The reliability of market and consumer inflation expectations

After yesterday’s poor U.S. GDP number and despite Mark Carney’s seemingly dovish testimony before the Treasury Select Committee, the Bank of England is increasingly looking like it will be the first of the major central banks to hike rates. At this stage, the BoE can retain its dovish stance because inflation is not an issue. However, in an environment of falling unemployment, early signs of a pick-up in wage inflation, rising house prices and stronger economic growth, consumers and markets may increasingly begin to focus on inflation. In anticipation, we think now is a good time to compare the inflation forecasting performance of markets and consumers.

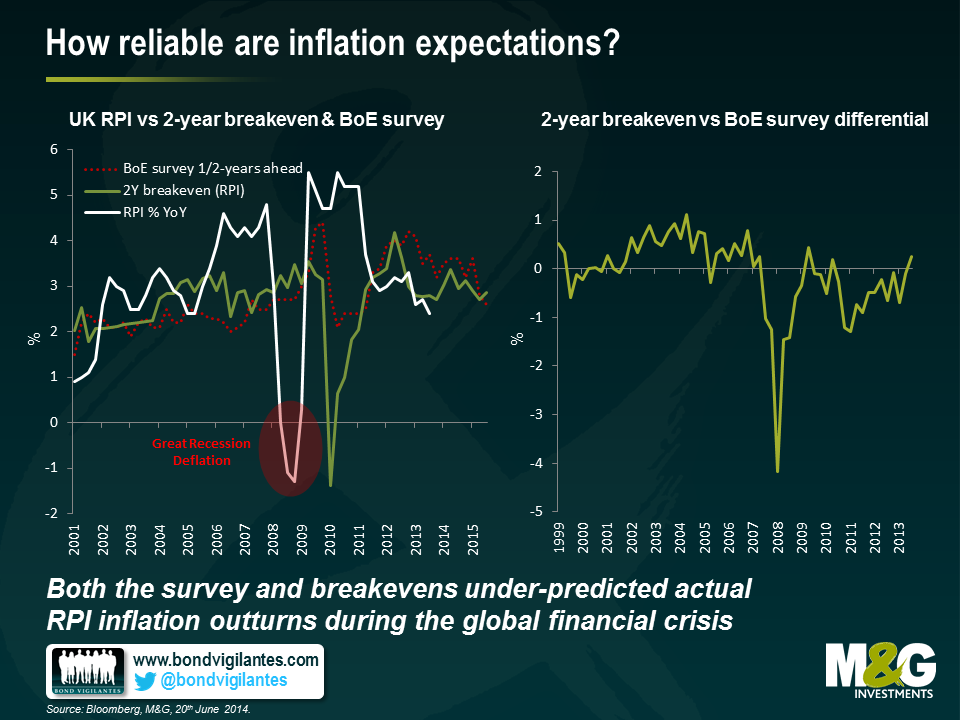

In the graphs below we have compared UK RPI bond breakevens (a measure of market inflation expectations) with the Bank of England’s Gfk NOP Inflation Attitudes Survey (i.e. a UK household survey with over 1900 respondents consisting of nine questions on expectations for interest rates and inflation). An important point to note is that the analysis compares realised inflation (% yoy) with what survey expectations and breakeven rates indicated 2 years before.

The comparison presents a number of interesting results:

Unexpected deflation: Both the survey and breakevens underestimated actual RPI inflation outcomes between 2006-2008 (in other words, nobody anticipated the inflationary shock coming from higher commodity/energy prices). In 2008, UK RPI was rising at an annual rate of 5.2% as high oil prices were feeding through into higher energy bills. Market and consumer inflation expectations largely ignored the higher inflation numbers, a sign the central bank inflation targeting credibility remained strong.

UK RPI turned negative in 2009 as the world plunged into recession and the BOE cut interest rates. The market eventually began to price in deflation but only after RPI turned negative. For example, in November 2008 the 2 year breakeven was -1.4%, the actual RPI print in November 2010 was 4.7%. Owing 2 year gilt linkers relative to conventional 2 year gilts directly after the financial crisis was a great trade.

Deflation (and recessions) appear particularly hard to forecast, for consumers and markets alike. This is because consumers and markets tend to anchor their future expectations off current inflation (and growth) readings.

Post-crisis unanchoring: Consumer inflation expectations generally underestimated realised inflation up until the global financial crisis, and has overestimated it since then, a possible sign that the crisis-recession years may have affected consumer views on the BoE’s commitment to fight inflation. Between 2000 and 2009, 2 year-ahead expected inflation averaged 2.5%. Since 2009, it has averaged 3.4%, almost one percentage point higher; suggesting a lower level of confidence that price stability will be achieved and also reflecting the higher RPI prints post 2009.

Surprisingly similar forecasts: Breakeven and survey rates differed only slightly over the sample period, with the largest gap (400bps) opening up in October 2008 after the Lehman crash. This was probably caused by the forced unwind of leveraged long inflation trades combined with a huge flight to quality bid for nominal government bonds, which distorted the market implied inflation rate. The average differential through the period (excluding years 08-09) is just 8bps. Nevertheless, breakevens seem to track RPI better since consumer surveys are usually carried out on a quarterly basis whilst the former are traded and re-valued with higher frequency. This makes them better at capturing quick moves and turning points in inflation.

Future expectations: Over the next 2 years, both consumers and markets expect RPI to rise above the current level of 2.6%. With a 2.7% implied breakeven, 2-year gilt linkers look relatively inexpensive today.

Of course, breakevens are far from being a perfect measure of inflation, as they embed inflation and liquidity risks premia, but they do appear to be better predictors of future inflation relative to consumer surveys. That does not mean survey-based data does not provide us with useful information, and for this purpose we launched the M&G YouGov Inflation Expectations Survey last year (available here). Consumer inflation expectations affect a number of economic variables, including consumer confidence, retail spending, and unit labour costs. However, during inflection points, such as the one we may be going through at present and in a world of approaching shifts in monetary policy, the timeliness of breakevens could represent an advantage that makes it worthwhile to follow them carefully.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox