The power of duration: a contemporary example

In last year’s Panoramic: The Power of Duration, I used the experience of the US bond market in 1994 to examine the impact that duration can have in a time of sharply rising yields. By way of a quick refresher: in 1994, an improving economy spurred the Fed to increase interest rates multiple times, leading to a period that came to be known as the great bond massacre.

I frequently use this example to demonstrate the importance of managing interest rate risk in fixed income markets today. In an investment grade corporate bond fund with no currency positions, yield movements (and hence the fund’s duration) will overshadow moves in credit spreads. In other words you can be the best stock picker in the world but if you get your duration call wrong, all that good work will be undone.

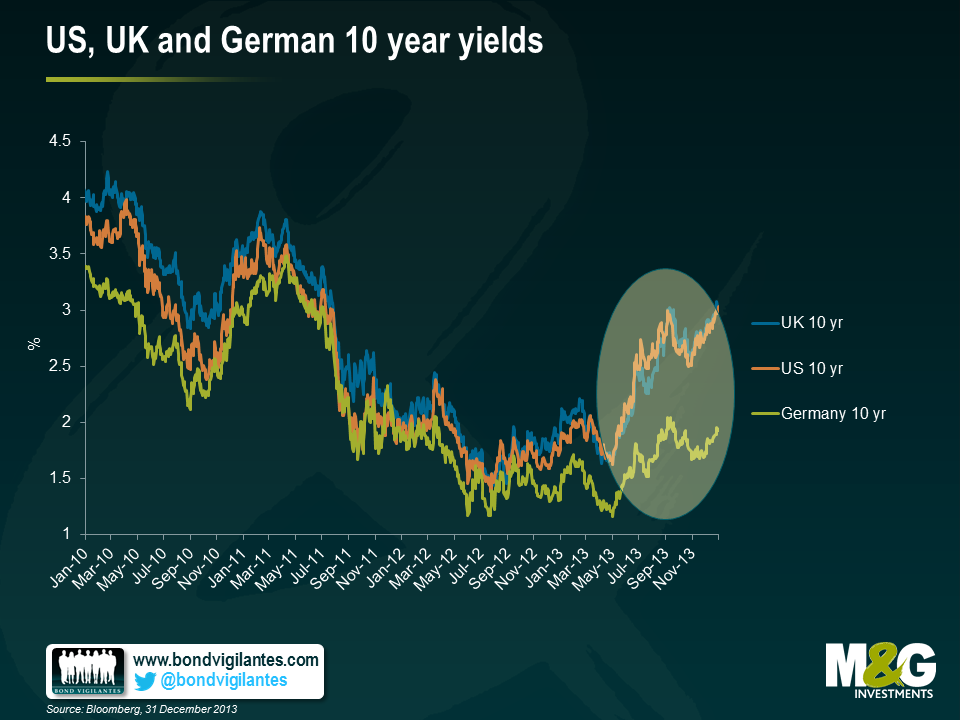

We now have a contemporary example of the effects of higher yields on different fixed income asset classes. In May last year Ben Bernanke, then Chairman of the Fed, gave a speech in which he mentioned that the Bank’s Board of Governors may begin to think about reducing the level of assets it was purchasing each month through its QE programme. From this point until the end of 2013, 10 year US Treasuries and 10 year gilts both sold off by around 100bps.

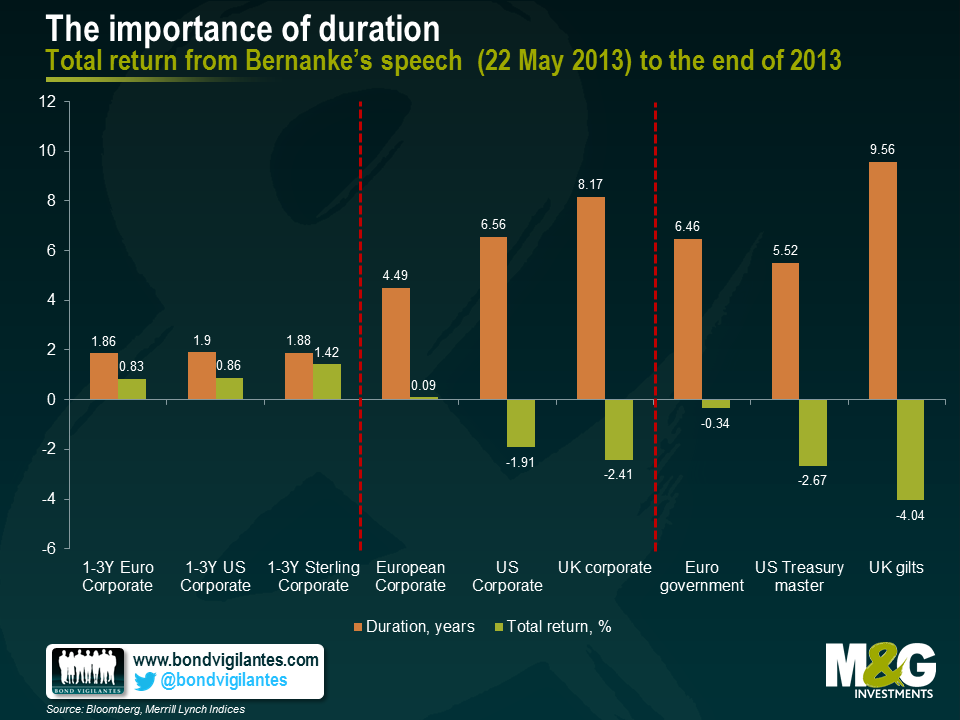

How did this 1% rise in yields affect fixed income investments? Well, as the chart below shows, it really depended on the inherent duration of each asset class. Using indices as a proxy for the various asset classes, we can see that those with higher durations (represented by the orange bars) performed poorly relative to their short duration corporate counterparts, which actually delivered a positive return (represented by the green bars).

While this is true for both the US dollar and sterling markets, longer dated European indices didn’t perform as poorly over the period. There’s a simple reason for this – bunds have been decoupling from gilts and Treasuries, due to the increasing likelihood that the eurozone may be looking at its own form of monetary stimulus in the months to come. As a result, the yield on the 10-year bund rose by only 0.5% in the second half of 2013.

Whatever your view on if, when, and how sharply monetary policy will be tightened, fixed income investors should always be mindful of their exposure to duration at both a bond and fund level.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox