How much of the “improvement” in peripheral EZ sovereign creditworthiness is actually due to the CDS short selling ban?

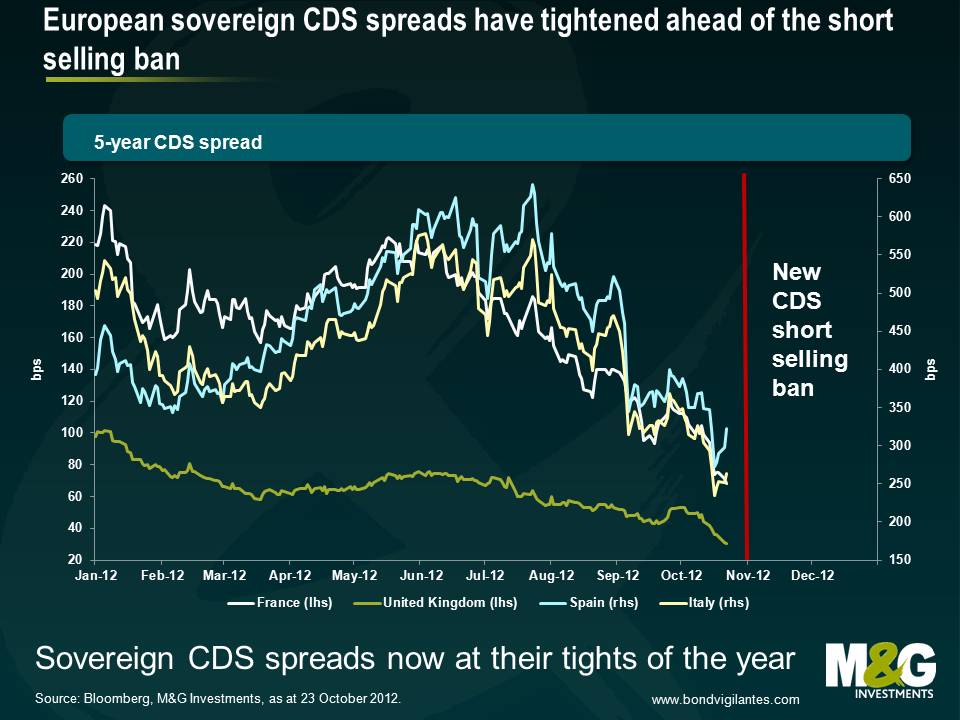

Since the middle of this year, credit spreads on peripheral sovereigns have narrowed considerably. Having been as wide as 600 bps, Spanish 5 year CDS is now around 300 bps, Italy is down from 500 bps to 250 bps. Ireland now trades at just 200 bps. Now at least part of this performance can be put down to Draghi’s speech in July in which he said “within our mandate, the ECB is ready to do whatever it takes to preserve the euro. And believe me, it will be enough”. And after the “whatever it takes” speech, Draghi eventually followed this up in September with the announcement of the Outright Monetary Transactions (OMT) programme in which the ECB would buy short dated government bonds of Eurozone members where bond spreads reflected too high a breakup premium (but with some conditionality attached in return). So is the improvement in credit sentiment a reflection of conviction in the European authorities to “save” peripheral bond markets? Perhaps.

The other dynamic over the past few months might be just as powerful – a growing realisation amongst hedge funds and other asset managers that the EU Regulation on Short Selling and Sovereign Credit Default Swaps, finally published in April, might well force them to close out short positions in the troubled sovereigns. The Regulation states that uncovered (“naked”) sovereign CDS shorts on European Union (not just Eurozone) nations will not be permitted, and must be closed out by 1st November 2012. “Naked” broadly means not hedging an underlying government bond exposure – it covers bearish trades on government creditworthiness. The short can be closed out by either using an opposing CDS contract, or by buying underlying government bonds to the same value. Whilst there is an exemption for positions initiated in a period before the Regulation was published, any short positions put on since then have to be closed out, whether this is a single name CDS or even an index which includes an EU member (for example the iTraxx Sovx CEEMEA index, a CDS index consisting of 15 sovereigns from Central and Eastern Europe, Middle East and Africa, includes Poland, and so a naked short position in the index would be banned). The Regulation is global in its reach and so should forbid even, for example, a Singaporean bank dealing with a US insurance company out of an office in Chile.

So as November approaches, the market is one-way. Whilst there is likely to be some sort of market maker exemption for having short positions (nobody seems entirely sure), there is no longer any willing counterpart to take the short risk positions off the Eurozone bears’ books. So they are forced to cover these positions at increasingly penal levels, and in doing so exacerbate the squeeze.

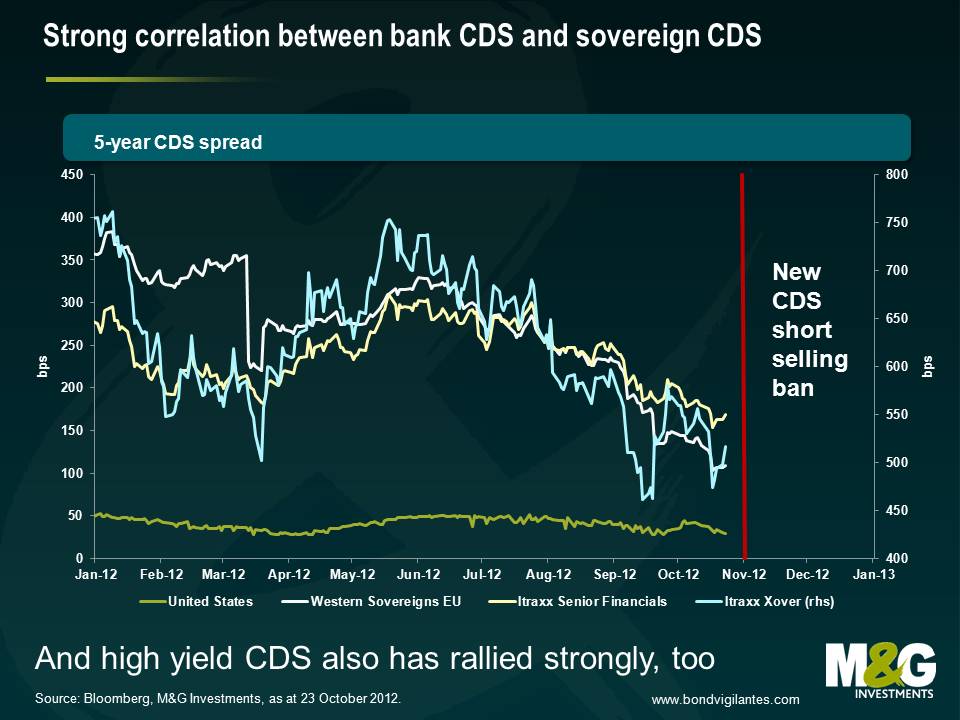

You can see that the impact is wider than just the Eurozone nations – UK CDS has fallen to 30 bps, despite deteriorating growth and fiscal conditions (and the chance of a AAA downgrade in the next few months). You can see a similar impact in the US, and also a very strong correlation with European sovereign CDS and European banks, and even high yield (the Itraxx Xover index on the chart). In other words, might the general rally in bond risk assets in the past few months be at least partly linked to this short CDS ban? Might the Regulatory deadline date at the start of November trigger the end of this trend? And given the high interdependency between the sovereigns and the banking sector in Europe, will short positions in future go into banks if investors are not allowed to short European sovereigns anymore?

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox