The UK’s current account deficit keeps getting worse. Terrible numbers today – time to reduce sterling exposure?

There were some reasons to be cheerful in today’s UK economic data – second quarter GDP growth wasn’t quite as bad as previously thought (the economy shrank by 0.4% rather than 0.5%), and stripping out the weak construction sector, the economy is growing at a reasonable (if below trend) rate.

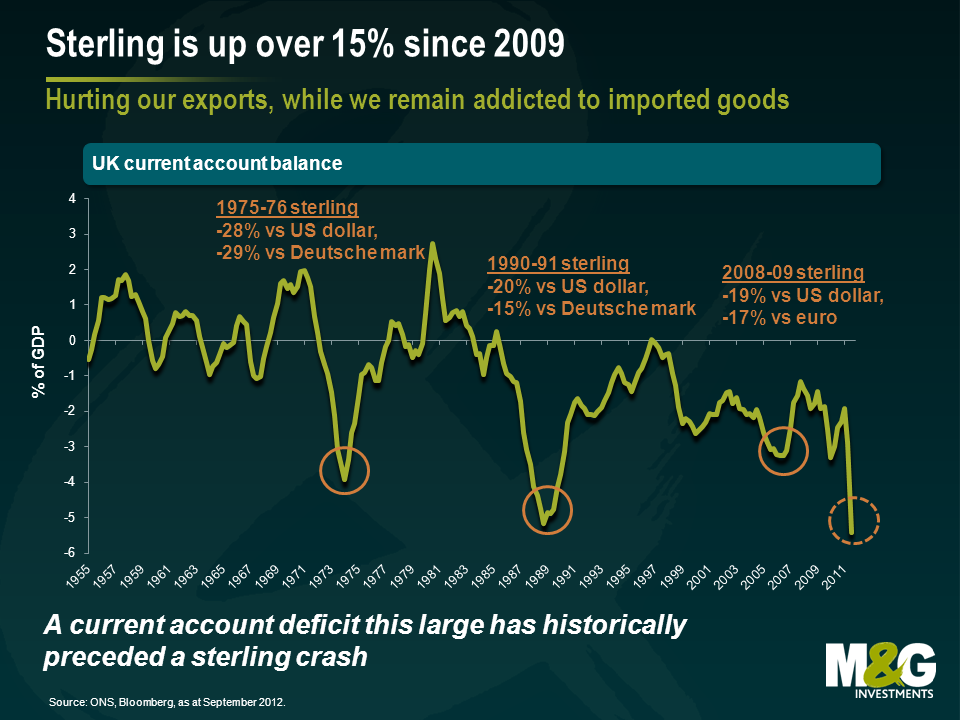

But we also had news that the UK’s current account deficit showed a significant deterioration. The gap between imports and exports grew during the quarter, to a deficit of £20.8 billion – equivalent to 5.4% of GDP. Additionally the first quarter deficit data was revised higher by £4 billion to over £15 billion. The relative strength of the pound is hindering the effort of the UK to rebalance its economy away from consumption and towards manufacturing and exports. On a trade weighted basis, sterling is around a 4 year high – helping to feed our addiction to consumer goods (and as a positive side effect helping keep inflation below the BoE’s letter writing territory for the first time in ages).

The chart below perhaps acts as a warning for those of us who by domicile or asset allocation are exposed to the pound. It shows the UK’s current account position going back to 1955, and you can see that periods when the deficit exceeded around 3% of GDP, a severe weakening of the pound often followed. In the mid 1970s the pound fell by nearly 30% against the Deutsche Mark and US dollar, and big falls also followed in the early 1990s, and in the first wave of the credit crisis. Of course there are other things you can point to in all of these occasions (bad UK banks in 2008, leaving the ERM 20 years ago this month) but if the UK’s safe haven status comes under question (for example if we lose our AAA rating post the Chancellor’s Autumn Statement) that might give the currency markets an excuse to revalue the pound downwards.

Incidentally, on a purchasing power parity measure (PPP, which looks at the level of exchange rates needed to equalise the price of buying things in different economies) sterling is fair value against the Euro, cheap against the Australian dollar (which looks 23% overvalued – if you’ve been there on holiday and paid a million pounds for a schooner of lager you’ll know that’s true), but 15% dear against the US dollar.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox