5 Signs That the Bond Markets (rightly or wrongly) think the Eurozone Crisis is Over

Regardless of your opinion on the merit of the ECB’s policy, there is little doubt that the efficacy of Mario Draghi’s various statements and comments over the past 2 years has been radical. Indeed there are several signs in the bond markets that investors believe the crisis is over. Here are some examples:

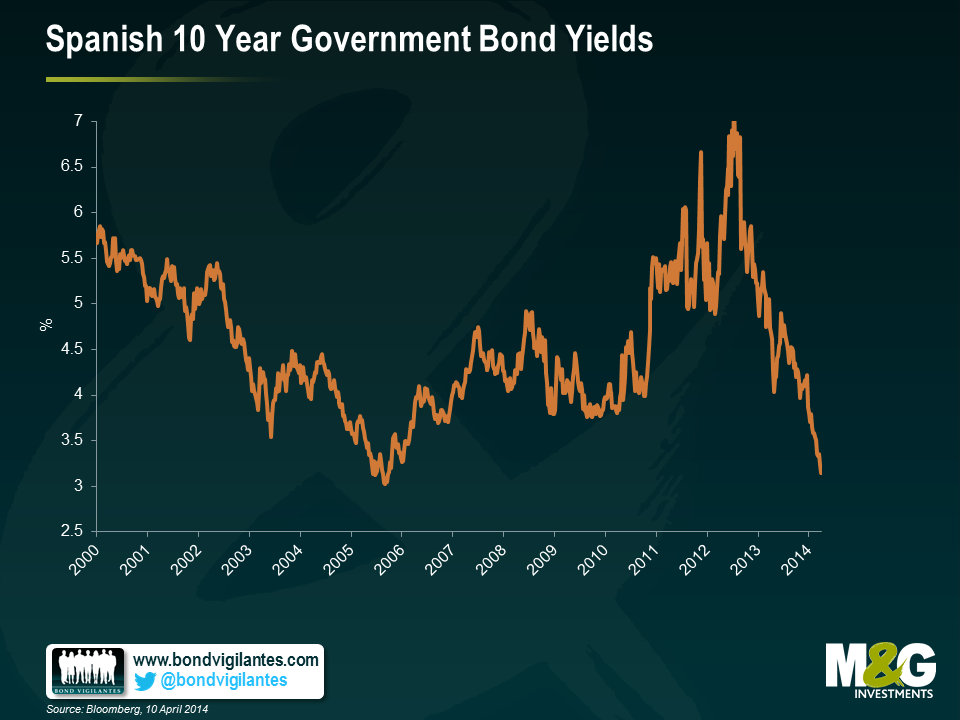

1) Spanish 10 yr yields have fallen to 3.2%, this is lower than at any time since 2006, well before the crisis hit, having peaked at around 6.9% in 2012. This is an impressive recovery, almost as impressive as …

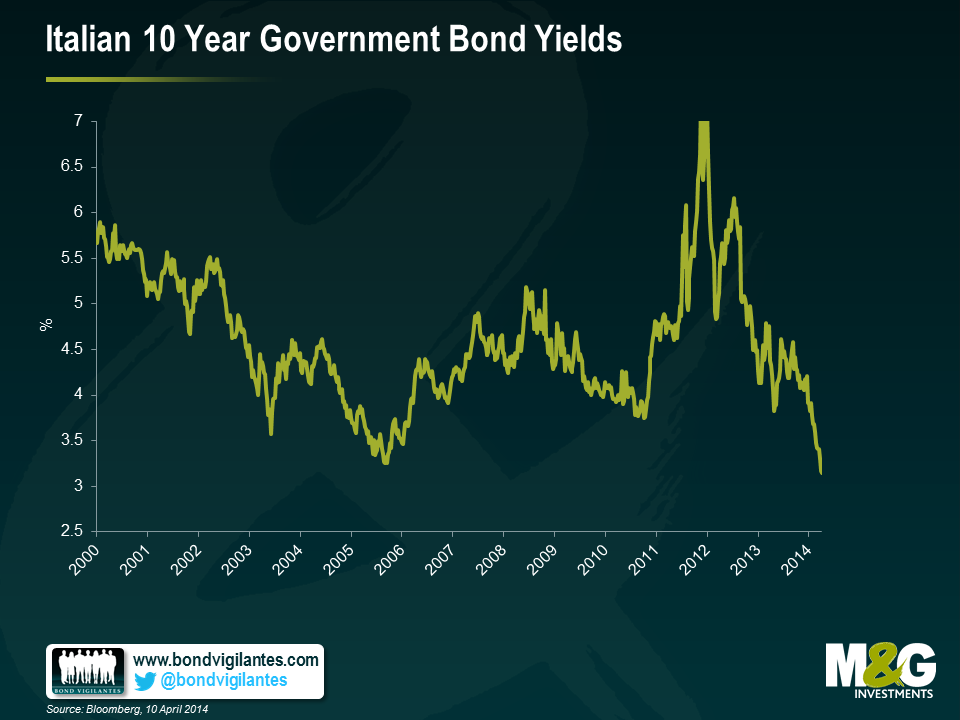

2) The fall in Italian 10 year bond yields, which have hit new 10 year lows of 3.15%, lower than any time since 2000. The peak was 7.1% in December 2011. To put this in context, US 10 year yields were at 3% as recently as January this year.

3) Last month, Bank of Ireland issued €750m of covered bonds (bonds backed by a collateral pool of mortgages), maturing in 2019 with a coupon of 1.75%. These bonds now trade above par, with a yield to maturity of 1.5%. The market is not pricing in any material risk premium relating to the Irish housing market.

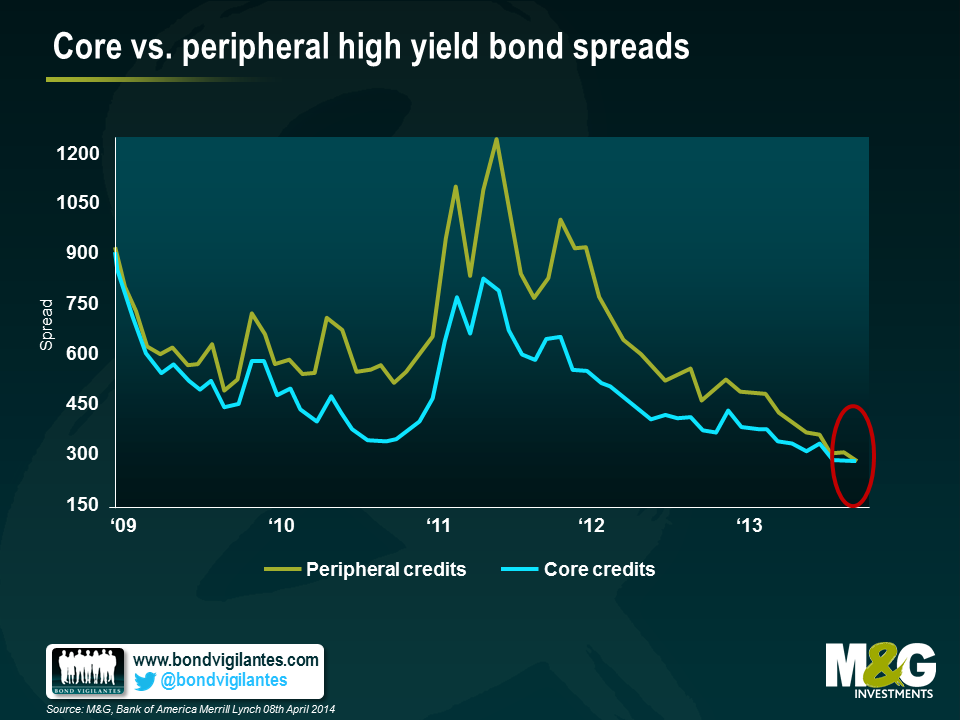

4) There is no longer any risk premium within the high yield market for peripheral European risk. The chart below (published by Bank of America Merrill Lynch) shows that investors in non-investment grade corporates no longer discriminates between “core” and “peripheral” credits when it comes to credit spreads.

5) Probably the biggest sign of all, is that today Greece is re-entering the international bonds markets. The country is expected to issue €3bn 5 year notes with a yield to maturity of 4.95%.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox