a screaming sell ? No, not really. To think that high yield is a sell you have to be fearful of either a big rise in underlying government bonds yields, a major re-pricing of credit spreads or both.

In the case of government bond yields, we could well see a rise from current levels, however, the extent of the rise, in my view, will be limited. I don’t think we will see 10 year yields north of 5% for Treasuries, Bunds and Gilts anytime soon as governments and policy makers have made it very clear that they will continue to intervene in the markets to keep long term interest rates lower for longer. Nominal growth and the labour markets are the primary concern, not the risk of higher inflation. This means the potential move up in sovereign yields is likely to be limited and hence capital losses for high yield bonds due to this move will be relatively benign. To put this in context, the modified duration of the European high yield market is currently 3.1 years**, hence if government bond yields rose by 1% across the board, the capital loss would be around 3% all other things being equal. When you add back a credit spread of 6.7%, assuming that you are not hit by a wave of defaults (always a big ‘if’ admittedly), then the total return from high yield would still be positive.

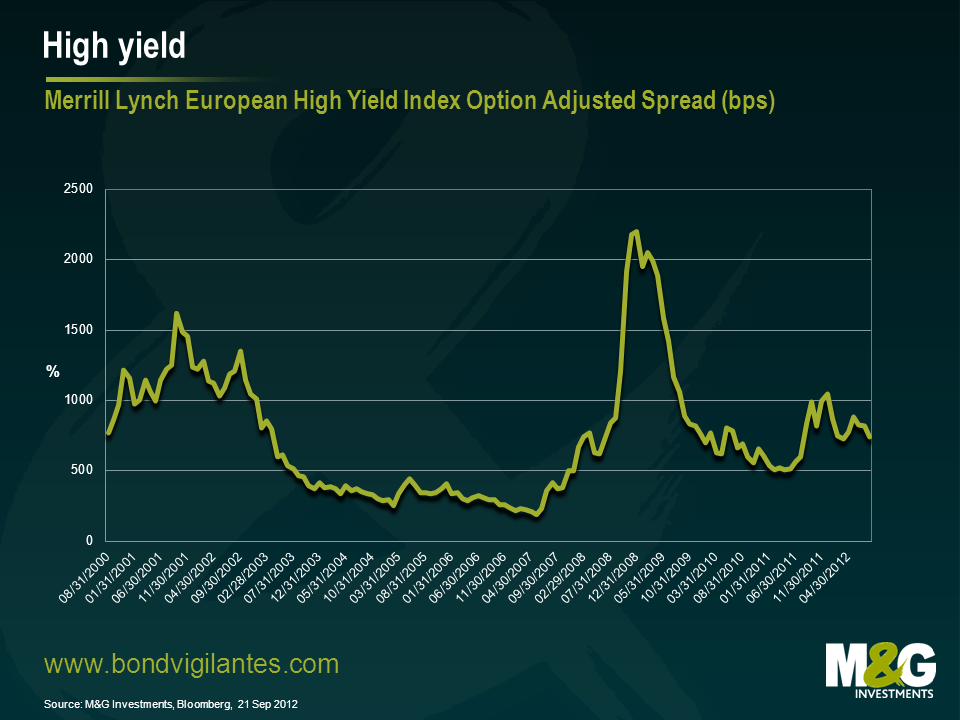

The more important driver of returns for the asset class will be any move in credit spreads and what default rates are likely to be. In contrast to all-in yields in the previous chart, we can see from the chart below, that credit spreads are still a long way off their lows. The incremental yield over government bonds was at 7.4% at the end of August, compared to 1.9% in May 2007. As such, there seems to be plenty of scope for spreads to go tighter, with the potential for some capital gains as they do so.

Does this mean high yield is a screaming buy? Again, no. We have to look at credit spreads in the context of the economic reality for companies in Europe. Much of Europe remains in the grip of low or no growth and credit remains scarce. As such the price of credit (the spread) should reflect that reality. At the end of the day, investors should demand a credit spread that adequately compensates them for the illiquidity inherent in the asset class and a modest rise in default rates. With this in mind, spreads are extremely unlikely to go anywhere near the 2007 level of 1.9% any time soon. There is also the ever present threat of a macro-economic or political curve ball that prompts a general shift in risk appetite and push spreads wider. Nevertheless, when we look at fundamentals and consider the medium term valuation case I think high yield spreads are closer to “fair value” right now.

This leads us to the rather unsatisfying conclusion that whilst the high yield market may not generate big capital returns, there is a case for remaining invested. What I would say though, is that a more defensive approach within high yield portfolios is probably merited in the current environment. The risk/reward trade off between a more aggressive position and a less aggressive position has shifted in favour of the latter. In essence, this means dialling down the “beta” for want of a better phrase.

To revert to the poker analogy, betting on the high yield market right now is like playing a hand with two pairs – you might make money so it’s worth staying in, but it doesn’t feel like the time to go all in and bet the ranch.

*Merrill Lynch Euro High Yield Index total return from 31st Dec 2011 to 21st Sep 2012. Equity market returns year to date as of 21st Sep 2012. Source: Bloomberg, Bank of America Merrill Lynch

** Merrill Lynch Euro High Yield Index as of 21st Sep 2012, Source: Bloomberg, Bank of America Merrill Lynch

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox