The M&G Central Bank Credibility Survey – the Carney impact?

Whilst YouGov is surveying consumers around the UK, Europe and Asia for the M&G YouGov Inflation Expectations Survey, we thought it would be useful for them also ask some questions about how people perceive both their central bank’s ability to hit the inflation target, and the likely effectiveness of government fiscal policy. You probably won’t be surprised to hear that Europeans generally don’t think highly of the ECB or their politicians (although France is striking in its low levels of confidence in both, reflecting a degree of economic stagnation there, even as other areas of the Eurozone see signs of recovery). But it’s the UK that’s seen the biggest improvement in sentiment towards its central bank, the Bank of England.

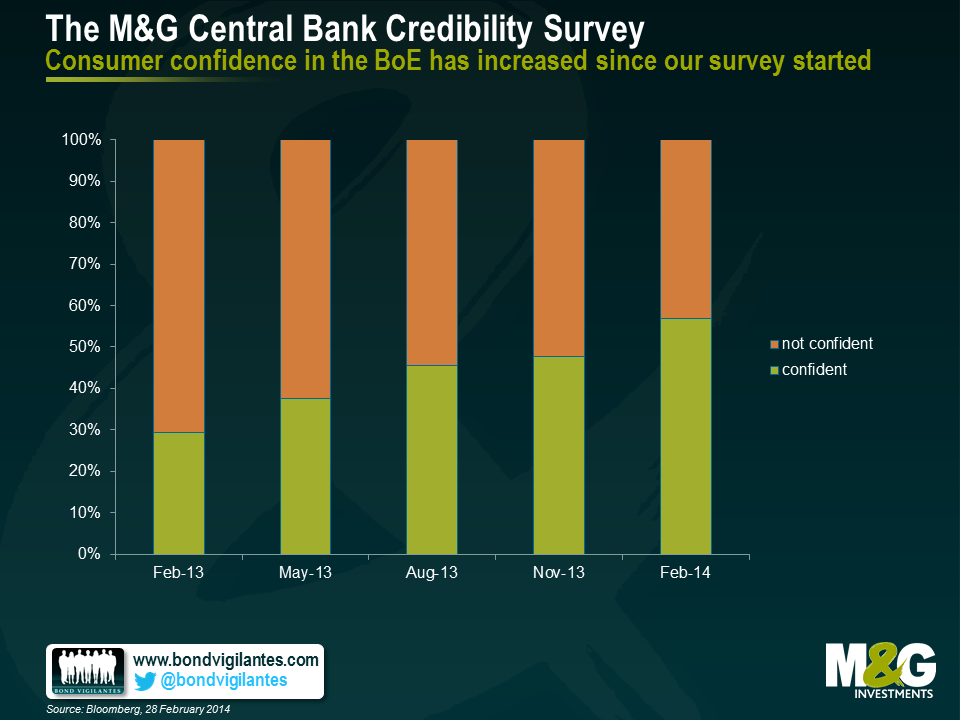

Mark Carney was announced as the 120th Governor of the Bank of England at the end of November 2012, at the start of our first survey quarter. At the time, only 28% of the 2000+ people surveyed who had a view (stripping out “don’t knows”) were confident that the “central bank is currently pursuing the correct policies in order to meet its target of price stability (i.e. inflation around 2%) over the medium term (i.e. the next 3-5 years)”. Our latest survey shows that in every quarter since then – and Mark Carney arrived at his desk on 1 July 2013 – this percentage has increased. The latest quarter shows the biggest increase yet, with 55% of respondents confident that the Bank is following the right policies to achieve medium term price stability.

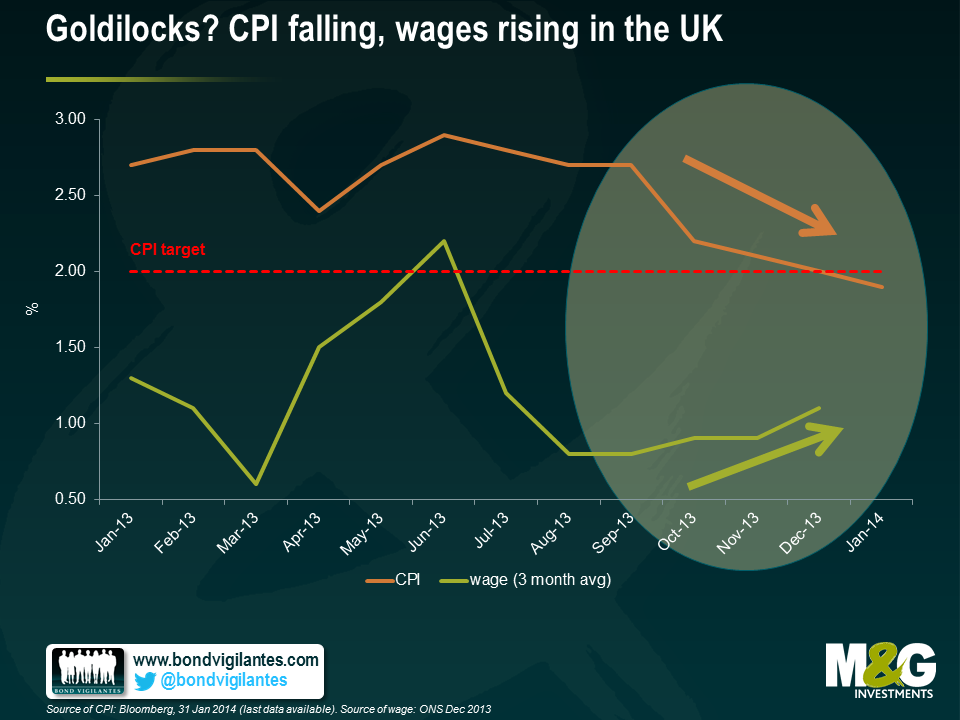

And this is against a backdrop of a fair few raspberries about the Bank’s forward guidance regime (gilt yields tended to rise, and the pound strengthened every time Carney did some more communicating). So why the almost doubling in the confidence in the Bank of England amongst the UK population? Well, it’s the economy. The UK has been one of the developed world’s fastest growing economies over the past year, with GDP growth at 2.7% year on year, after a couple of years where it felt as if it would be stuck at or below 1% forever. Crucially when it comes to thinking about credibility, for the very first time since the depths of the financial crisis in 2009, CPI inflation is back below the Bank of England’s 2% inflation target. At one point in 2011 CPI was running at over 5% year on year. And whilst real wages are still falling, nominal wages have started to perk up in the past few months, so the hit to workers’ pay is lessening.

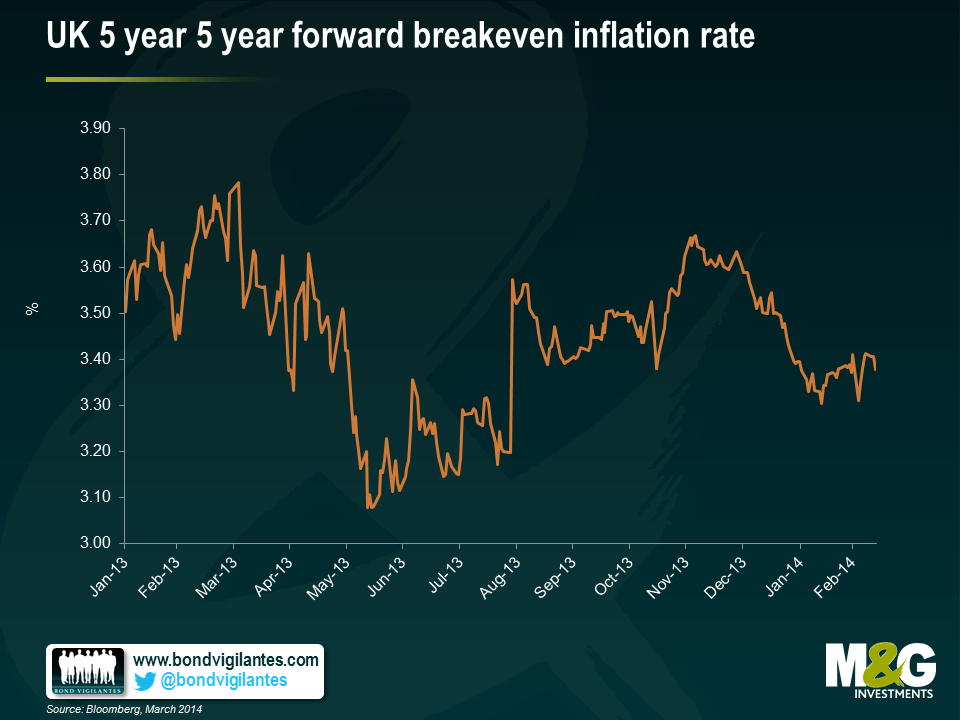

Our survey isn’t the only measure that shows that the Bank of England’s credibility is strong and improving. Central banks like to use index linked bonds to derive a market participant view of whether inflation expectations are anchored. Remembering that UK index linked gilts are priced from RPI rather than CPI, and that estimates are that the long term “wedge” between the two measures is somewhere around 1.1% over the medium term (it could be higher in a rate rising environment as RPI contains a big chunk of mortgage interest payments). The current 5 year 5 year forward breakeven inflation rate – the market’s price for average inflation over the five years from 2019 to 2024, i.e. taking out the current cycle and looking at a medium term expectation for inflation – stands at 3.35%, down from 3.65% at the end of November last year. If you subtract the wedge you end up with a market CPI inflation forecast of 2.25% over the medium term. This is a little above target, but given the Bank’s history in recent years of large upside misses, could reflect improving credibility. It should be said however that this measure has generally been pretty stable (5 year average of 3.5%) so it doesn’t feel as if there is a significant signal on King Bank versus Carney Bank credibility here.

You can see the full M&G YouGov Inflation Expectations Survey here, and the M&G Central Bank Credibility Survey is within that report on page 6.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox