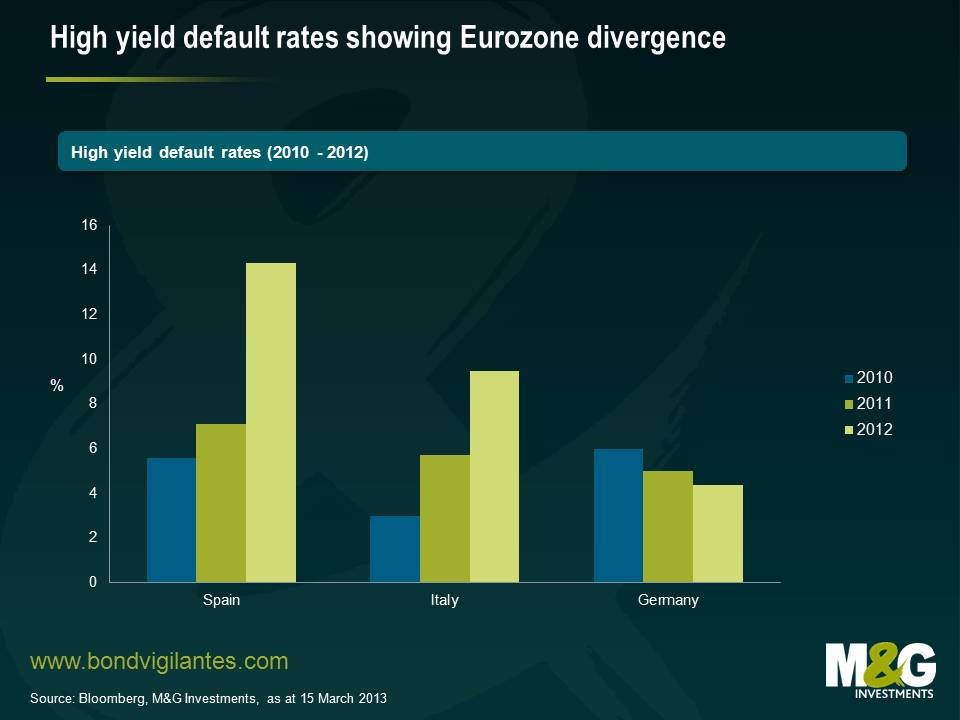

HY default rates showing the divergence in the Eurozone

2012 was not a good year for peripheral European defaults in the high yield market. Spain’s default rate doubled from 7% to 14%, while Italy’s went from 5.7% to 9.5%. Clearly, that the Spanish and Italian economies are under stress is not news, but what I thought was interesting though was that German defaults have continued to fall. It is important to point out that this is not just the public high yield market, it also includes private bank loans and it has been those that account for the majority of the defaults.

As the chart below shows, in 2010 Germany had the highest level of defaults of the three countries but over the subsequent years the situation there has improved. The opposite has been the case in the periphery with last year’s jump in defaults looking particularly worrisome.

We have been speaking for a while about the strain that operating under inappropriate policies puts on an economy, and this looks like empirical evidence of just that. Italy and Spain need looser monetary policy and less constrictive fiscal policies. In a pre-euro world these countries would have had full control of these policy tools, been able to devalue their currencies, relieve some of the strain and increase the competitiveness of their economies. This is not an option open to them now (short of leaving the euro) and I can see no way the situation will improve anytime soon. Even with Mario Draghi and the ECB willing to do whatever it takes to save the euro, the only outcome I can see for the next few years is the strong getting stronger and the weak getting weaker.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox